Our personalities, mannerisms and values are all shaped by our surroundings, and our savings patterns are not an exception. Different generations exhibit different savings patterns, many of which have been moulded by the landscape in which those generations grew up.

“…generations take on special meaning because their members tend to experience critical life events and transitions at particular historical moments, and these moments define their lives”

Dr. Deborah Carr, PhD

The savings patterns of those who grew up in times of war and scarcity, are much more frugal when it comes to savings; while those who have grown up in times of instant gratification tend not to prioritise long-term savings over current spending.

Historically, the last period of high inflation and long-term recession was in the early 90s. During this period, the work force consisted of the Silent Generation, Baby Boomers and some Generation Xers. During the 00’s, the Global Financial Crisis of 2008 was not accompanied by high inflation. Some Millennials were working at this stage, while the balance of Millennials and most Generation Zers experienced the turmoil through their parents’ hardships as a result thereof. By the time Covid and the related recession hit, Millennials and Generation Zers had mostly entered the workforce. The recession experienced by the workforce in 2020 was however short and high inflation only came thereafter.

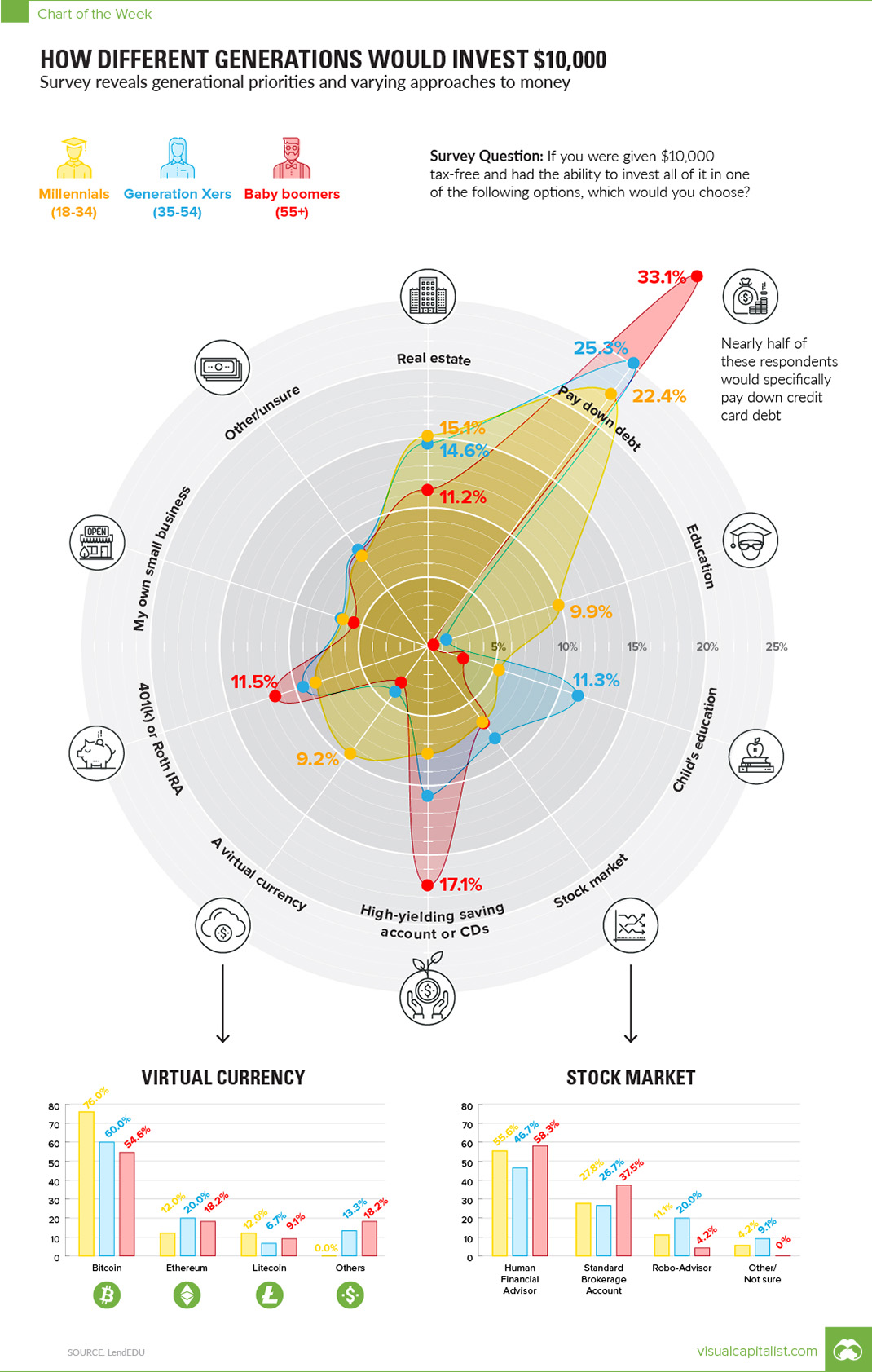

As a result of these life experiences, Generation Z tends to be more frugal and pragmatic than Millennials. According to a 2022 Bank of America survey, they prefer alternative investment opportunities (as opposed to the traditional asset classes). The 2021 Annual Transamerica Retirement Survey found that Generation Z started saving towards retirement at a median age of 19, while Millennials started at 25 and Generation X at 30.

In addition to life experiences, the life stage of a particular generation and their associated needs and wants also impacts their ability and willingness to save. For example, Millennials are more likely to spend more on housing, healthcare and personal insurance than Generation Z. Millennials are also more likely to have higher disposable income than Generation Z as they are further along in their careers. Astoundingly, across the generations, one expense remains approximately equal as a proportion of their income – housing. A 2021 study by the World Economic Forum found that between 30% and 40% of total annual spending across generations was on housing.

The lack of savings amongst Baby Boomers has left Generation X with two sets of financial commitments – supporting their aging parents, as well as children of their own. This phenomenon has led to Generation X being dubbed the “Sandwich Generation”.

With the changing work environment and introduction of “forced saving” via automatic enrolment in defined contribution plans, Generation Z has managed to save 2.5 times (on an inflation adjusted basis) the amount Generation X had saved, in defined contribution plans, at the same age (1989 compared to 2022). According to the International Career Institute’s (ICI) report, from respondents aged 18 and older, in the US, between November and December 2023, this bodes well for their long-term financial outlook.

An additional contributor, according to the ICI’s report, to higher savings rates amongst Generation Z is their perception surrounding obstacles when it comes to comfortable retirement. Generation Z workers have voiced their concern around inflation, unexpected expenses, helping aging parents financially, their children’s education expenses, stock market volatility and credit repayments (at higher interest rates).

The main characteristics of various generations, in the context of investing, identified by ddm marketing communications include:

- Baby Boomers are identified as being more risk seeking when it comes to their portfolio holdings. Approximately 8% of Baby Boomers are 100% invested in shares, and approximately half of Baby Boomers opt for riskier investments than their advisors recommend.

- Gen Xers are more focused on efficiency. They value advisors who can provide guidance for their investments in a concise and timeous manner.

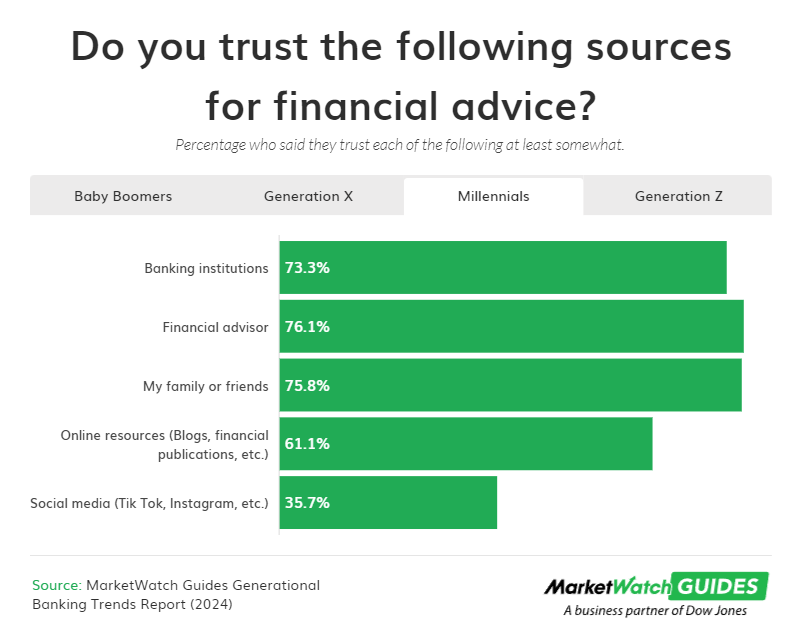

- Millennials are conscientious, prioritising ESG and social responsibility. They prefer to collate advice from various sources and formulate their own opinions.

- Gen Zers are far more tech savvy and place more reliance on trusted friends and family opinions when it comes to investments. They are also the youngest generation to start building retirement savings (with a median age of 19).

“Each generation imagines itself to be more intelligent than the one that went before it and wiser than the one that comes after it”

George Orwell

Earlier this year, Daily Maverick posted an article in which positive habits of various generations were identified. Everyone is shaped by the experiences which they encounter, but if we are able to learn from others’ life lessons, perhaps we can all be more financially savvy. We can also stand to benefit from identifying our short comings and adjusting for them where possible.

- Although Baby Boomers prioritise needs over wants (something younger generations could benefit from implementing), they are often not transparent enough when it comes to their financial standing and limit the beneficial input of others in the know. According to MarketWatch, younger generations are more comfortable talking about their finances and employing the opinions and advice of their trusted peers and family.

- Although their fondness for diversification is a powerful tool in long-term wealth accumulation, Gen Xers are often seen as more risk averse, limiting their return potential.

- Millennials tend to prioritise convenience, relying on apps and digital platforms which automate investment decision making. There are many benefits to employing technology within one’s financial planning, but this should not come at the cost of control and understanding of one’s personal finances. According to MarketWatch, Millennials utilise and place more trust in a variety of information sources when compared to older generations.

- Gen Zers place emphasis on exploration of alternatives. Although there is place for these within a portfolio, they often come with unique risks and should not be blindly invested in.

Despite the differences between generations, there are also similarities. A 2017 study by Stash Financial Inc. found that saving for retirement was ranked as the top investment goal across generations interviewed (Boomers, Xers and Millennials), but the reason for it being prioritised differed. Baby Boomers prioritised retirement due to their age and proximity to retirement, while Gen Xers and Millennials recognise the onus is on them since defined benefit pension plans were phased out. The younger generations additionally highlighted scepticism around government support in retirement. The same study identified paying down debt as a high priority amongst respondents, but the type of debt varied. Baby Boomers prioritised credit card debt, while Millennials prioritised student loan debt above all. A 2024 article by MarketWatch additionally notes the similarities between different generations. The article highlights low savings rates and high credit utilisation across generations.

As investors, we should all pay attention to the evolving landscape in which we invest. Uncertainty spurred on by the pandemic, coupled with lockdowns, led to an influx of new market participants. The median age of US stock market investors prior to 2020 was 48, new investors (now representing 15% of US stock market investors) now have a median age of 35. According to BlackRock, 45% of Millennials are more interested in the US stock market than 5 years ago.

Although the current spread of wealth is still in favour of older generations, these individuals are passing away and leaving their wealth to Millennials and Gen Zers. As such, the younger generations and their impact on investment trends and markets will increase substantially. Understanding their saving patterns and financial goals will better equip financial advisors and investment managers when it comes to advising on and managing investments across various generations.