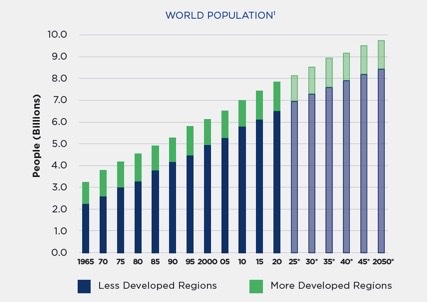

Source: Population division of the Department of Economic and Social Affairs of the United States

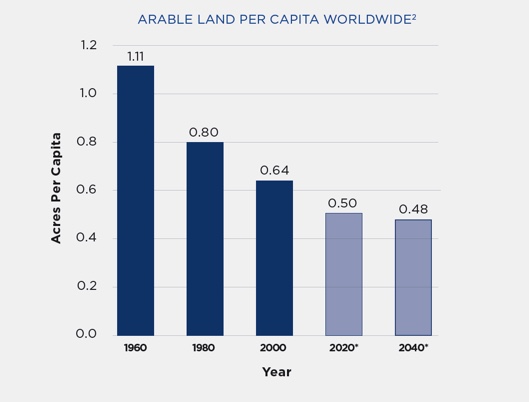

Urbanisation and industrialisation. The destruction of the world’s finite fertile farmland for residential, business and industrial development is expected to continue unabated.

Climate change. Increasingly erratic weather patterns causing droughts and water shortages.

Emerging markets middle class. The growing middle class in the emerging world is demanding more meat protein as they upgrade their diets, which places increased pressure on global grain supplies. The Organization for Economic Co-operation and Development (OECD) estimates that consumption of major meat proteins in emerging markets will increase by 21% by 2027. The ratio of feed grain to beef is ten to one; in other words, every kilogram of beef produced requires ten kilograms of feed grain.

China. China has to feed a fifth of the world’s population, but only has approximately 8% of total arable land (which continues to be consumed by urbanisation). Limitations on clean water, continued urbanisation and diet improvements means China will become more reliant on imports and is already a net importer of grains, including wheat, corn and rice.

Maximum fertilizer efficiency. Crop yields are reaching maximum output levels on current fertilizer science.

Pesticide and herbicide resistance. Insects and weeds are becoming immune to poisons.

Water scarcity. Aquifers are being depleted at an ever-increasing rate. Water sources are becoming increasingly polluted and require costly water treatment solutions. Regions with ample water supply will in effect become water exporters by virtue of their crop and livestock production.

Performance of Agriculture and related industries

The chart above shows the performance of the MSCI Agriculture and Food Index. This index represents a global basket of companies that is involved in the production of agricultural goods, as well as packaging, distribution, chemicals and fertilizers (including companies like Archer Daniels, Nestle, Corteva, Nutrien, General Mills etc). Since 2006, this basket of shares has delivered a superior return to the World Index of all shares and at a lower level of risk or volatility.

Farmland: the ultimate agriculture exposure

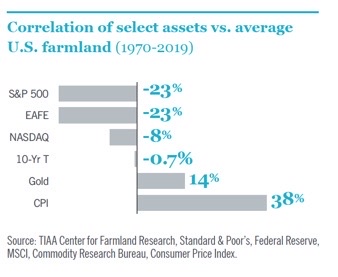

Farmland offers good return potential, low correlation to other asset classes like equities and bonds (i.e. offers good diversification benefits) and is an effective inflation hedge. In addition to the supportive fundamental outlook for agricultural products in general, farmland is facing a “supply” constrain as it is a finite asset. Furthermore, climate change and redevelopment is impacting the supply of arable land. Lastly, as the global population grows, the availability of arable land per person is decreasing.

Source: United Nations

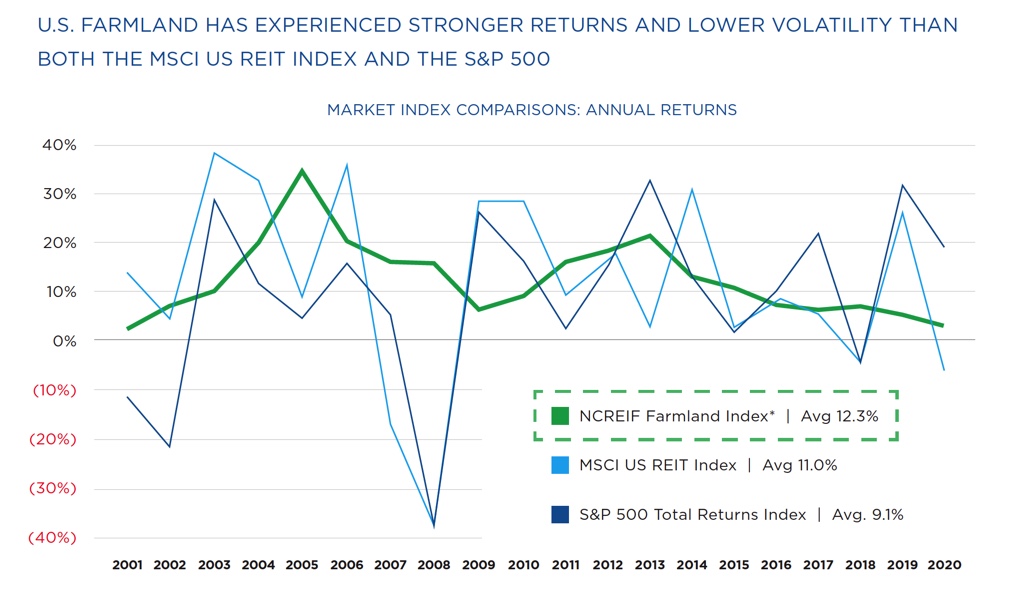

The chart below show the return characteristics of farmland: