| Bubbles abound? Valuation matters. |

| Bubbles abound? Valuation matters. |

Bubbles abound? Valuation matters.

Some in clandestine companies combine

Erect new stocks to trade beyond the line

With air and empty names beguile the town

And raise new credits first, then cry ’em down

Divide the empty nothing into shares

And set the crowd together by the ears

– Daniel Defoe

The Mississippi Scheme, the South Sea Bubble, the Tulip Mania and the Dotcom Bubble are but a few examples of mania that gripped society’s attention over the centuries and caused many, professional investors and laymen alike, to fall into and out of enormous amounts of wealth. It was apparently after losing a large amount of his family’s money during the bust of the South Sea Bubble, in the early 1700’s, that Sir Isaac Newton said that he “could calculate the motions of the heavenly bodies, but not the madness of the people”.

In very simplistic terms, a bubble occurs when an asset’s price increases to levels significantly above its norm and/or its intrinsic value. In my opinion, for an asset to have an intrinsic value there is a fundamental requirement that the asset possesses the ability to generate a sustainable income stream or earnings. If this requirement is not met, price determination of an asset becomes a matter of opinion or even speculation. The “Greater Fool Theory” states that an asset’s price can continue going up as long as there is a greater fool willing to pay an even higher price, regardless of fundamentals, quality factors or whether the asset is overvalued.

Fundamentally, bubbles can be caused by a number of factors, like an abundance of money supply and low interest rates. They are also however, without fail, characterised by behavioural aspects, like fear and greed. The desire to become wealthy and “make” more money drives people to participate in speculation of overpriced assets or assets with no intrinsic value, while fear (popularly referred to as FOMO or “fear of missing out”) also causes people to throw caution to the wind.

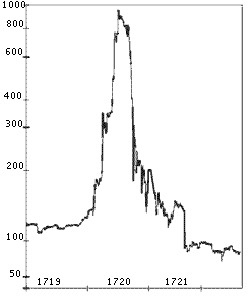

The South Sea Bubble of 1720 – a very brief overview

The South Sea Company was established in 1711 to assist the British Government in debt management, and was in return given a monopoly for trade with the islands in the “South Seas” and South America. In 1720, the stock of the South Sea Company experienced a meteoric rise, increasing ten fold. This, in part, created an environment for broad speculation in a range of other companies. Those unable to buy South Sea stock were persuaded, by overly optimistic company promoters or downright swindlers, into unwise investments.

These new companies popped up everywhere and were given the name of “Bubbles” (a very apt description). Some companies did not survive but a few weeks, while others did not see the light of day, but not before the promoters sold their stock to the public. Charles Mackay in “Extraordinary Popular Delusions and the Madness of Crowds” described a company that successfully “listed” and raised thousands of pounds in capital despite being, per it’s prospectus, “a company for carrying on an undertaking of great advantage, but nobody to know what it is”.

Another “scheme” was the “Globe Permits”, nothing more than playing cards on which was an impression of a seal of the Globe Tavern in wax. The card gave the owner the permission to subscribe at some future time, for shares in a sail cloth manufacturer. Globe Permits sold like hotcakes.

Needless to say, the speculative excess of 1720 ended in tears.

South Sea Company share price

Source: Wikipedia

Fast forward to 2021

History may not repeat itself, but it sure does rhyme – Mark Twain

For the record, I am not making a statement that in 2021 we are in the midst of a mania or bubble that is at the cusp of bursting, but there have been some very interesting developments of late. Some of these developments may be reminiscent of the stories of the South Sea Bubble. Secondly, I am not commenting on the validity of the “investments” listed below, but merely attempting to give some context to what has been happening in financial markets of late. I do have a view, but that’s a whole separate newsletter altogether.

Meme stocks

A meme stock is a stock that has seen a dramatic increase in its share price, over a very short space of time, not because of how well the company performs, but rather because of hype on social media and online forums like Reddit. These stocks have become very popular recently, thanks to the rise of retail investing. There have been a number of meme stocks in 2021 that captured the market’s imagination, most notably Gamestop, essentially a floundering company that has seen its share price rise from around USD 15 at the start of 2021, to USD 483 in late January.

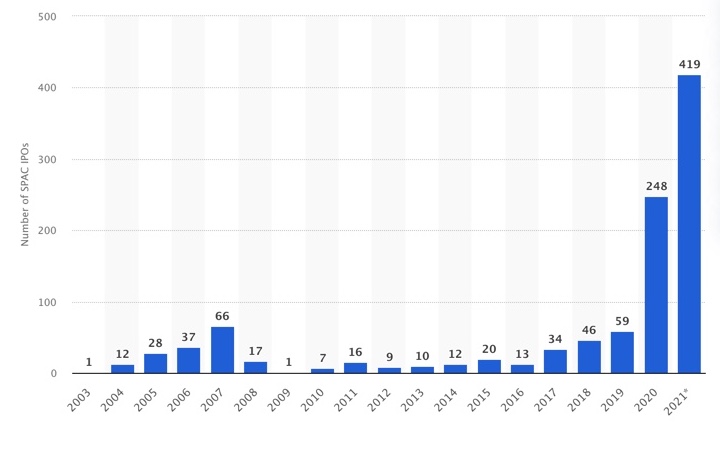

SPACS

A special purpose acquisition company (SPAC) is a company with no commercial operations, that is formed strictly to raise capital without going through a traditional initial public offering (IPO). SPAC’s are also known as “blank check companies” and their purpose is to raise capital to acquire an existing company at some later time. Over recent years, the growth in SPAC’s has been spectacular. These companies tend to have very complex shareholder arrangements and represent nothing but a promise to execute a mandated investment strategy in the future. During 2021 there has been a marked increase in the number of SPAC listings, year to date a total of USD 122 billion has been raised in 419 listings.

Source: Statista

Cryptocurrencies

One must have been in hibernation not to know what a cryptocurrency is. They have shown impessive growth in popularity (there are currently some 6 500 cryptocurrencies in the world!) and the value of most cryptocurrencies have risen quite spectacularly over the last two years. Bitcoin and Ethereum, the two biggest cryptocurrencies, have seen prices increase by a factor of five and ten times respectively, since the start of 2020. Dogecoin, a meme cryptocurrency which was established as a joke and regularly endorsed by Elon Musk, has seen it’s price increase by 40 times over the last two years.

NFT’s

A non-fungible token, or NFT, is a unique digital asset that is used to represent a piece of art or collectable. NFT’s are based on the technology behind cryptocurrencies, called the blockchain, and have seen tremendous growth in 2021. The most expensive NFT, “Everydays: The first 5000 days”, by famed digital artist Mike “Beeple” Winkelmann, recently sold for USD 69.3 million.

Would you pay USD 11.8 milllion for the “CryptoPunk # 7523” NFT pictured above?

What about conventional assets like ordinary listed shares?

It is very difficult to make a generalised statement about the valuation of shares, as there are so many geographic regions, sectors and investment styles (like “Value” and “Growth”) to consider. As always, the devil is in the detail. Considering US shares and specifically IT/e-commerce shares like Amazon, Microsoft, Alphabet, Apple, Netflix, Facebook and the likes, there seems to be some cause for concern. Make no mistake, these are quality businesses which have delivered exceptional growth in sales and earnings over the last ten years. But it could be argued that the valuation placed on the shares of these companies may be too optimistic, despite superior historic growth rates delivered.

For some historical context, let us look at Cisco as an example. Cisco listed on the Nasdaq in 1990 at a market capitalisation of USD 224 million. Over the next ten years it established itself as the leading IT company, unseating Microsoft as the world’s most valuable company. In March 2000, at the height of the Dotcom bubble, its market capitalisation reached USD 531 billion. The share price delivered a compound annual return in excess of 100% (more than 100 000% cumulatively) over the ten years!

At the time, Cisco and its management team was hailed as American heroes. According to a Bloomberg headline, six months before the share price peaked:

And Fortune Magazine on 15 May 2000 said: “No matter how you cut it, you’ve got to own Cisco.”

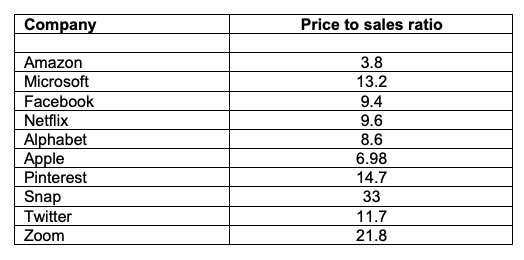

Source: Koyfin

Sure, Cisco was (and still is today) a quality business with a great management team and had the wind of the “Internet Age” behind its sails, selling networking equipment connecting the world to the internet, but was the price justified?

The graph above shows Cisco’s share price history since listing. The share was listed at around USD 0.07 per share in 1990, peaked more than 100 000% higher at USD 77 per share at the height of the Dotcom bubble in 2000. The share price then lost nearly 90% when the bubble burst. At USD 55 per share today, investors who bought the share on the promise of the perpetual benefits the “Internet Age” would bestow on Cisco as a business are still approximately 30% down – almost 21 years later. Was Cisco a bad business? Probably not altogether, but the valuation placed on its shares was not in line with reality. At the peak, Cisco’s share price traded at a price to sales ratio of more than 30 times. That means that, at the time, if one invested in Cisco shares and the company distributed 100% of sales to shareholders as dividends (a ludicrous expectation seeing that the company has cost of sales, wages and salaries, operational expenses and taxes to pay), it would take thirty years to earn back capital invested! Valuation matters.

The table below lists the price to sales ratios of a selection of US IT, e-commerce and social media businesses today. Although not at the manic extremes of Cisco during the Dotcom bubble of 2000, the ratios are quite high in absolute terms and also above norm for most of the companies.

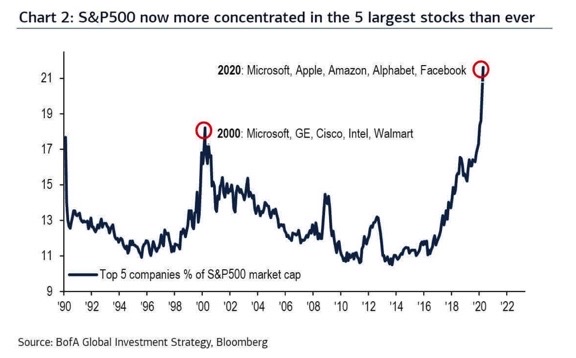

The price momentum in technology companies has been exceptionally strong, as is evident in the contribution of technology companies to the composition of the S&P 500 index. The index is very much dominated by the top 5 companies by market capitalisation, all technology shares. It must be asked whether this is sustainable, especially considering the fact that the macro economic environment has become more challenging.

The US Fed has indicated that they are starting to taper Quantitative Easing within the next month or two and higher interest rates will follow. In fact, according to the Fed’s indications (the so called “Dot Plots”), there may be more interest rate hikes on the cards than previously anticipated. What will happen when two of the major drivers of investment markets returns in recent years, liquidity and the cost of capital (interest rates), become more restrictive? This question does not apply to shares only, but possibly more so to the new age “investment” trends described earlier.

As always there are still opportunities. As opposed to “Growth” oriented companies (like the one’s listed above), there are other sectors of financial markets that offer better valuations. “Value” oriented shares like materials (commodities), energy, retailers and banking appear to be offering good potential.

In terms of our investment philosophy, we focus on investments in quality multinational businesses, that offer healthy cashflows, that are available at reasonable valuations. Chasing the next meme stock or NFT does not fit our approach of preserving and growing capital steadily over the long term and we would rather hold onto cash until we see opportunities which facilitate long-term returns and wealth preservation.

Bennie