It has been 403 days since South Africa’s first Coronavirus lockdown, which was instated at midnight on 26 March 2020. Although the country is currently on adjusted alert level 1 as of 1 March 2021 (very limited restrictions), Cooperative Governance and Traditional Affairs (Cogta) minister, Nkosazana Dlamini-Zuma, has announced the extension of South Africa’s national state of disaster by a further month, until 15 May 2021.

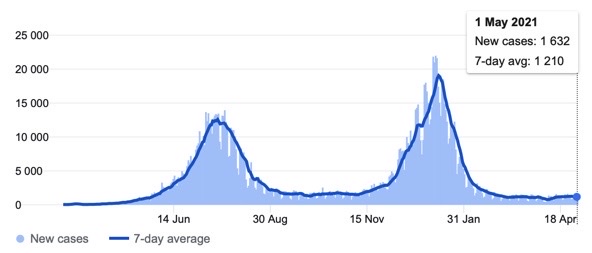

Daily infections in SA seems to be under control, but with winter fast approaching, possible virus variants and a very slow vaccine roll-out program, caution seems to be at the order of the day.

Source: Johns Hopkins University Center for Systems Science and Engineering (JHU CSSE)

While India is currently experiencing a massive spread of the virus (currently in excess of 350 000 new cases per day!), the rest of the world seems to be making good progress fighting the virus as vaccination programs are rolled out aggressively. In the US, UK and Europe, daily cases seem to be falling and restrictions are being relaxed.

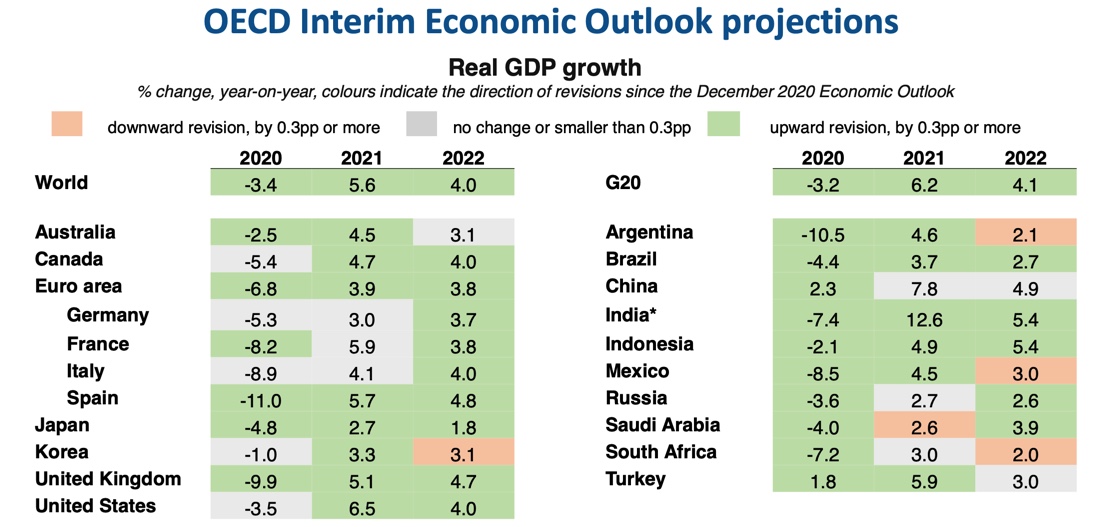

The impact of the Coronavirus and the accompanying restrictions on the movement of people, goods and services, has had a significant impact on the global economy. The global economy contracted by 3,4% in 2020, but swift and decisive action by central authorities, especially in the US and Europe, has had a positive impact on growth. Monetary policy (quantitative easing and lower interest rates) and fiscal packages (government spending) are fuelling an economic recovery. The table below lists the economic growth expectations for major developed and emerging economies.

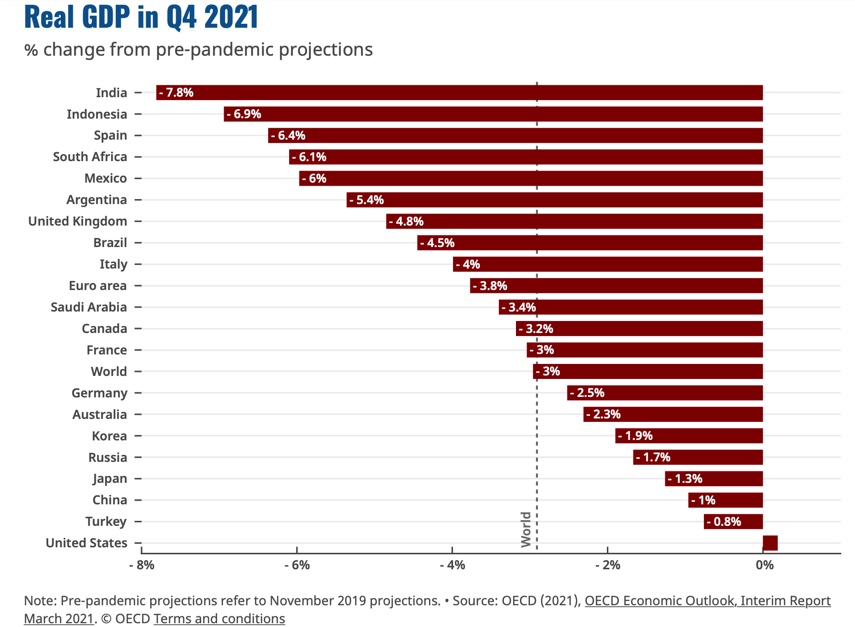

The Covid impact will however be with us for some time, and for some economies it will be a while before economic output recovers to pre-pandemic levels, as per the chart below. The chart shows the deviation of economic activity in quarter 4 of 2021, relative to expectations from before the pandemic. The world is still playing catch-up. Of special interest is South Africa, which has significant ground to cover as we have more than just the pandemic to contend with…

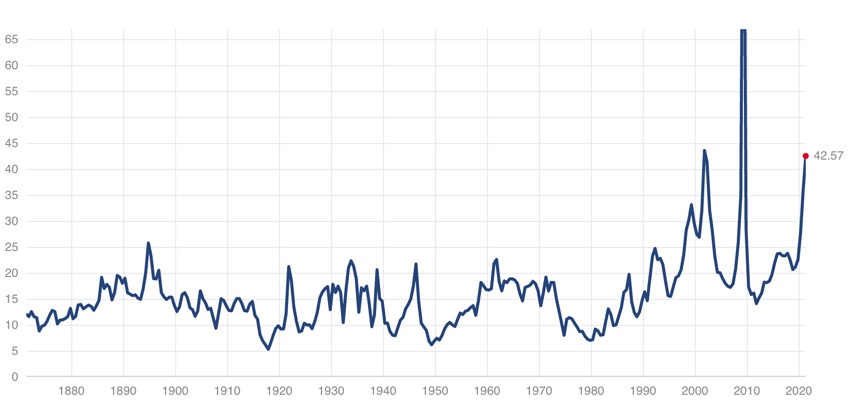

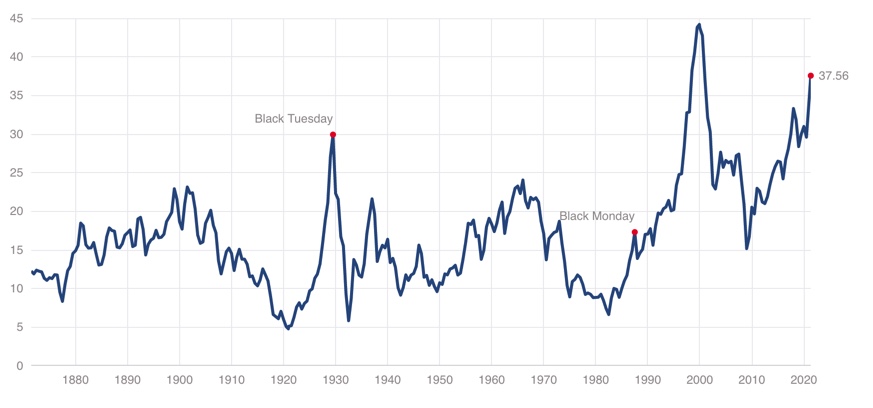

Global stock markets seem to have priced in the strong economic recovery and may even be more optimistic than economic projections imply. That is a debate we have daily. As an example, the S&P 500 Index has not only made up all the lost ground post the Covid crises erupted, but is trading at all time highs. The S&P 500 is 23% above its pre-pandemic level and currently trading at a historical PE ratio (price to earnings ratio) of around 42. For long-term context, see the chart below.

Source: multpl.com

There are some that argue that markets are discounting mechanisms and look forward (I agree that they are and they do), but markets can become too optimistic about future prospects. Some may argue that low interest rates should be taken into consideration and, again, I agree: low interest rates may justify higher PE multiples. The chart below shows the cyclically adjusted Shiller PE ratio (developed by Nobel laureate Robert Shiller). Makes for interesting reading.

SOURCE: MULTPL.COM

We are not making predictions or forecasts that markets will fall in a heap tomorrow or a month from now, we do not have the ability to predict the future. We are merely highlighting that there has been a very strong recovery in global equity markets, driven by a multitude of unusual circumstances. The most important of which, in our opinion, is the glut of cheap money (even free money aka Stimulus Cheques in the case of the US) that has been injected into the financial system. In our opinion, being conservatively positioned and ensuring healthy diversification is always a good strategy, not only for long-term growth, but also to protect capital.

Pyxis News

Last month we shared information about our newly launched Unit Trust, the Pyxis BCI Worldwide Flexible Fund. We are proud of this achievement and believe it fulfills an important role in our service offering. Contact me if you would like more information or should you want to discuss the fund in more detail.

Over the next few months, we are going to run an information series on wills and trusts. We will be distributing several blogs on matters related to this and we will be offering reviews and audits of wills and trust documents, free of charge. Watch out for more information!

Lastly, as you know, we follow a number of long-term investment themes and this month I will be writing a blog about Agriculture. Not a well known investment theme but certainly a lot of food for thought (no pun intended).

Have a fantastic May.

Bennie