Afrimat primarily engages in open pit mining processing and the supply of a broad range of industrial minerals and construction materials to an assortment of industries across southern Africa. In addition, Afrimat supplies bulk commodities to local and international markets. The Group has extensive in-house industry experience, and a stable employee base.

Afrimat’s CEO, Andries van Heerden, joined the industry 20 years ago, in a little quarrying company called Prima Klipbrekers, in Worcester. In 2003, Andries saw a major change in the industry with a lot of new legislation and regulations being enforced. He came up with the idea of consolidating the industry. The shareholders at the time had their doubts about this idea and decided it would be better to fire Andries and maintain the business in its current form. He was fired from Klipbrekers in 2005.

Confident in his analysis of the changing landscape, he found similar minded partners and together they purchased a small quarrying company called Lancaster Quarries in KwaZulu Natal. He moved to Vryheid and listed his quarrying business. Klipbrekers subsequently saw the value in his vision and the two companies merged, and listed in 2006 under the name Afrimat, meaning African materials. Since then, Afrimat has acquired additional quarrying businesses, in line with Andries’ initial planned consolidation process.

The global financial crisis in 2008 saw the property sector fall, leaving many construction and property firms at risk of bankruptcy. In an attempt to diversify their income streams and protect themselves against another changing landscape, Afrimat decided to expand their operations into mining. They started by purchasing a few industrial mineral businesses, the first of which was a mine called Glen Douglas (purchased from Exxaro). Since 2012, Afrimat has purchased a few limestone and dolomite mines. The group aspires to find assets with large upside potential. These assets are often underperforming, but Afrimat analyses their ability to turn them profitable and where feasible choose to invest.

In 2016, Afrimat bought an iron ore mine in the Northern Cape. At that time, the iron ore price was $55 and the Rand was trading at R12,00 to the dollar. They have acquired a few more iron ore reserves in the Northern Cape and recently also bought an anthracite mine in Mpumalanga that was also in deep distress. They are currently busy with the turnaround of the mine. The group plans on adding manganese to their portfolio in the near term.

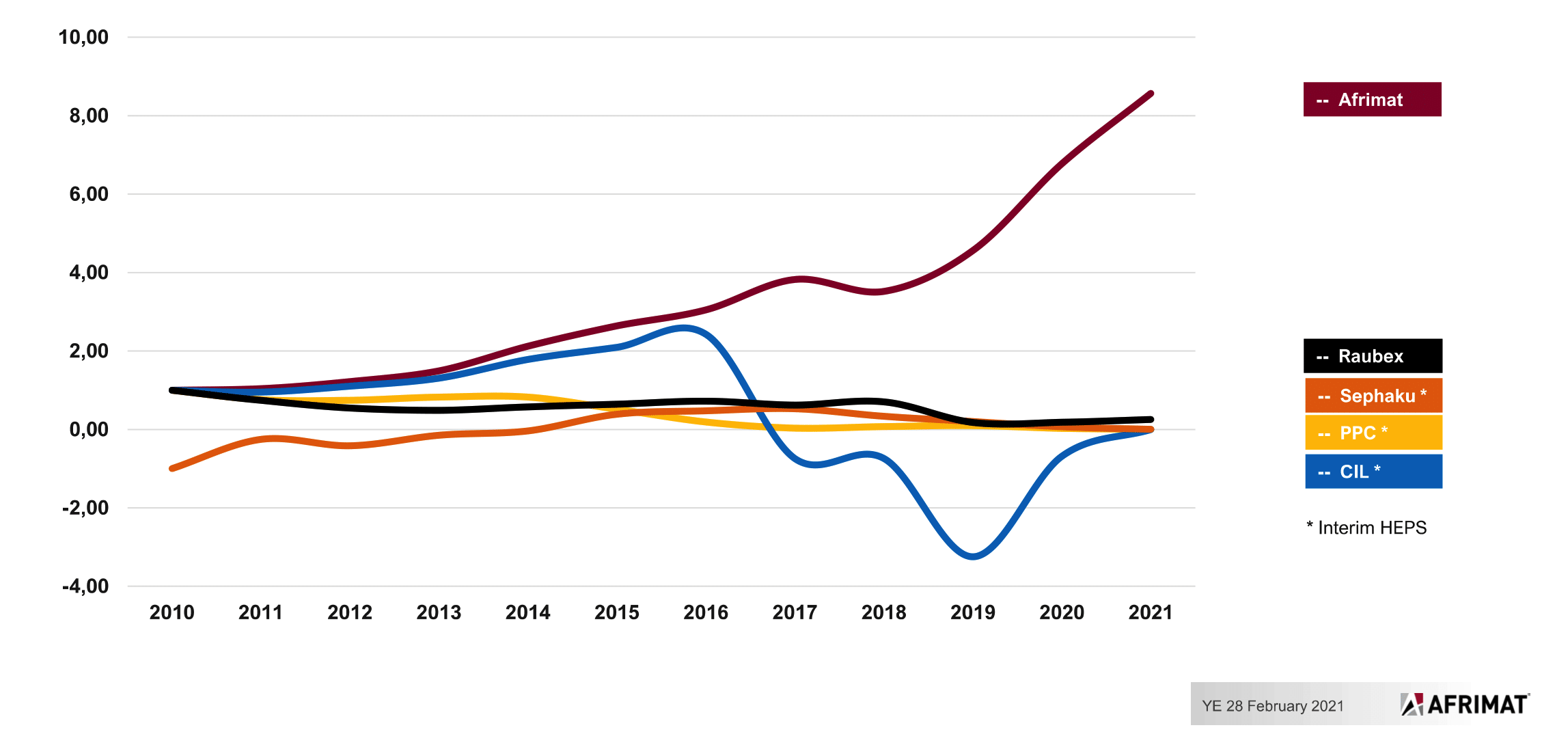

Afrimat has had tremendous success in diversifying their portfolio of operating assets and in turn ensured that shareholder value was created, despite cyclical downturns in the construction industry. In their recent results presentation, the following graph was presented. Their outperformance, when compared to their construction peers, is largely attributable to their robust diversification strategy:

Headline earnings per share (HEPS) comparison:

Source: Afrimat

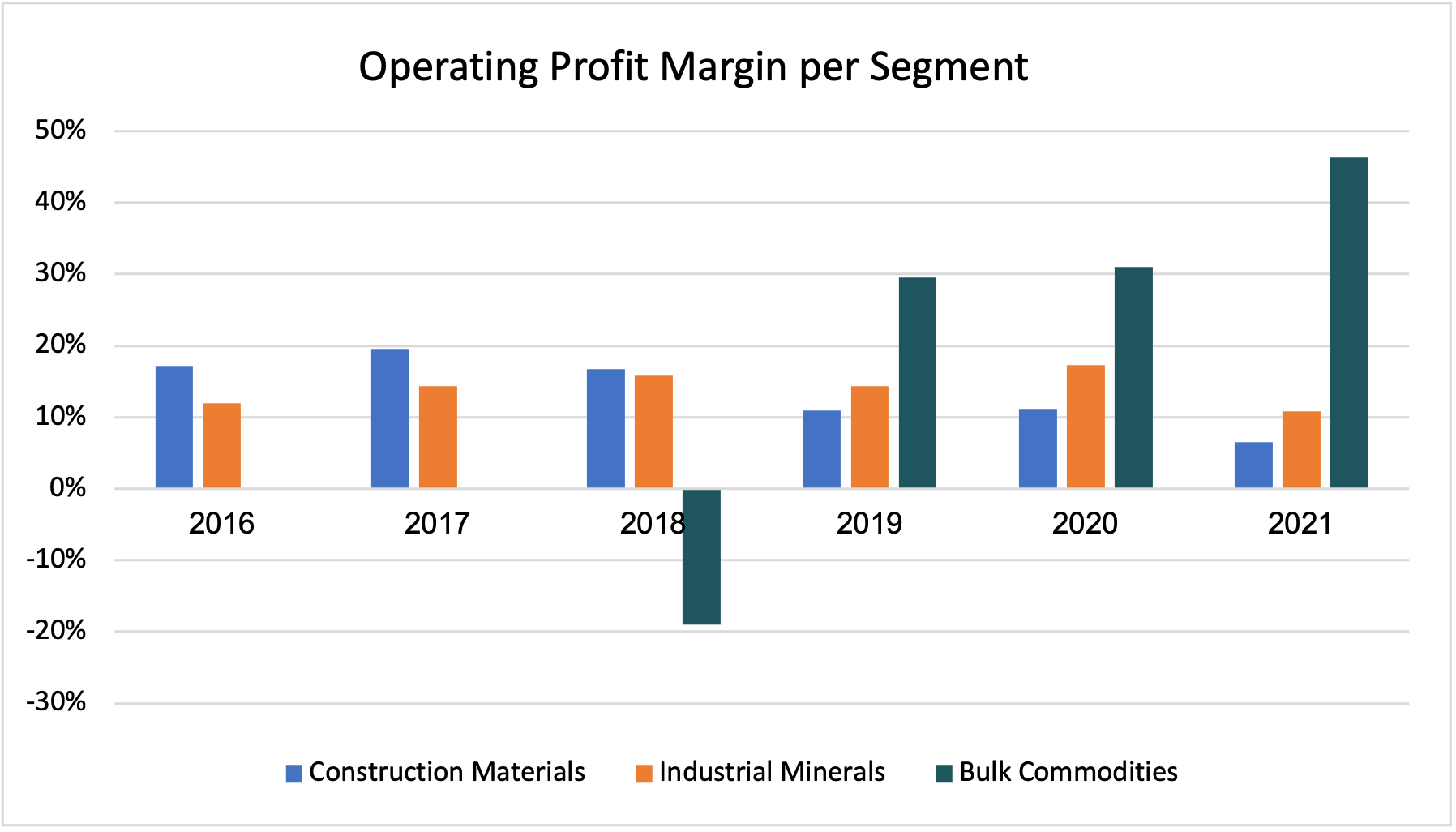

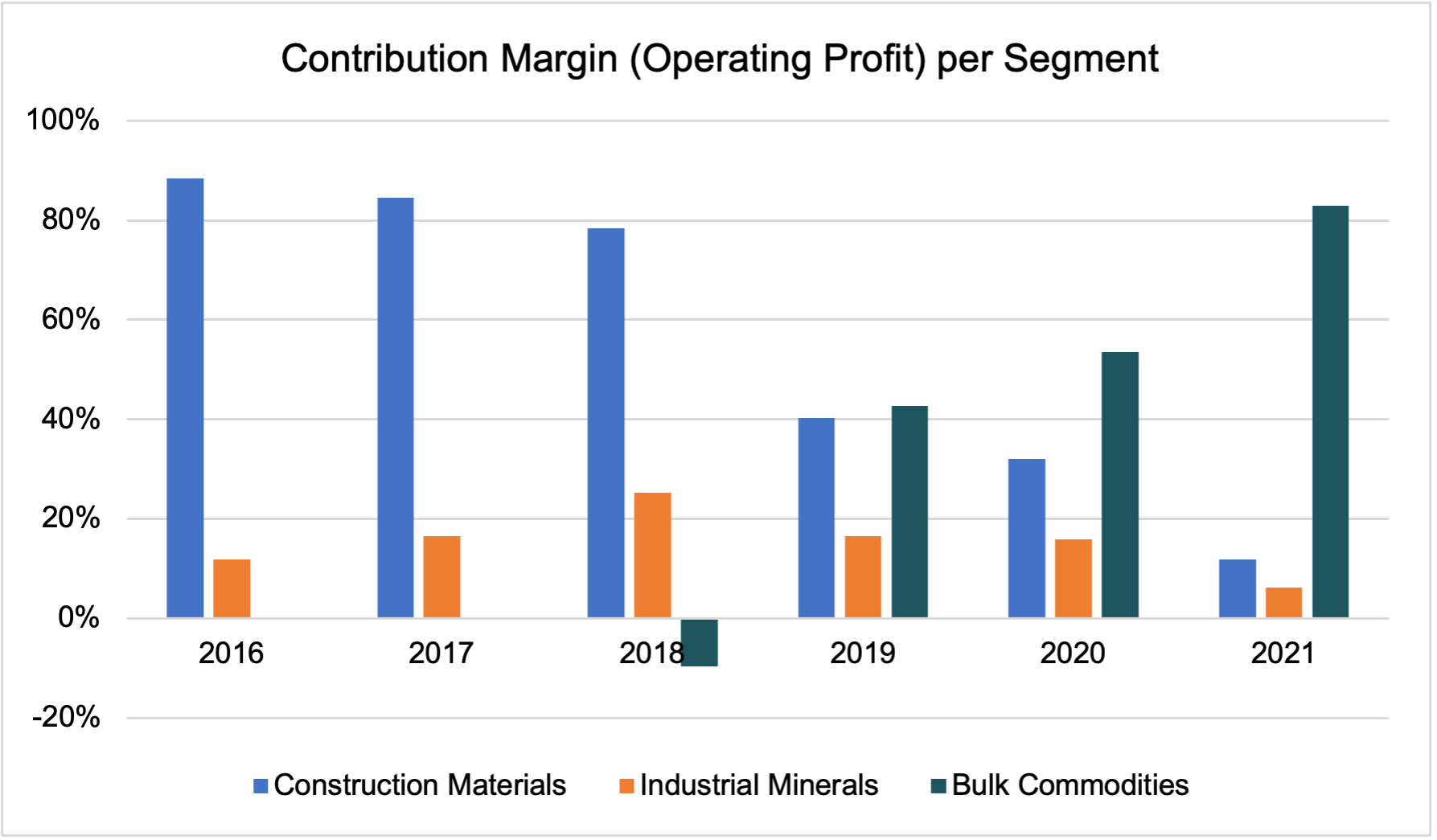

Currently, Afrimat has three operating segments: construction materials, industrial materials, and bulk commodities. Over the last five years, their revenue has grown at a CAGR (compound annual growth rate) of 18.4%. Over the same period, operating profit has grown at a CAGR of 29.7%. This additional increase in operating profit over revenues indicates the company’s improved cost control and synergies realised between the three operating segments.

If we look at the percentage of profit generated from revenue (Operating Profit Margin) and operating profit contributed by each segment (Contribution Margin) for the last 5 years, we can once again see the benefits of their diversification strategy and high margin generating business:

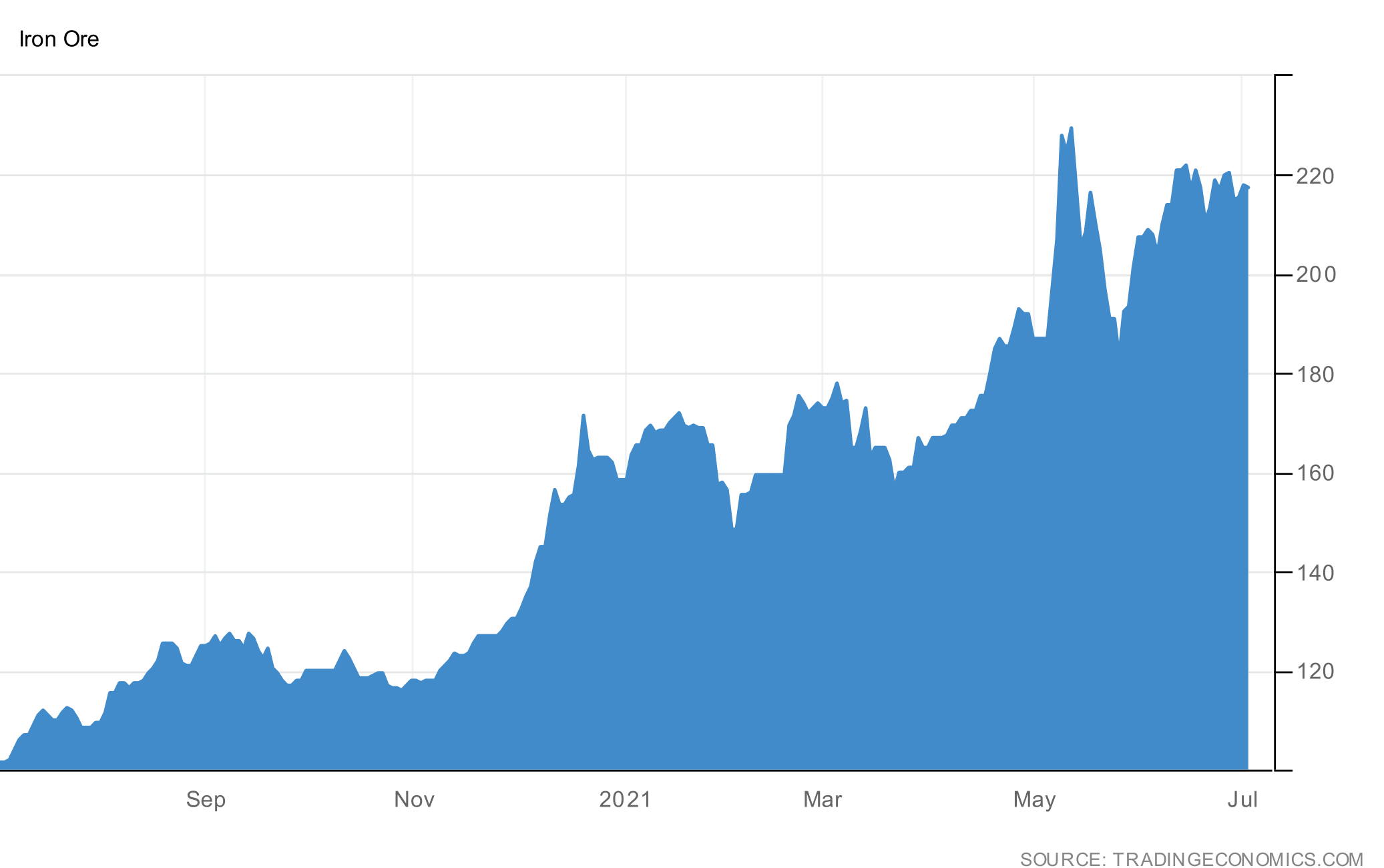

During the past three years, the Bulk commodities side of the business has boomed due to sound investment decisions on Afrimat’s side, as well as strong Iron Ore prices. In the 2021 financial year, Bulk Commodities contributed 43% to revenue and 82% to operating profit. The quality of iron ore mined by Afrimat is similar to the grade sold by Kumba Iron Ore, approximately 80% lumpy – resulting in a small upward adjustment to the price due to the slight improvement in quality compared to the 62 Plats Index. All Iron Ore is currently (2021 Financial year) sold to the marketing department of Kumba, who exports via the Saldanha bay harbour to China. Currently, they do not hedge the iron ore price or rand dollar exchange rate, which has the implication that margins at current prices are not locked in.

Their Denameng mine is currently their biggest Iron Ore generating mine. The mine has a short-cycle, three to four years left, of supplying around 850,000 tonnes per annum. The Denameng mine predominately services the export markets. They have more recently acquired the Jenkins Iron Ore mine to service the local market. The Jenkins mine has an expected volume output of 500,000 tonnes in year 1 and 1,250,000 tonnes in year 2. Afrimat has two other potential resources to replace the volumes of the Denamang mine. Afrimat has sufficient capacity to improve and maintain current volume outputs in the short- to medium-term.

Iron Ore Price over the last year:

Afrimat’s Bulk commodities business additionally includes Anthracite and Manganese. The group believes that diversification makes them more resilient to economic downswings. The Nkomati anthracite mine is expected to contribute to the second half of 2022 and the mine’s potential remains exciting due to high quality of product. Afrimat has recently acquired the Gravenhage Mine to include Manganese in their portfolio. The Gravenhage mine acquisition complements their diversification strategy within the bulk commodities segment, while additionally increasing the group’s scale in the ferrous-metal value chain and providing further exposure to foreign currency denominated earnings.

Afrimat could, depending on the price of iron ore (Currently 54% up from 1 Jan 2021), use the cash generated by their Iron Business to fund the acquisition of the Gravenhage mine and cover the capital costs over the next financial period.

Afrimat has a strong balance sheet accompanied by a rapid growth in net cash generated from operations (CAGR of 17.26% for the last 5 years). This was, to an extent, due to the remarkably high iron price which could be a risk, but according to our internal calculations Afrimat could sustain a drop in the Iron Ore price over the long run. The other two segments, Construction materials and Industrial materials, were unable to operate during the harder Covid-19 lockdowns, thus did not contribute towards revenue over this period. The segments have however seen improvement in the second half of the 2021 financial year, “exceptional performance” as noted by Pieter de Wit (CFO of Afrimat).

Taking everything into account, we believe that Afrimat stayed true to their diversification strategy. Looking at current acquisitions, we believe that the future within the Bulk commodities segment is an attractive business case. If we look at where Afrimat started and where they are today, we commend the management team for their sound investment decisions and strong commitment to building a well-diversified and profit-driven business.

We will continue to monitor the company, with the view of making an investment at a favourable price. Currently, the PE ratio is higher relative to the historical average. It all depends on the iron ore price and recovery of other segments, but if the iron ore price stays elevated relative to the average price in the previous financial year, there may be more upside. Afrimat has transformed into a diversified business with strong support from iron ore at the moment, so if you believe the iron ore price will remain elevated, then an investment in Afrimat may deliver satisfactory returns.

ABOUT THE AUTHOR:

Heinrich van der Merwe, CA(SA)

Heinrich van der Merwe, CA(SA), completed his articles at PricewaterhouseCoopers (Johannesburg) where he gained exposure to a wide range of industries; mining services (Gold, Iron Ore & Coal), security services, renewable energy, construction and healthcare services, with exposure to listed and privately-owned companies. This was followed by a five-month short-term assignment with PwC Sweden and PwC Canada.