Prior to the 2021 budget speech, large speculation and concern surrounded the proposed way forward for us South Africans.

The large concern stemmed mostly from the fiscal cliff which we are on the brink of. This is not a new concern amongst South Africans, but rather one which seems all the more real post the economic woes of Covid 19.

Although the Medium-Term Budget Policy Statement (MTBPS) in October provided some sign of improvement in the short-term, a change in government behaviour is necessary to ensure we do not go off the edge. But how could they possibly do anything when the repercussions would most likely be even higher unemployment, exacerbating poverty.

The implications of reaching the fiscal cliff

If we reach the fiscal cliff, the obvious solution will be to go to the International Monetary Fund or a similar agency to borrow money. Should this be the case, the loan will be conditional on the above three measures being rectified.

The Finance Minister has his work cut out for him, at a time when South Africans are all the more concerned for our future.

Tito Mboweni gave his address on Wednesday the 24th of February, below are some highlights:

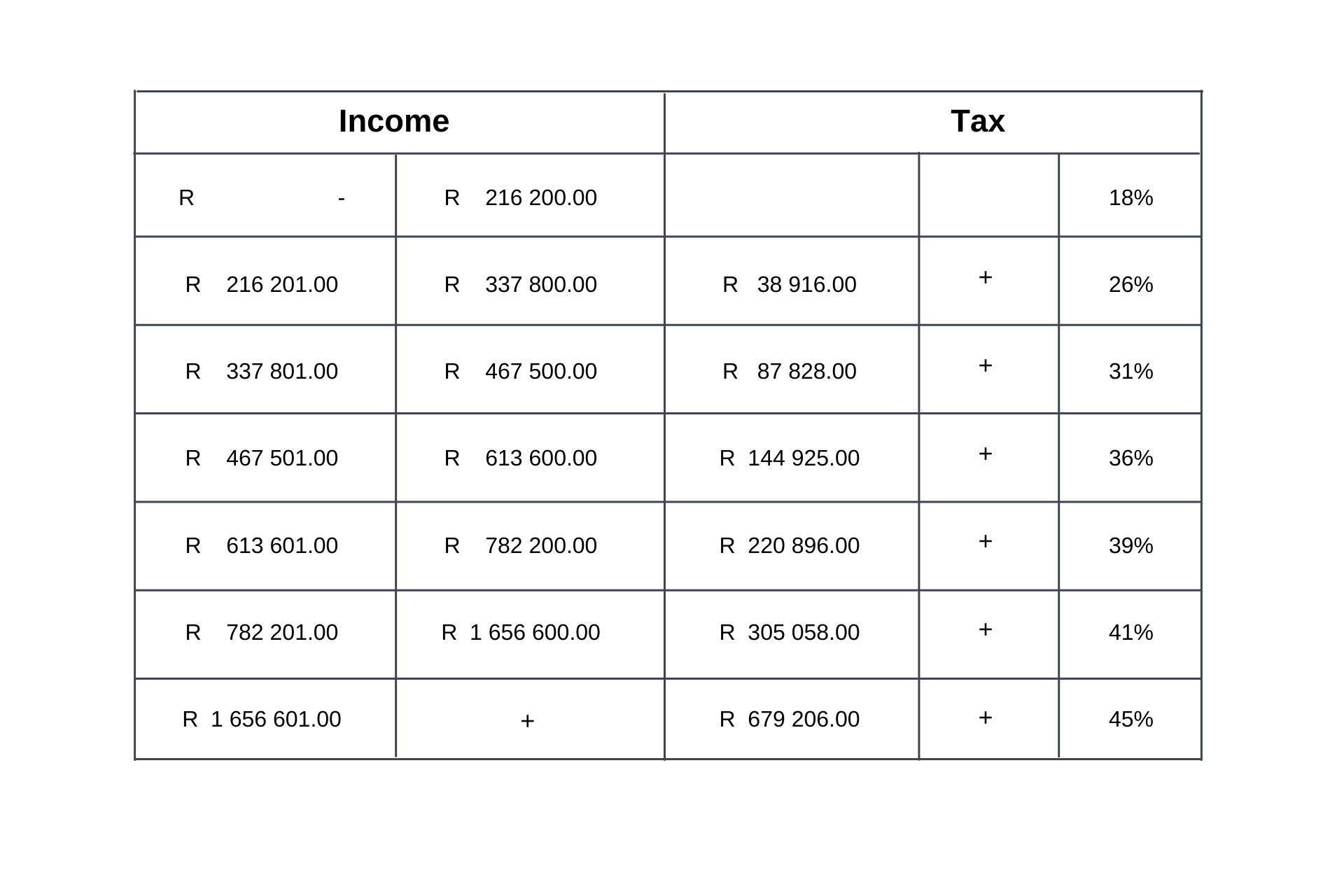

1. Personal income tax bracket adjustments:

Personal income tax brackets have been adjusted by 5%, resulting in R 2.2 billion of tax relief, largely benefitting those in lower- and middle-income households.

2. Withdrawal of previously proposed tax increases:

In the Medium-Term Budget Speech, tax increases of R 40 billion over the next four years was introduced. Attributed to better than expected revenue performance, it appears there is no longer a need for the implementation of these measures. The Minister additionally noted that historical tax hikes had not contributed to growth in the way intended as taxpayer behaviour became more conservative.

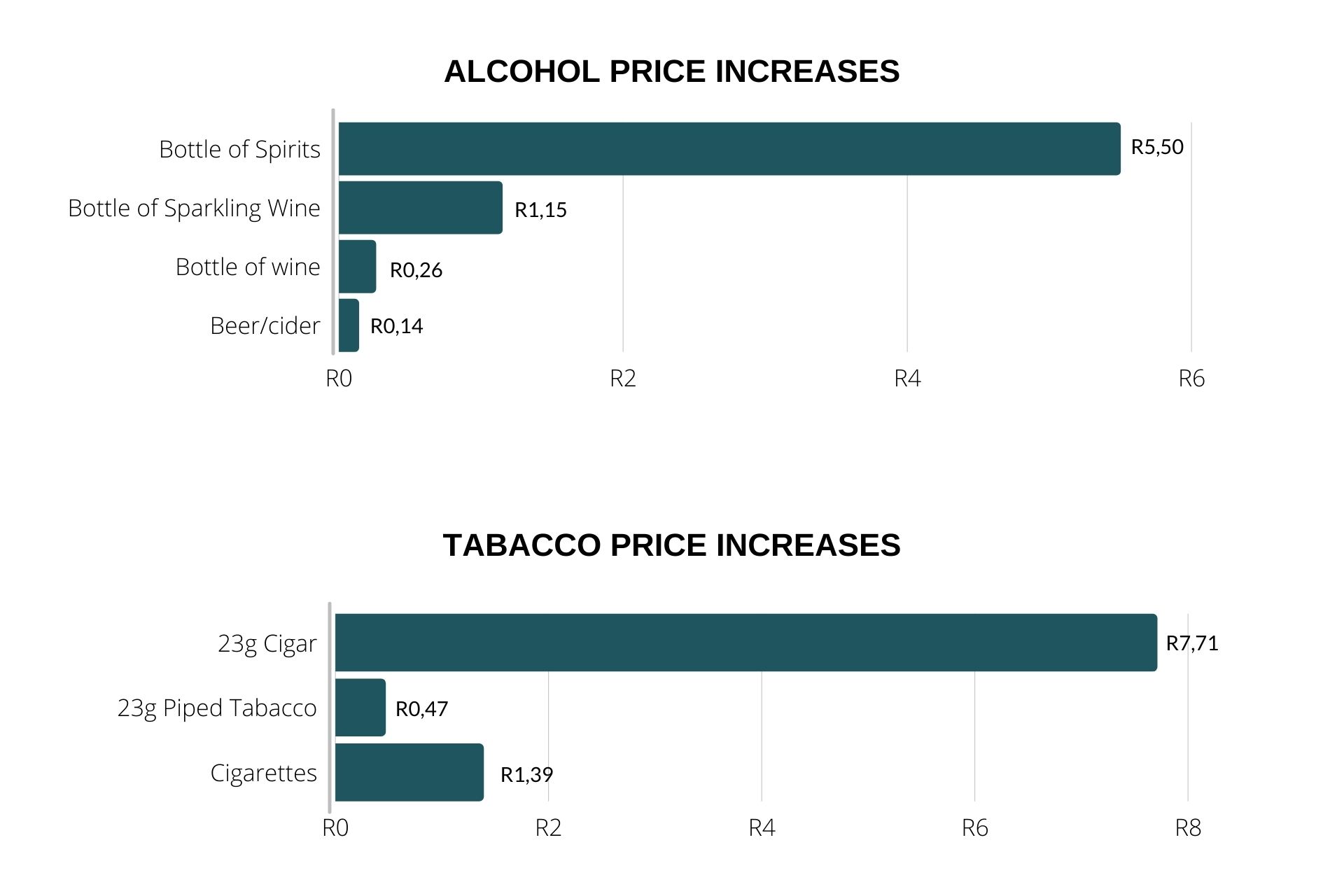

3. Increases to tobacco and alcohol excise duties

Excise duties on these sin products will go up by 8%. Alcohol restrictions during lockdowns have emphasised alcohol abuse and its implications within the country. Higher duties, coupled with many provinces’ attempts to impose stricter laws around alcohol consumption, will hopefully aid in curbing abuse. The combined increases are expected to add R 1.8 billion to the budget for the 2021/2022 fiscal year.

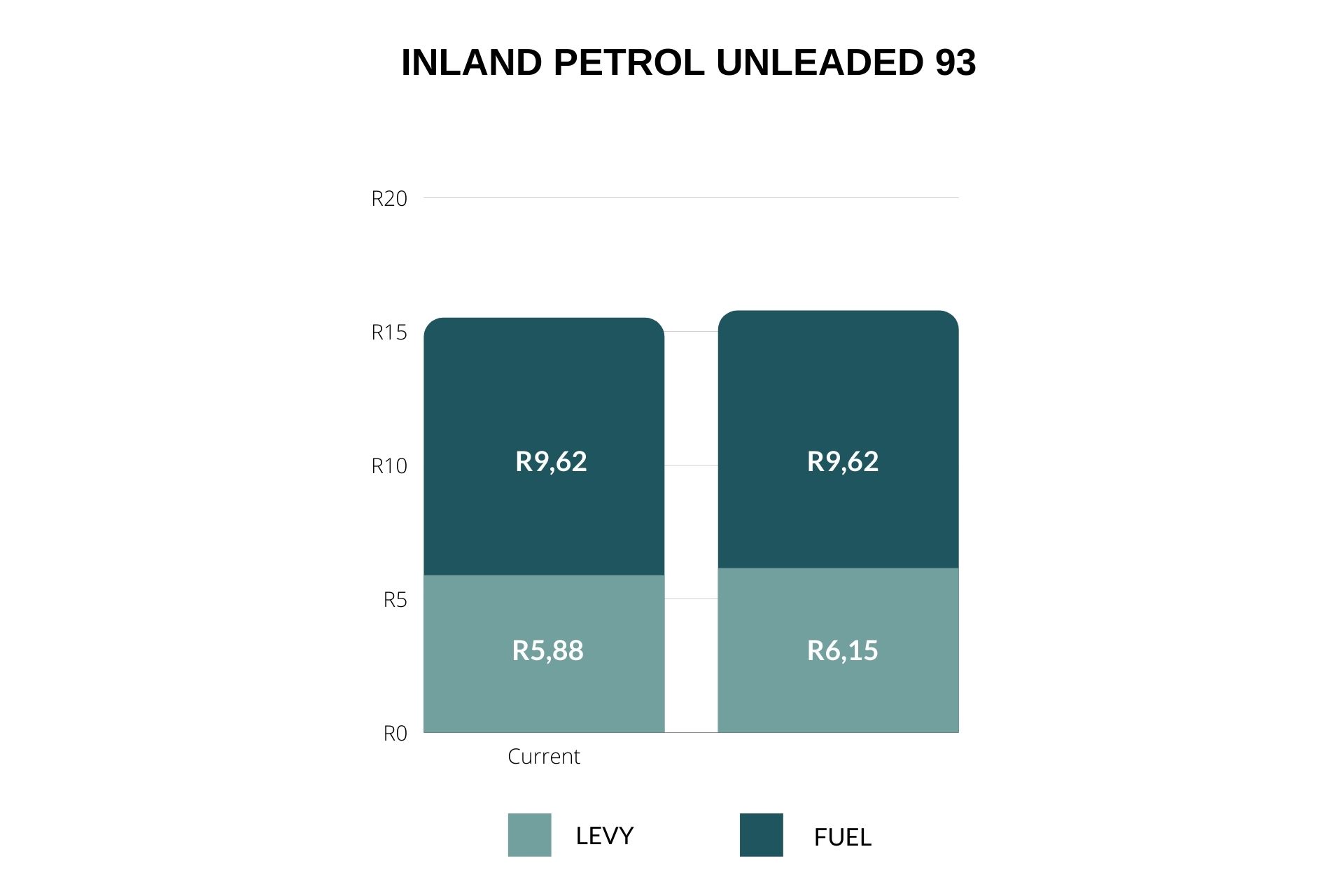

4. Fuel increases

As of 7 April 2021, the fuel levy will be increasing by 15 cents per litre, while the Road Accident Fund levy will go up by 11 cents per litre. Approximately R 5.88 of the current petrol price is a combination of these two levies, the increases will result in a combined levy of approximately R 6.15. This, coupled with expected oil price increases, could lead to a fairly large price increase in the coming year.

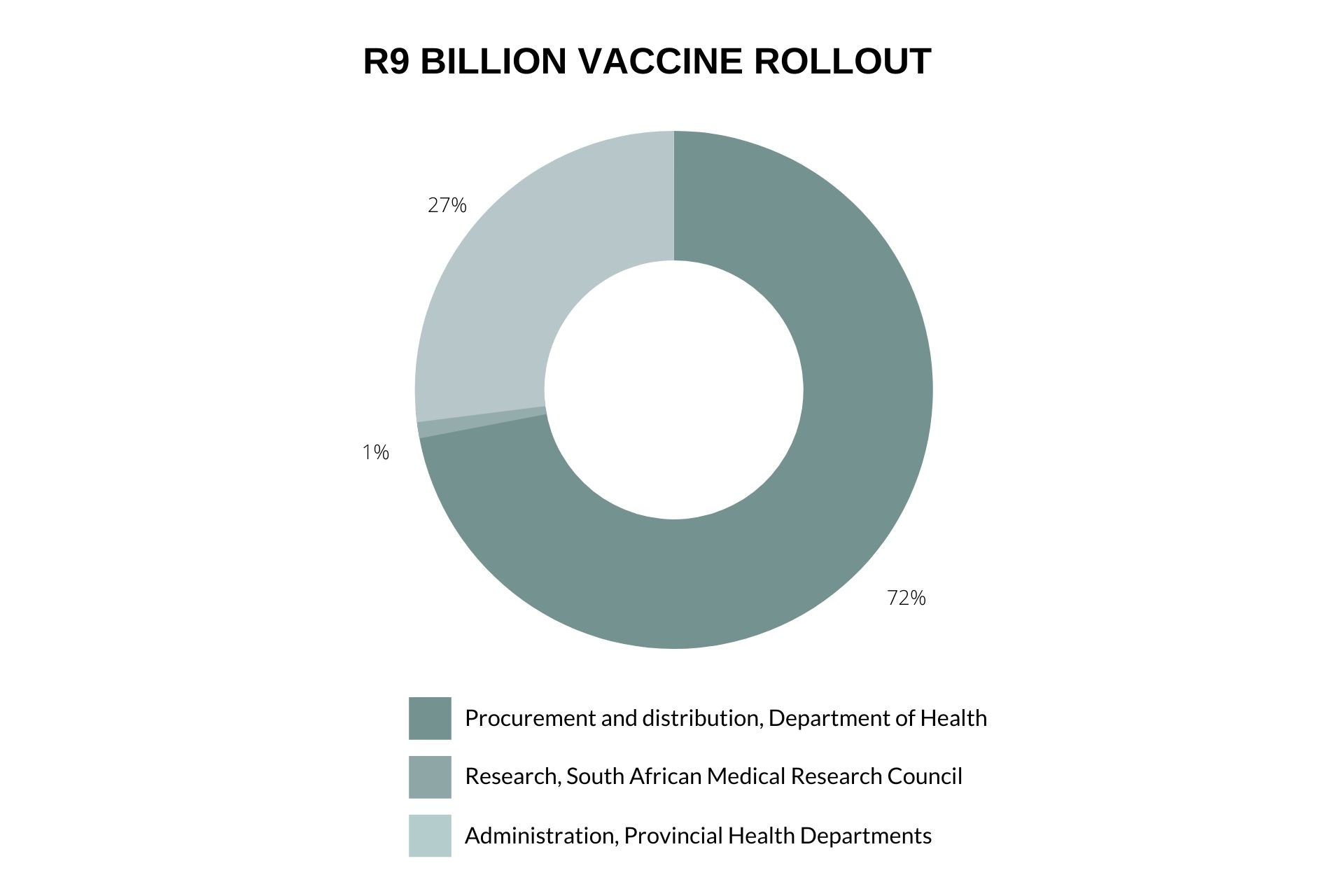

5. R 9 billion allocated to vaccine rollout

In an attempt to fully reopen the economy, the government has committed R 9 billion to facilitate the administration of free vaccines to the public.

6. Restricting the Public Service Wage Bill

For the 2020/2021 year, 47% of government revenues went to public service compensation. As a percentage of the economy, South Africa’s wage bill is in line with Nordic nations, and well above that of Ireland, Korea, Switzerland, Germany, the US, UK and the global average. The way forward will be to reduce growth of the wage bill (which has historically grown at 4% per annum before inflation, while economic growth has been at 1.5%) and the amount of spending on wages, while maintaining real spending increases on capital payments (such as buildings). Treasury will be eliminating cost-of-living adjustments in public service until 2023/2024, reducing head counts, implementing early retirements and natural attrition, as well as eradicating non-critical posts as far as possible. Treasury aims to cut this bill by R 265 billion in the next 3 years.

Tito Mboweni additionally acknowledged the risk of SOEs defaulting and the pressure this puts on the budget, as well as the increased unemployment which comes with an uncertain outlook.

Overall, the government is aiming to reduce the budget deficit and stabilise the debt-to-GDP ratio. Over the past year, the budget deficit has doubled and the shortfall in revenue is approximated at R 213.2 billion. At current levels, this number is projected to increase, resulting in financing costs of R 338.6 billion for the 2023/2024 period. The Treasury has noted this fact and has based their strategy thereon intending to “return public finances to a sustainable position”.

Pyxis update and what to look out for:

Back at the office, we have been hard at work preparing for a new service offering. We are always looking for ways to enhance your options and this is just one of many ideas coming into fruition. Look out for more details in next month’s newsletter, where we will unpack and give you the full breakdown of our newest Pyxis solution.