In this month’s newsletter Henk Myburgh looks at target return objectives and discusses the potential pitfalls of the narrative fallacy by using investment themes. He compares Nominal and Real returns and argues that Real returns should be favoured as an investment objective.

Narratives

Nassim Nicholas Taleb discusses the concept of explaining events in hindsight in his book “The Black Swan: The Impact of the Highly Improbable” (published in 2007).

In this book, Taleb introduces the idea of the “narrative fallacy”, which is the human tendency to create stories or explanations after the fact, often making the past seem more predictable than it really was. He argues that we retrospectively fit events into a coherent narrative, even when those events were highly unpredictable, which distorts our understanding of uncertainty and risk. This concept is central to his broader thesis about Black Swan events—rare and unforeseen events that have a massive impact.

Taleb warns that this tendency to explain things in hindsight leads to overconfidence and an illusion of understanding complex systems.

Themes

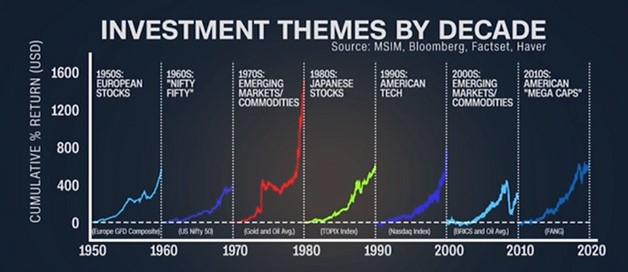

Drawing insights from data analysis conducted by Morgan Stanley Investment Management, the distinct investment landscapes of each decade come to life in vivid detail. Over the course of 10-year intervals, specific asset classes, sectors, or regions have consistently seized the attention of investors, exerting a profound influence on returns and outshining other segments of the market.

Embarking on a journey through seven decades, since the 1950s, we witness the ebbs and flows of investment trends that have shaped the financial landscape.

The above graph shows cumulative returns (left margin) by decade going back to 1950. Winner’s seldom repeat. Losers in the previous decade can become winners. If the pattern holds, American mega caps / big tech will pass the baton to another theme for the next 10 years.

Source: https://www.visualcapitalist.com/key-investment-theme-each-decade-since-1950/

In the 1950s, a resurgence swept through European stocks, riding the wave of post-war recovery. This surge found its momentum in substantial investments from both corporations and governments, marking a transformative period as Europe embraced integration.

Fast-forward to the 1960s, and investors eagerly flocked to the allure of blue-chip stocks in the renowned “Nifty Fifty,” with household names like Johnson & Johnson, Disney, and Coca-Cola capturing imaginations. The prevailing belief was in the enduring strength of these franchises to yield substantial returns over the long haul. However, the 1973-1974 bear market delivered a stark reality check as these stocks plummeted.

The 1970s, characterized by a staggering surge in oil prices from $3.35 to $32.50, witnessed a dominance of commodities. This era also saw emerging economy exporters of oil and gold basking in the spotlight amid production and output cuts.

Shifting gears to the 1980s, the spotlight shifted to Japanese stocks, experiencing a meteoric rise. By 1989, the Tokyo Stock Exchange commanded a staggering 41% share of global equities, surpassing the value of the U.S. equity market just two years prior. The Japanese equity market capitalisation is currently 20% of the US equity market and only recently surpassed the highs recorded in the late 1980’s.

With robust economic growth propelling the United States forward, the 1990s became the era of American tech stocks. Though the crash of 2000 claimed many high-flying tech stocks, survivors like Qualcomm, which skyrocketed by 2,620% in 1999, persisted. Notable entities such as Amazon and Cisco also weathered the storm.

Venturing into the 2000s, a shift unfolded as investors gravitated towards commodities and emerging markets, this time with a focus on the BRIC economies—Brazil, Russia, India, and China.

The last decade, the 2010s, was a great run for large companies with growth stocks leading and the FAANGs (Facebook, Apple, Amazon, Netfilx and Google) in particular as technology permeated myriad industries, shaping the investment landscape in unprecedented ways during a period of ultra-low interest rates.

The 2020s have been defined by investment themes driven by technological innovation, sustainability, and shifting global dynamics. Technology continues to dominate, with areas like artificial intelligence (AI), cloud computing, and 5G playing central roles in reshaping industries. ESG (Environmental, Social, and Governance) investing has gained prominence, as some investors prioritise sustainability and ethical practices. The energy transition towards renewable sources, such as solar and wind energy, is also a key theme, accelerated by climate change concerns. Digital finance innovations, including cryptocurrencies, blockchain, and decentralized finance (DeFi), have disrupted traditional banking, while biotechnology and healthcare have gained attention due to the global focus on health following the COVID-19 pandemic.

A few observations:

- Looking back, it seems obvious that these were the themes at play in those periods. But this is exactly the point Nassim Nicholas makes with the “Narrative fallacy”.

- Performance chasing into yesterday’s winning asset class, fund, ETF, or stock seldom works. It’s not uncommon for a period of outperformance to be followed by a period of dismal performance (Japan’s property & stock bubble, early 2000 tech crash, emerging markets lagging in the 2010s, etc.)

- It’s impossible to consistently predict tomorrow’s winners.

- Diversification is a hedge against not knowing what happens next.

- Be mindful of over-exposure or becoming emotionally attached to an asset class.

- Which investment theme will dominate the next 10 years? History might suggest it won’t be big technology stocks.

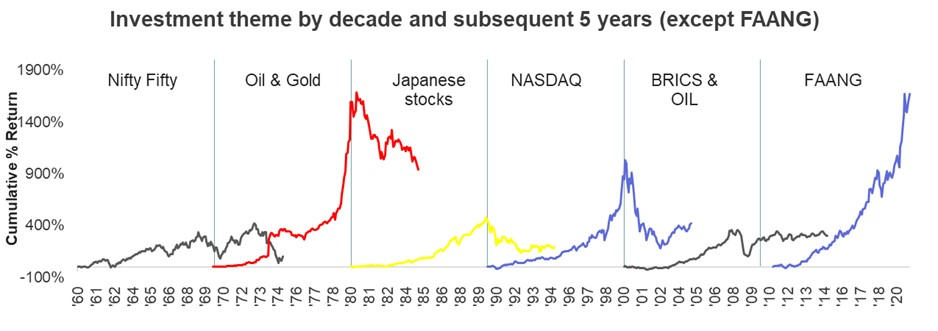

If your focus, or objective is pure return, the key aspect to evaluate from above is the general likelihood of capturing some of these extraordinary returns in real time. To do this we show the performance of these themes after the end of each decade and then compare two simple scenarios with each other.

As you can see, the peak in each theme is usually followed by a downturn in the following years.

Hypothetical pure return chasing scenarios:

- Idealised portfolio

We imagine that we had the foresight to invest in each of these themes at the start of each decade (highly unlikely) and then switch to the next theme at the end of the decade.

- Realistic portfolio

We assume that we could identify the theme halfway through each decade and invest in it until we switch to the next theme halfway through the next decade.

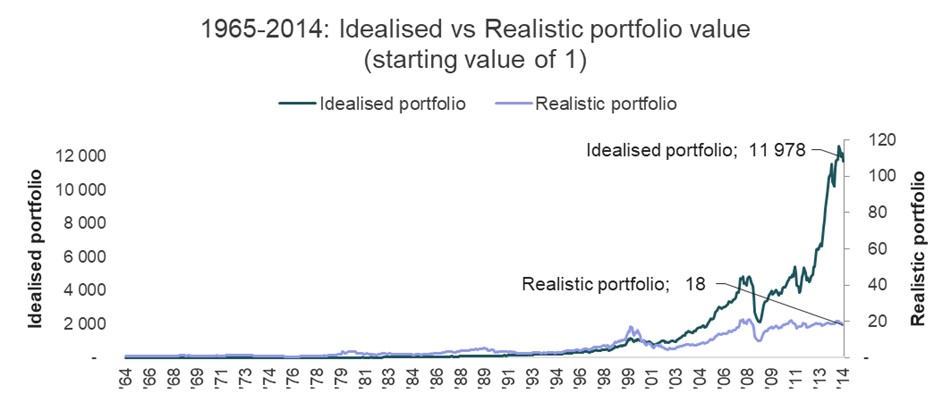

The result of this exercise is shown in the chart below.

The annualised return for the “Idealised portfolio” was 21.4% (annualised volatility 20.5%) vs 6.1% (annualised volatility 24.6%) for the “Realistic portfolio”. There is a stark difference between these outcomes and confirms the difficulties presented when attempting to predict the future and chasing return.

Even if you manage to predict one or two of these trends successfully, it is unlikely that you can do so consistently and the reversals that follow are usually fast and severe destroying most of the gains if you don’t exit at the top. It is safe to say that it is an exercise in futility.

Revisiting Investment Objectives

Defining investment objectives clearly, sets the tone for the decision-making framework that follow.

An investment mandate is crafted by aligning an investor’s financial targets with their personal risk profile, creating a tailored strategy to achieve specific objectives. Financial targets, such as capital growth, income generation, or capital preservation, set the desired outcomes for the portfolio. These goals, in turn, must be balanced with the investor’s risk tolerance, which reflects their comfort with potential losses or volatility.

The mandate serves as a blueprint, dictating asset allocation, investment style, and performance benchmarks, ensuring the portfolio’s strategy is consistent with both the investor’s financial goals and their capacity to handle risk.

This framework helps maintain discipline and clarity, guiding both investment decisions and performance evaluation.

Financial targets can be defined in terms of pure growth or real growth. Pure growth and real growth differ in how they approach wealth accumulation and risk management.

Pure growth focuses solely on maximizing nominal returns, without explicitly accounting for factors like inflation or the cost of living. Investors targeting pure growth typically seek high returns through aggressive asset allocations, often favouring equities or speculative investments with the potential for substantial capital appreciation. This strategy prioritizes absolute performance, aiming to grow the portfolio as much as possible in raw terms, regardless of inflationary pressures.

A pure growth target will usually attempt to outperform the market. This will tilt the investment approach towards performance chasing and deny the investment manager the ability to wait for an investment thesis to play out. The portfolio might lack diversification and suffer high drawdowns.

In contrast, real growth emphasizes inflation-adjusted returns, meaning the objective is to grow wealth in terms of purchasing power over time. Real growth investors are not just concerned with nominal gains, but with ensuring that the portfolio’s value increases faster than inflation, thus preserving or enhancing the investor’s actual wealth. This approach often involves more balanced or inflation-hedged investments, such as Treasury Inflation-Protected Securities (TIPS), real assets, or income-generating assets that can outpace inflation. While both strategies aim for growth, real growth focuses on maintaining long-term purchasing power, whereas pure growth targets high returns irrespective of inflationary erosion.

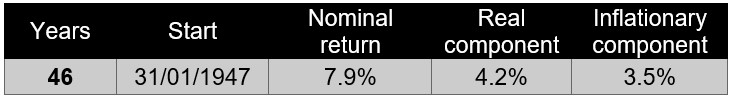

To assess the impact of inflation (as measured by US CPI) on nominal returns, the table below shows the contribution of inflation to the nominal return of the S&P 500 in annualised terms since 1947:

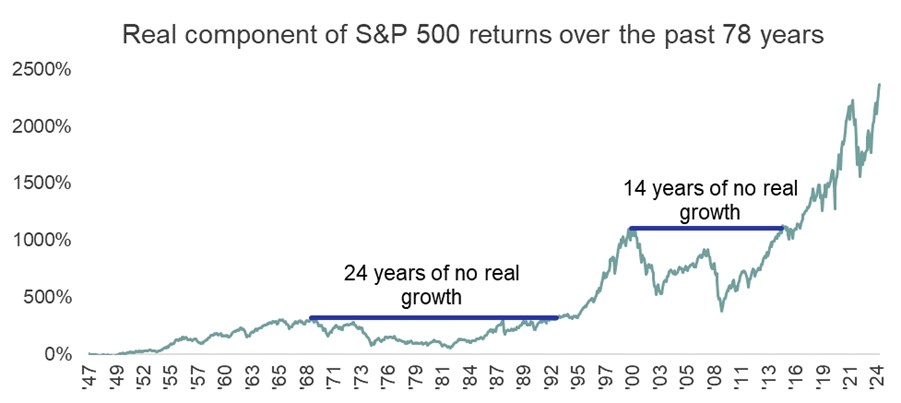

Almost half of the nominal return can be attributed to a general increase in prices (inflation). There were also prolonged periods of no real growth during this period as can be seen in the graph below.

When our investment objective is to grow the real value of a portfolio consistently, your focus will be on creating a diversified portfolio adding enough exposure to equities that can deliver growth in excess of inflation (CPI) while protecting against prolonged periods of relative real under performance.

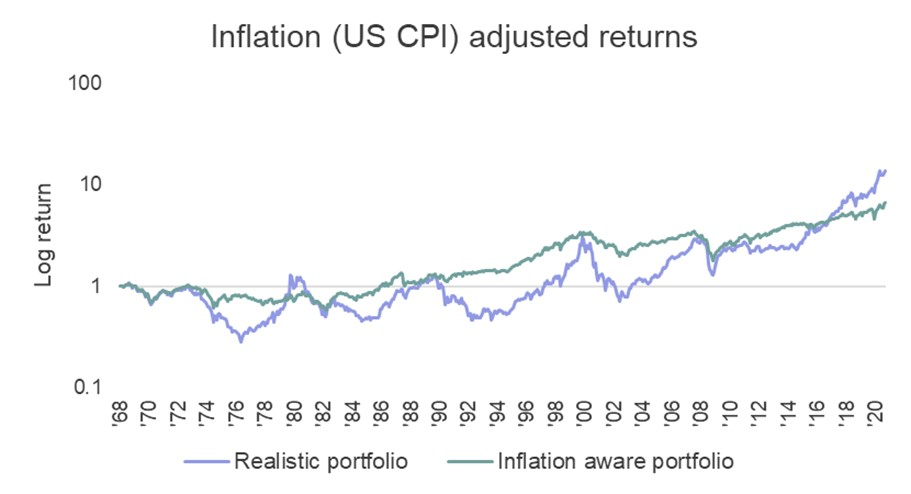

To illustrate this point, we created a third “Inflation aware” portfolio that consists of 85% S&P 500, 10% Gold and 5% Oil exposure to compare to the “Realistic portfolio” from above.

Both hypothetical portfolios are flawed because they suffer from hindsight bias. But the “Realistic portfolio” is concentrated and focussed on delivering capital return, while the “Inflation aware portfolio” is focussed on growing real value, diversified and have exposure to inflation hedges.

The below graph shows the result in additive cumulative terms between these two hypothetical portfolios adjusted for inflation (CPI).

The “Inflation aware portfolio” outperformed the “Realistic portfolio” 88% of the time (46 out of 53 years). The “Realistic portfolio” outperformed the “Inflation aware portfolio” by the end of the period shown. The consistency of the “Inflation aware portfolio” real return is much better with relatively low volatility when compared to the “Realistic portfolio”.

Conclusion

Focussing on real returns as return objective allows for a level-headed investment approach and paying less attention to popular themes and narratives.

Given the potential pitfalls of being drawn into narratives and changes in popular themes, targeting nominal returns creates a real risk of not achieving all investment objectives.

We strive to be focussed on sound and rational thought that should deliver real growth within a framework of sensibility. We do not aim to be the hero of today and the villain of tomorrow but rather a dependable partner in investment management.

View the September 2024 Market Summary

ViewABOUT THE AUTHOR:

Henk Myburgh, CFA®- Head of Research

After completing a BCom Econometrics and MSc in Quantitative Risk Management at the North-West University, Henk Myburgh (CFA), started his career in financial risk management at HSBC. He also worked at Sanlam Capital Markets, where his focus was on consolidation of financial risk across the firm and management of risk on a holistic basis. In 2018 he founded AlQuaTra, a quantitative private hedge fund.