In our newsletter of June 2024, we considered the potential impact on the US economy should Donald Trump succeed in winning a second term as President of the United States. At the time, there was some speculation as to Trump’s economic policy, specifically as it relates to the independence of the US Federal Reserve Board (the Fed) and how political interference in the Fed’s monetary policy may impact inflation and the US Dollar. It is widely accepted that a weaker US Dollar and rising inflation will result from a weaker or less independent Fed.

In a recent interview with Bloomberg Businessweek, which was published in late July, Trump shared his thoughts on, amongst many other matters, economic and foreign policy. From the interview, there seems to be some validity to the earlier speculation and concerns about Trump’s policy direction:

- Trump wants lower interest rates; and

- he will let Jerome Powell serve out his term, “especially if I thought he was doing the right thing”…

Other points worth highlighting include that he:

- wants to lower the corporate tax rate;

- will implement protectionist trade policies (trade tariffs);

- believes the Japanese and Chinese currencies are too weak (or that the US Dollar is too strong), which gives those economies an unfair advantage to the US; and

- wants to renew his 2017 USD 4,6 trillion Tax Cuts and Jobs Act.

These policies, if Trump gets elected, are expected to have a significant impact on the US economy, according to Wall Street firms like Morgan Stanley and Goldman Sachs. Oxford Economics, a nonpartisan research group, agrees that higher inflation is to be expected as a result.

Even though Trump’s odds of winning the presidential race have reduced slightly after president Biden’s withdrawal (and Kamala Harris becoming the presumptive Democratic nominee), Trump’s ideas are reason for concern to markets, more so considering that his big spending plans might increase an already eye watering US national debt burden of USD 35 trillion further! Which brings us back to JP Morgan’s comments in 1912 regarding character, trust and creditworthiness and that all assets in the banking system, including US Dollars, are forms of credit, whose value depends on the borrowers’ ability to pay it back. Putting all the puzzle pieces together, should Trump be elected, it is not far reaching to expect a weaker US Dollar and higher inflation.

From an investment point of view, the question is how to position appropriately for such an environment? We believe there are a number of strategies that could be employed, one of which is implementing exposure to real or tangible assets like precious metals, specifically gold (and silver).

The long term investment case for gold

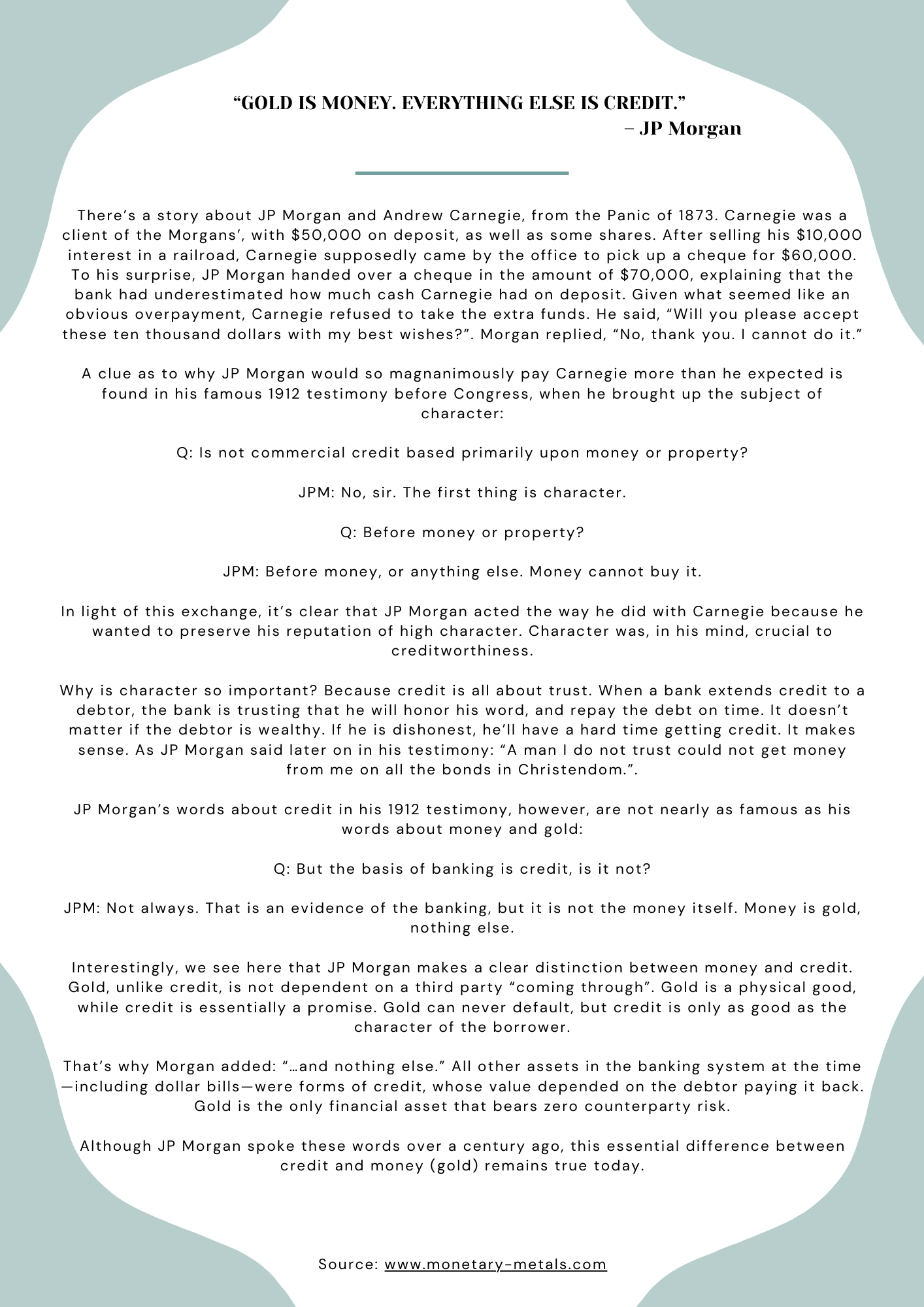

Gold’s diverse sources of demand give it the potential to deliver good returns in various market environments. Used by investors as an investment to protect wealth during periods of uncertainty, this counter cyclical demand supports the price of gold. Utilised as a consumer good (in jewellery and technology hardware), periods of pro-cyclical consumer demand support performance. In addition, global central banks have increased their gold holdings as a percentage of their reserves. According to the World Gold Council, global central banks have purchased 1082 and 1037 tonnes of gold in 2022 and 2023 respectively, more than double the annual average over the previous 10 years.

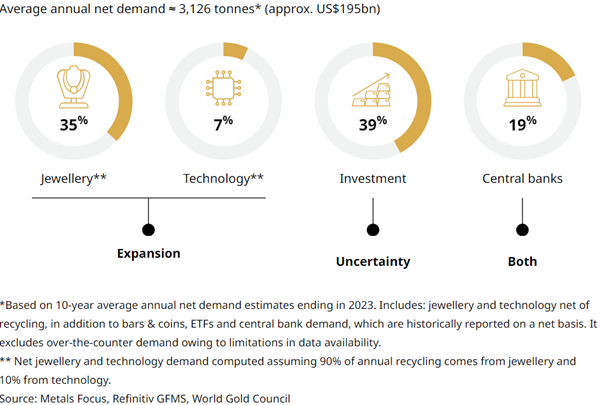

The historical performance of gold supports the theory outlined above. Over the last 20 years, for instance, gold has outperformed most major asset classes, including global equities, bonds, cash and commodities.

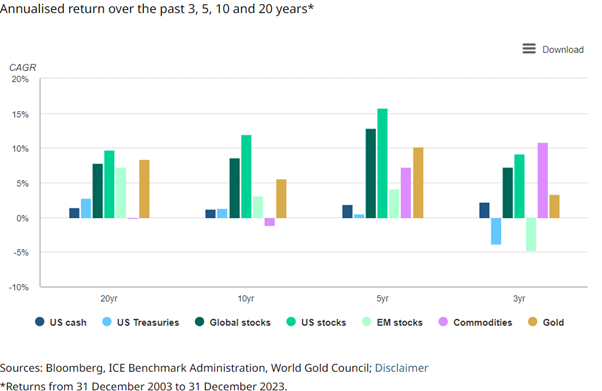

Not only has gold performed well over time, but it has done so at lower levels of volatility relative to most asset classes, leading to superior risk-adjusted returns.

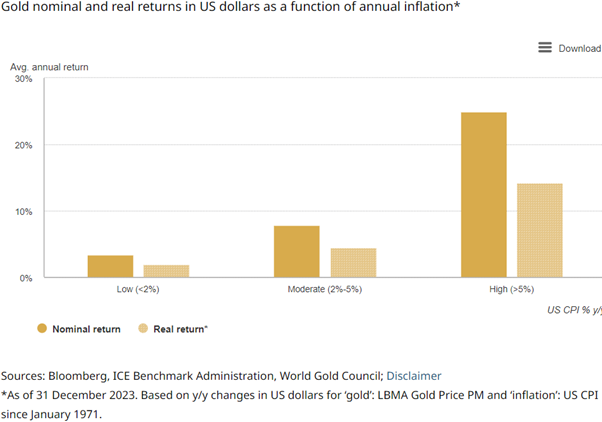

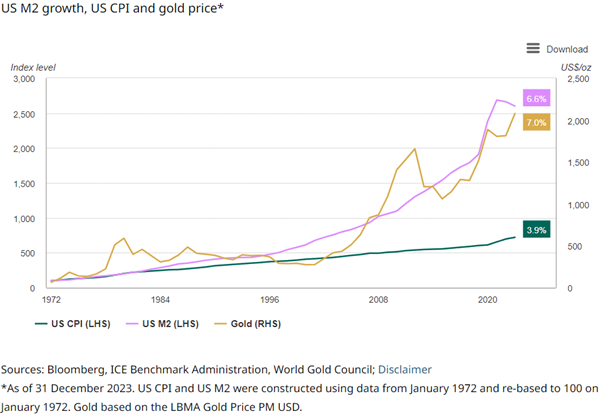

Speaking to the prospects of increasing money supply, US Dollar weakness and rising inflation, gold has performed as expected, as depicted in the charts below. Since 1971, when the gold standard was abandoned, gold has outperformed inflation, especially during periods of higher inflation.

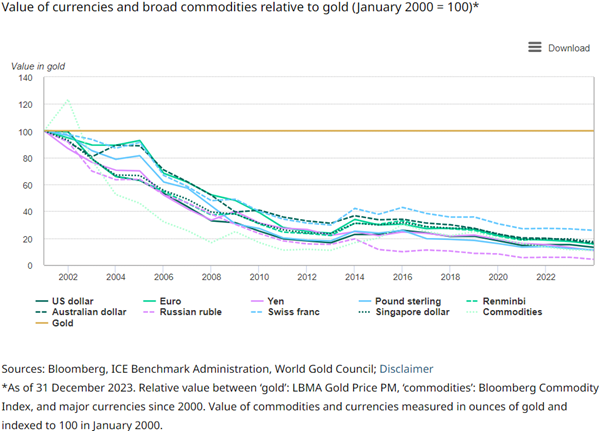

The chart below shows how various currencies have fared relative to the value of gold, supporting the store of value argument against currency debasement.

Lastly, gold has kept pace with the unrelenting growth of money supply, especially as a result of quantitative easing and other monetary policies implemented since 2008, as investors turned to gold to protect themselves against currency devaluation.

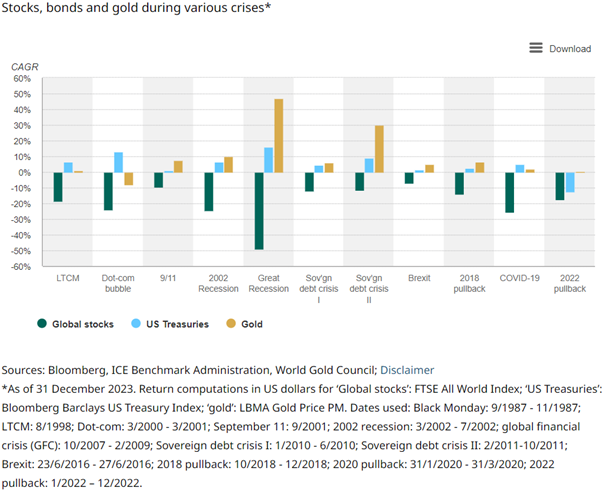

From a portfolio construction and diversification point of view, gold exhibits some interesting qualities. Most investment asset classes tend to become highly correlated as market uncertainty and volatility increase, meaning that the effects of diversification diminish during periods of crises. Gold is quite unique in the sense that its correlation to equities and other risk assets decreases as crises unfold and risk assets sell off. This quality is evident in the chart below, gold acts as an “insurance” of sorts against systemic risk.

The evidence suggests that gold, as a long-term investment, adds value to an investment portfolio. Gold has, historically, generated healthy risk-adjusted returns, acted as a store of value against inflation or currency debasement, and provides a capital protection characteristic to portfolios. One detractor from the investment case for gold is that it does not offer yield. In the short- to medium-term, the movement in interest rates, specifically real, or inflation adjusted, might influence the performance of the yellow metal. High real interest rates may detract from gold’s shine, while low or negative real interest rates may negate the opportunity cost of holding gold (from an income yield point of view).

As risk management and diversification are important aspects of our investment philosophy, we have been investing in gold (as well as silver, gold’s less known “companion”) for some time. Given the current global economic, political and geopolitical environment, we intend to maintain this stance.