This newsletter is the first in a series of three, where Henk Myburgh, CFA, will provide an overview of different methods used to allocate capital to asset classes, listing the advantages and limitations of each and indicating the combination of methods used by Pyxis Investment Management.

Finding attractive investments

Investment managers often dedicate substantial effort to identifying investments that satisfy their clients’ investment objectives. Identifying these investments is, however, only the first step in constructing a sensible investment portfolio.

Next, investment managers must decide how much of the limited investment capital at their disposal should be allocated to each investment identified initially.

Asset class allocation: key approaches

Pyxis first determines the appropriate capital allocation to an asset class (e.g. equity, bonds) and then to individual investments within each asset class.

There are different capital allocation approaches, which are summarised below, followed by the application of these methods to different types of portfolios.

- Strategic Asset Allocation (SAA)

SAA is a long-term approach that defines target allocations for asset classes (e.g., equities, bonds, real estate). Key characteristics of this approach include that it is based on an investor’s risk tolerance, return objectives, and investment horizon. It involves periodically rebalancing the portfolio to maintain target allocations. It is passive in nature; and focuses on consistent exposure to asset classes rather than market timing. An SAA approach provides a disciplined framework and reduces emotional decision-making, but provides limited flexibility to respond to short-term market changes.

- Tactical Asset Allocation (TAA)

TAA is a shorter-term, dynamic approach that adjusts allocations to capitalize on market opportunities. It deviates from SAA based on the market outlook and uses macroeconomic indicators, valuation metrics and sentiment analysis. It is often used to complement SAA by adding an element of active decision making. It can enhance returns by exploiting market inefficiencies and provides flexibility to adjust for economic shifts. However, this can result in higher transaction costs and introduce the potential for timing errors.

- Risk-Based Allocation

Risk-Based allocation focuses on distributing capital based on the risk contribution of each asset rather than expected returns. There are different methods that can be used:

- Risk Parity which involves allocating capital such that each asset class contributes equally to portfolio risk.

- Volatility Targeting which adjusts allocations to maintain a consistent level of portfolio volatility.

Advantages include a balanced risk exposure and effectively managing downside risks. It may, however, underperform in bullish markets as it avoids concentrated bets.

- Modern Portfolio Theory (MPT) and the Kelly Criterion Allocation method

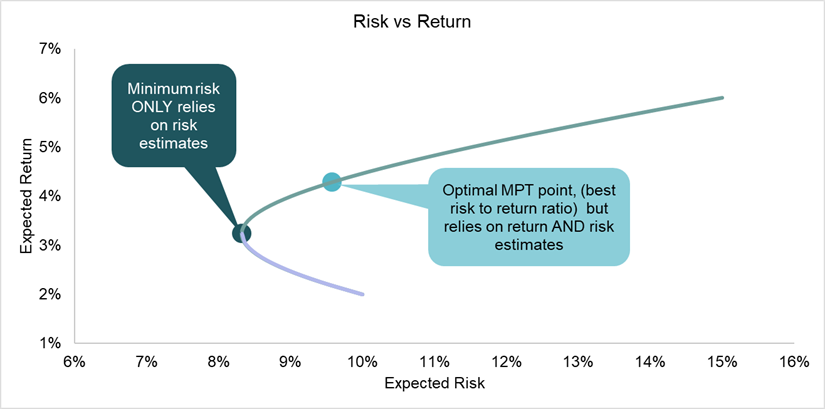

MPT optimises the risk return relationship of a portfolio while the Kelly criterion is a mathematical formula used to determine the optimal fraction of capital to invest in each opportunity to maximize long-term growth. This approach balances return expectations and risk (variance) and is often adjusted (e.g., Half-Kelly) to account for real-world uncertainties. This approach attempts to optimize the risk return relationship and reduces the risk of ruin by preventing over-investment. The drawback is that it assumes accurate estimation of volatilities, correlations and returns, which can lead to conservative allocations if these inputs are uncertain.

- Core-Satellite Allocation

Core-Satellite allocation combines a stable core portfolio with smaller, actively managed satellite investments. The Core is a passively managed, low-cost investment portfolio which tracks the appropriate benchmark (passive), Satellite portfolios are coupled with the core. These are actively managed, complimentary portfolios. This approach balances stability with growth potential and reduces overall costs while allowing for tactical bets. This approach requires active monitoring and management of the satellite positions on a continuous basis.

Pyxis Investment Management approach

The choice of capital allocation strategy depends on the investor’s objectives, risk tolerance, time horizon, and resources. At Pyxis Investment Management, a combination of approaches is employed. We identify the allocation method most aligned to the objectives of the product under consideration.

- Client portfolios

SAA is used to set asset class allocations. An upper and lower limit for each asset class is allowed to provide some flexibility depending on the client mandate. MPT is used to determine the SAA. A TAA is then used to guide the utilisation of capital within the upper and lower limits set for the SAA.

An example is given below. For each asset class, there is a SAA that is constant through time, a TAA that changes periodically and an upper and lower limit for the combined SAA+TAA.

|

Asset Class |

SAA |

TAA |

SAA+TAA |

Lower Limit |

Upper Limit |

|

Equity |

60% |

-2.5% |

57.5% |

43.4% |

75.0% |

|

Property |

5% |

-0.1% |

4.9% |

1.9% |

11.0% |

|

Alternatives |

5% |

5.0% |

1.9% |

11.0% |

|

|

Fixed Income |

20% |

2.4% |

22.4% |

10.3% |

33.7% |

|

Cash |

10% |

0.2% |

10.2% |

4.4% |

19.5% |

|

Total |

100% |

100% |

From the table above, the TAA for equity is negative, indicating an allocation smaller than the SAA, but still within the upper and lower limit.

- The Pyxis worldwide multi asset flexible unit trust

This unit trust was designed to deliver a very stable return profile. The return target is CPI+3% with capital preservation. There is a very strong emphasis on risk management and the allocation method can be seen as a hybrid between the MPT and the Risk-Based approach.

For the unit trust, the asset allocation is closer to the minimum variance portfolio than the MPT optimal point.

This is in line with the overarching objective of the unit trust, which is to manage return volatility, the risk in estimating return is almost eliminated by using this approach.

- Discretionary Fund Manager (DFM) portfolios

A Core-Satellite approach is employed in combination with a SAA and TAA.

Although similar to direct client portfolios, the combined SAA and TAA is split between the Core and Satellite in the appropriate ratio.

|

Asset Class |

SAA |

TAA |

SAA+TAA |

Core |

Satellite |

|

Equity |

60% |

-2.5% |

57.5% |

23.0% |

34.5% |

|

Property |

5% |

-0.1% |

4.9% |

2.0% |

2.9% |

|

Alternatives |

5% |

5.0% |

2.0% |

3.0% |

|

|

Fixed Income |

20% |

2.4% |

22.4% |

9.0% |

13.4% |

|

Cash |

10% |

0.2% |

10.2% |

4.1% |

6.1% |

|

Total |

100% |

0% |

100% |

40% |

60% |

Conclusion

Allocating capital to investments is a function of both the client’s requirements and the investment manager’s chosen capital allocation approach. In depth understanding of the strengths and limitations of each approach is crucial in constructing a tailored strategy which aims to reach client objectives.

In two subsequent newsletters, we will look at capital allocation to single investment opportunities, followed by the expansion of the framework to a portfolio of investments.

View the December 2024 Market Summary

ViewABOUT THE AUTHOR:

Henk Myburgh, CFA®- Head of Research

After completing a BCom Econometrics and MSc in Quantitative Risk Management at the North-West University, Henk Myburgh (CFA), started his career in financial risk management at HSBC. He also worked at Sanlam Capital Markets, where his focus was on consolidation of financial risk across the firm and management of risk on a holistic basis. In 2018 he founded AlQuaTra, a quantitative private hedge fund.