In our previous newsletter, Henk Myburgh, CFA, explored a mathematical tool that can help guide allocations to individual investments: the Kelly Ratio. In the final instalment of this series, we will explore how the Kelly Criterion can be extended beyond single investments to evaluate the safety of portfolios as a whole.

The key takeaway from the previous newsletter was that there is a minimum required return for each level of risk, to justify investing all of your capital. If the expected return of an investment is lower than the required return, you should lower the proportion of your capital invested accordingly.

If the expected return of an investment is higher than the required return, the amount of excess return represents a margin of safety.

We will use Modern portfolio theory (MPT) to find efficient portfolios and then apply the Kelly ratio to investigate the margin of safety for each portfolio on the efficient frontier.

MPT offers a systematic approach to portfolio construction, aiming to maximise returns for a given level of risk through diversification.

Core Principles of Modern Portfolio Theory

- Risk and Return: MPT posits that each investment carries its own expected risk and return. The theory emphasizes that the risk of an individual asset should not be viewed in isolation, but in how it contributes to the overall portfolio’s risk and return.

- Diversification: Central to MPT is the concept of diversification—spreading investments across various assets to reduce risk. By combining assets that do not move in perfect harmony, the overall portfolio can achieve a more favourable risk-return profile.

- Efficient Frontier: MPT introduces the idea of the “efficient frontier,” representing portfolios that offer the highest expected return for a given level of risk. Portfolios on this frontier are considered optimally diversified.

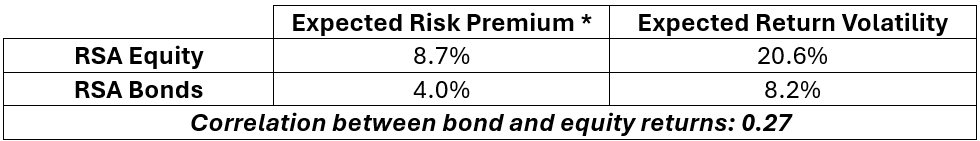

The efficient frontier.

To construct the efficient frontier, we used historical data from 1970 to 2024:

*Note: The expected risk premium is the return over the risk-free interest rate (South African government 3-month rates – average over the period was 6.8%).

Throughout the rest of the discussion, two portfolios are highlighted:

- 30% Equity; 70% Bond – similar to the composition of the Pyxis BCI World-Wide Flexible Fund (our income focused unit trust), and

- 60% Equity; 40% Bond – similar composition to our newly launched Pyxis BCI Balanced Fund.

It is evident in the graph above that all portfolios with a bond allocation of 90% or more are inefficient – we can earn more return for the same level of risk from other portfolios.

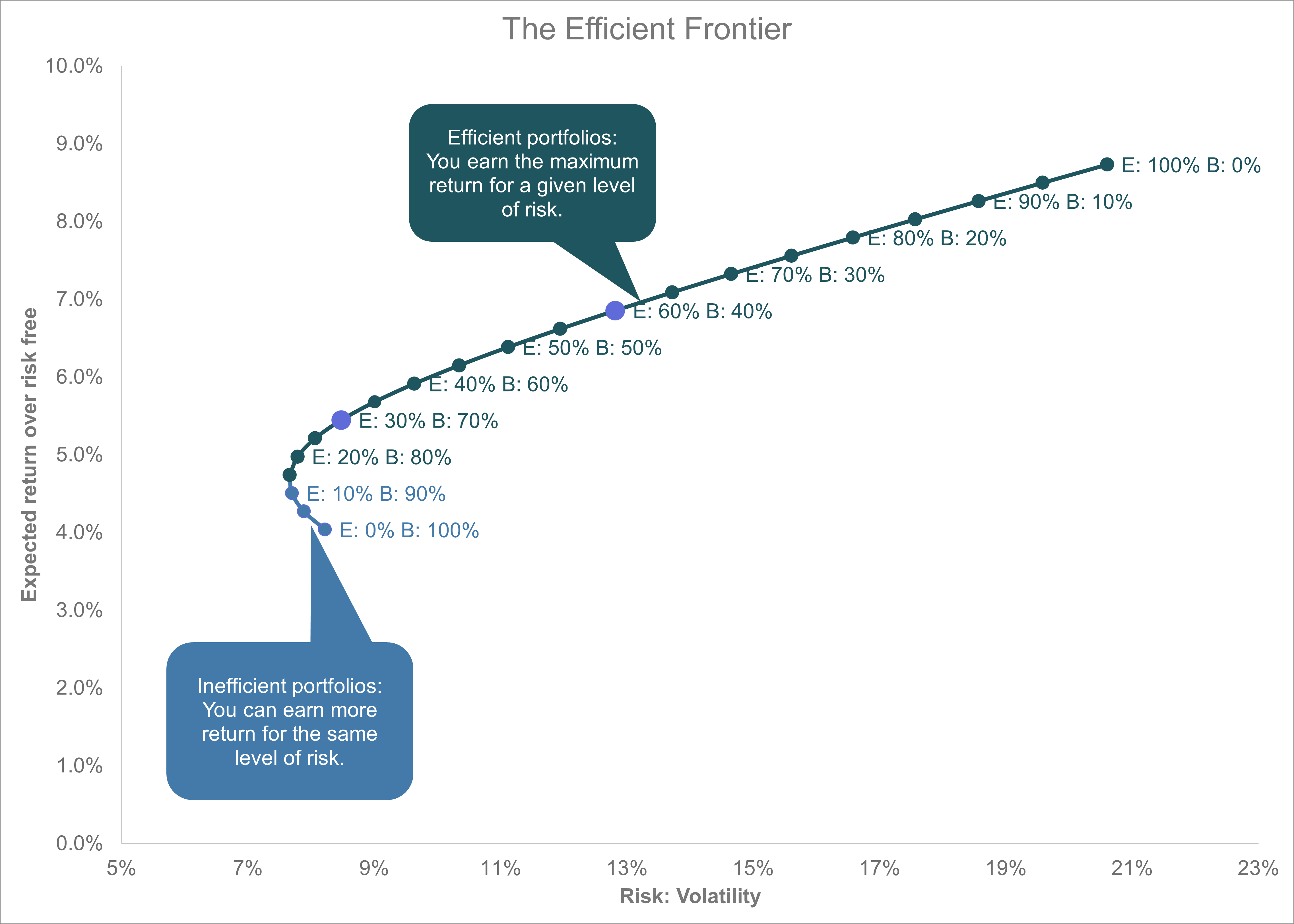

For each of the efficient portfolios, we now calculate the required return for a total (100%) investment of capital (using the half-Kelly ratio) and compare it to the expected return derived from history.

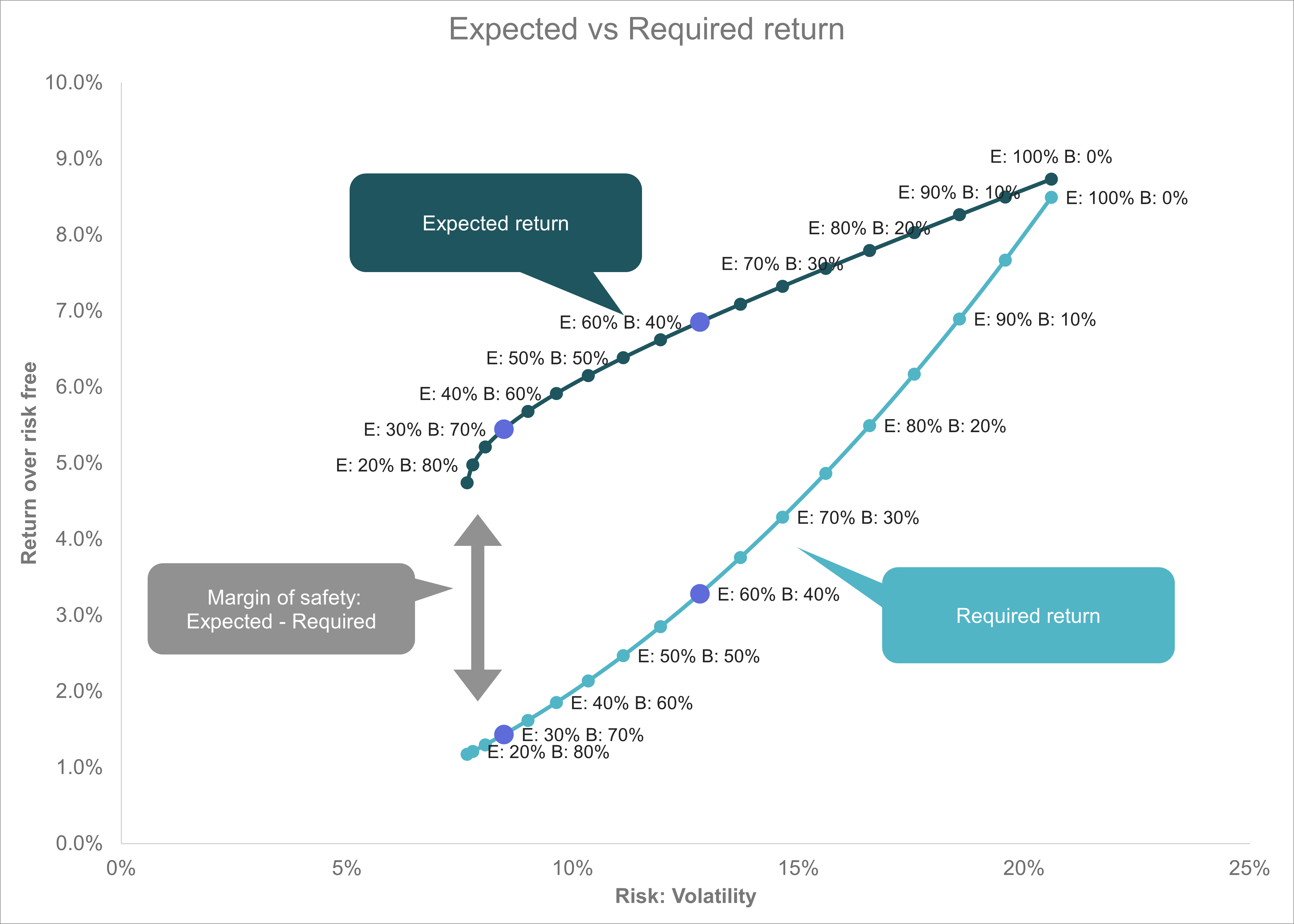

As we can see, low risk portfolios have a much larger margin of safety, while the required return on a 100% equity portfolio is almost the same as the expected return (practically no margin of safety). Put differently, 100% equity investors received a fair return for the risk they took, while balanced fund investors were rewarded in excess of a fair return.

The Pyxis BCI Worldwide Flexible Fund’s strategic asset allocation offers one of the highest margins of safety available within the efficient frontier set. While the Pyxis BCI Balanced Fund’s strategic asset allocation (60% Equity: 40% Bonds) sacrifices approximately 0.5% in margin of safety to gain approximately 1.5% in expected return.

This information is important for three reasons.

- It illustrates that it is safe to invest all of your investable capital into any efficient portfolio (you will not be overexposing yourself) if historic return trends persist,

- If future market returns are lower than historical returns, the unit trusts managed by Pyxis employ an asset allocation with substantial margin of safety. This means that if future market returns are up to 3.5% lower than historic returns, it will still be within the required return given the risk, and

- If realised future market returns for equities are lower than historical returns, there is a real risk of over exposure if all your investable capital is invested in equity only.

In this newsletter we illustrated how MPT and the Kelly ratio can be used to calculate the required return and margin of safety presented by expected asset class returns and volatility. We showed that low risk portfolios typically have a greater margin of safety and that medium equity portfolios can gain substantial increases in expected return, without sacrificing too much margin of safety. Historically, 100% equity portfolios did not offer any margin of safety.

View the February 2025 Market Summary

ViewABOUT THE AUTHOR:

Henk Myburgh, CFA®- Head of Research

After completing a BCom Econometrics and MSc in Quantitative Risk Management at the North-West University, Henk Myburgh (CFA), started his career in financial risk management at HSBC. He also worked at Sanlam Capital Markets, where his focus was on consolidation of financial risk across the firm and management of risk on a holistic basis. In 2018 he founded AlQuaTra, a quantitative private hedge fund.