Welcome, 2021!

Welcome to 2021, the year in which hindsight will, for once, actually be 2020! Jokes aside, we wish you all the best for the new year: health, safety and prosperity!

Have a look at the summary of market moves at the end of the newsletter, interesting reading material indeed. Who would have thought that after what was a tumultuous year, investments generally would end up delivering reasonable returns. However, studying the numbers, it becomes clear that the dispersion of returns between the various investment asset classes has been vast. While it may be great when one identifies and invests in the outperforming asset class, geographic region or sector, the impact on an investment portfolio’s value when making the wrong choice can be fatalistic. For example, R 1 million invested in the Nasdaq Index (US Technology Index) at the beginning of the year has grown to R 1,46 million by 31 December 2020. On the other hand, R 1 million invested in South African listed property stocks, was worth a paltry R 612 000 at year-end.

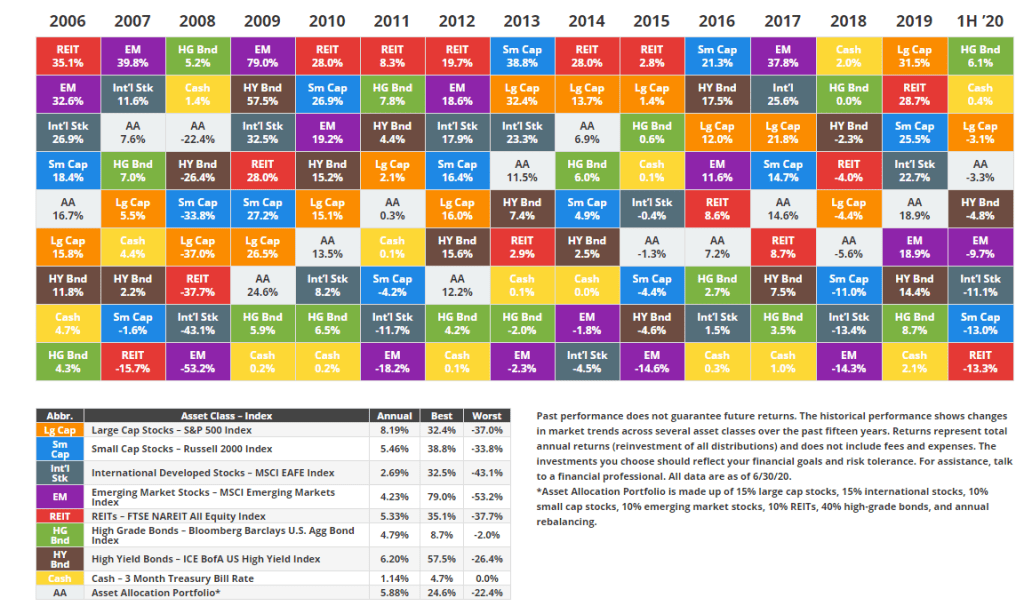

But a very important follow-up consideration is whether one could consistently allocate capital correctly. Refer to the table below. Investment returns are by definition variable and the outperforming asset class or sector in one year will not necessarily be top of the pops in the next year. Having analysed this information, it becomes clear that “betting the farm” on one asset class can yield fantastic or detrimental results.

But without a crystal ball or tremendous luck, correctly allocating capital between asset classes from year to year seems to be a guessing game.

Nobel Prize laureate Harry Markowitz (the father of the Modern Portfolio Theory) summed it up nicely when he said that “diversification is the only free lunch in finance”. Spread risk, or don’t put all your eggs in one basket, and so forth. While diversification is indeed a powerful tool to manage capital at risk, the concept should be implemented intelligently. Portfolio diversification is not just about spreading investment capital at random across as many asset classes as possible. The diversification, or portfolio construction, process should be based on a thorough analysis of investment objectives, risk tolerance, investment horizon as well as historical asset class risk and return characteristics. In addition, some element of fundamental analysis should be performed to take consideration of prevailing and prospective economic and market circumstances to develop a framework of forward looking expectations.

In summary, I am not going to bore you to tears with 10 pages of economic analysis and predictions for the next 12 months (re-read my November and December newsletters, my view on the rise of inflation is central to our investment positioning going into the next number of years). Pyxis has spent considerable time and effort on incorporating the technical aspects of portfolio diversification described above into our investment process. This is reflected in the Pyxis Best Investment View Portfolio, which I will discuss with you in our forthcoming meetings.

Pyxis update:

As usual, I have a company update to share with you. We are constantly looking to improve our service suite to offer you best-in-class solutions. We only partner with leading and well-established companies to ensure cost efficiency, longevity, safety and security of the solutions we offer. It takes a lot of time and effort to set up these solutions but it’s worth jumping through corporate governance and compliance hoops to ensure peace of mind.

Corporate Cash Manager Solution

Pyxis has established a business relationship with Investec Bank. We are proud to be able to offer our clients money market and fixed deposit solutions that offer corporate interest rates that are very competitive in the marketplace (especially in this low interest rate environment). These solutions are linked to an Investec bank account which is opened on behalf of clients with minimal effort and at no cost.

Contact us should you wish to find out more about this exciting offering: it’s a great solution for “parking” emergency funds or liquid funds that are not earmarked for longer-term investments.

Blogs

As a start to the year, we’ve done a blog on “new years” stock picks for 2021. These are stocks that we believe offer a compelling investment case and the potential for superior long term returns. These are not “bet the farm” stocks. Invest responsibly and always manage risk.

You can also read Ashley’s blog on biotechnology, the latest edition in our series on thematic investments.

We wish you a wonderful year and, as usual, we are just an e-mail, phone or Zoom call away. Please reach out should we be able to assist in any way.

Bennie