Holding precious metals within client portfolios has been part of our investment strategy since Pyxis’ inception. The addition of precious metals provides diversification benefits to a portfolio and they are a particularly attractive holding in times of high inflation (inflation hedge) and/or volatility (safe haven).

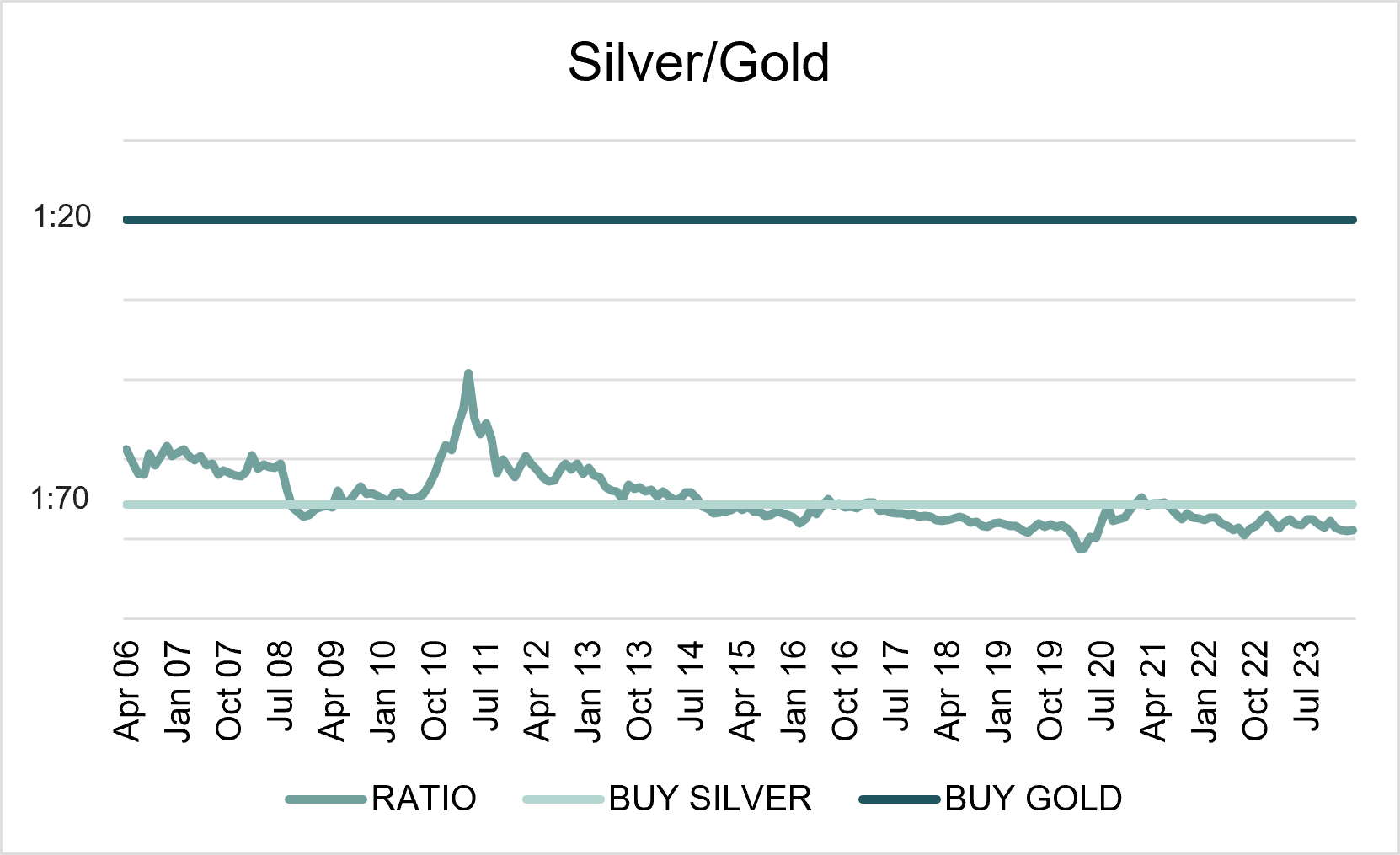

We monitor the discrepancy between the price of gold and silver. Based on data going back to the 70s, gold and silver typically trade within a range of 20 to 70 ounces of silver to the price of one ounce of gold. Traders often use this ratio as a gauge to decide when it is best to move from gold to silver or from silver to gold. We prefer to hold both precious metals, increasing exposure to one relative to the other in times of expected outperformance. Below is an updated graph of the ratio. Silver has remained the more attractive investment over the past twelve months.

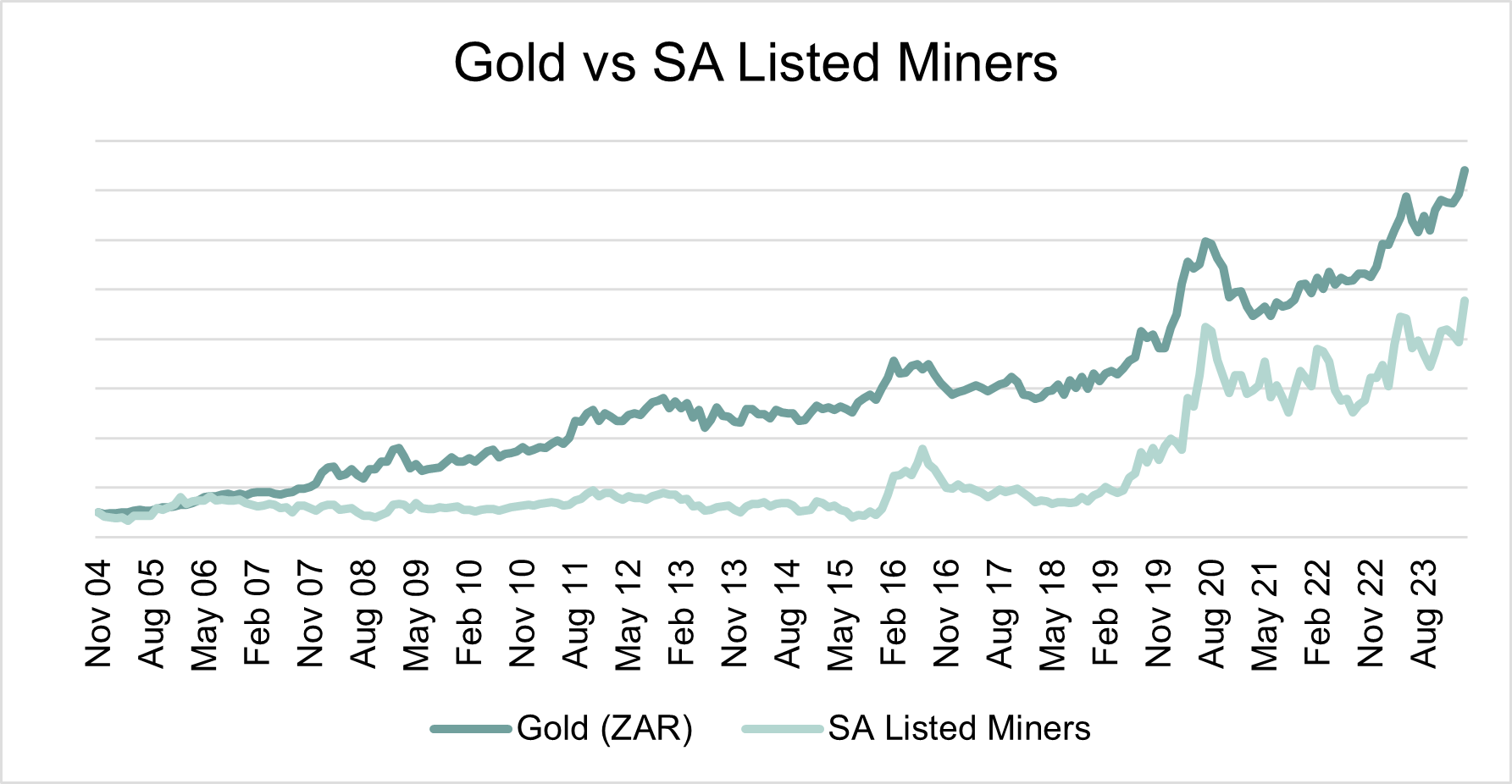

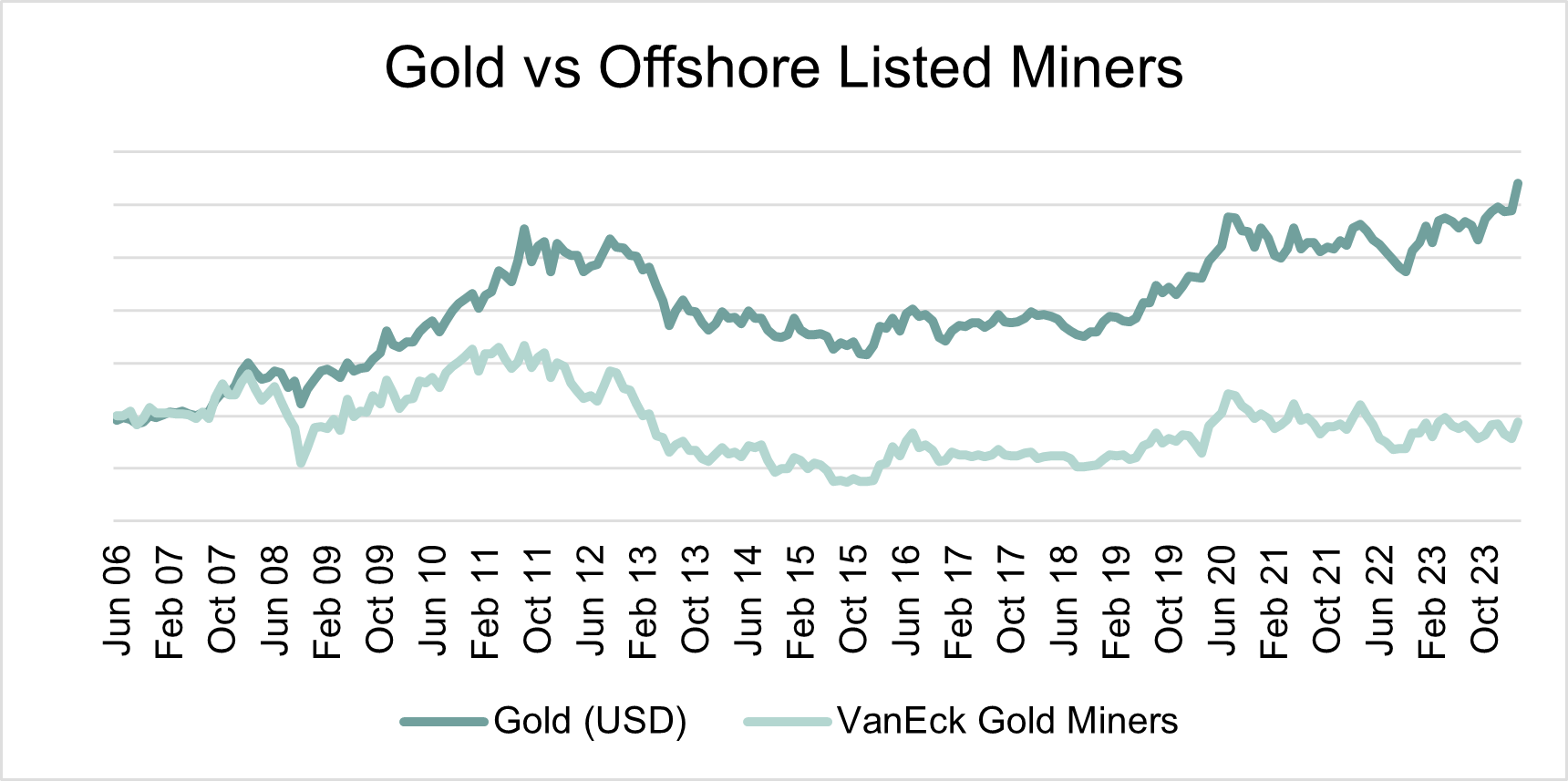

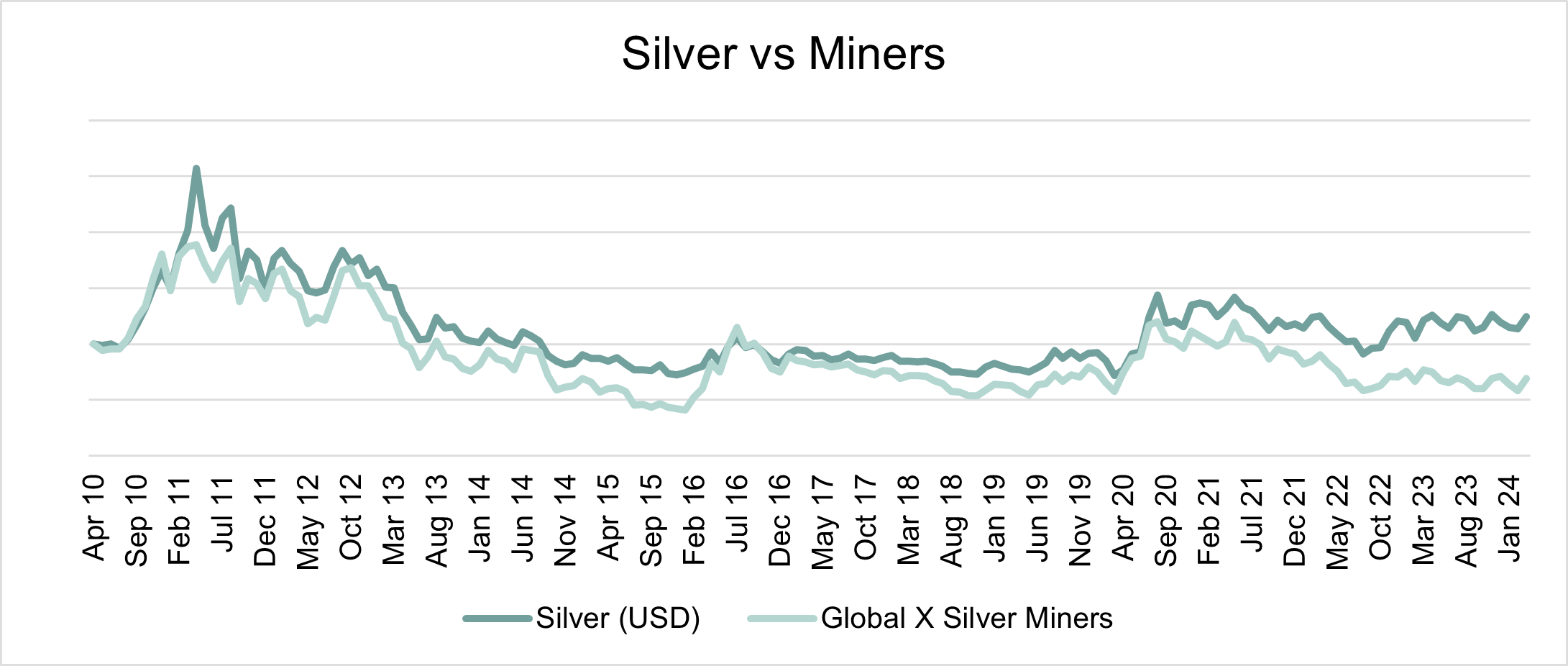

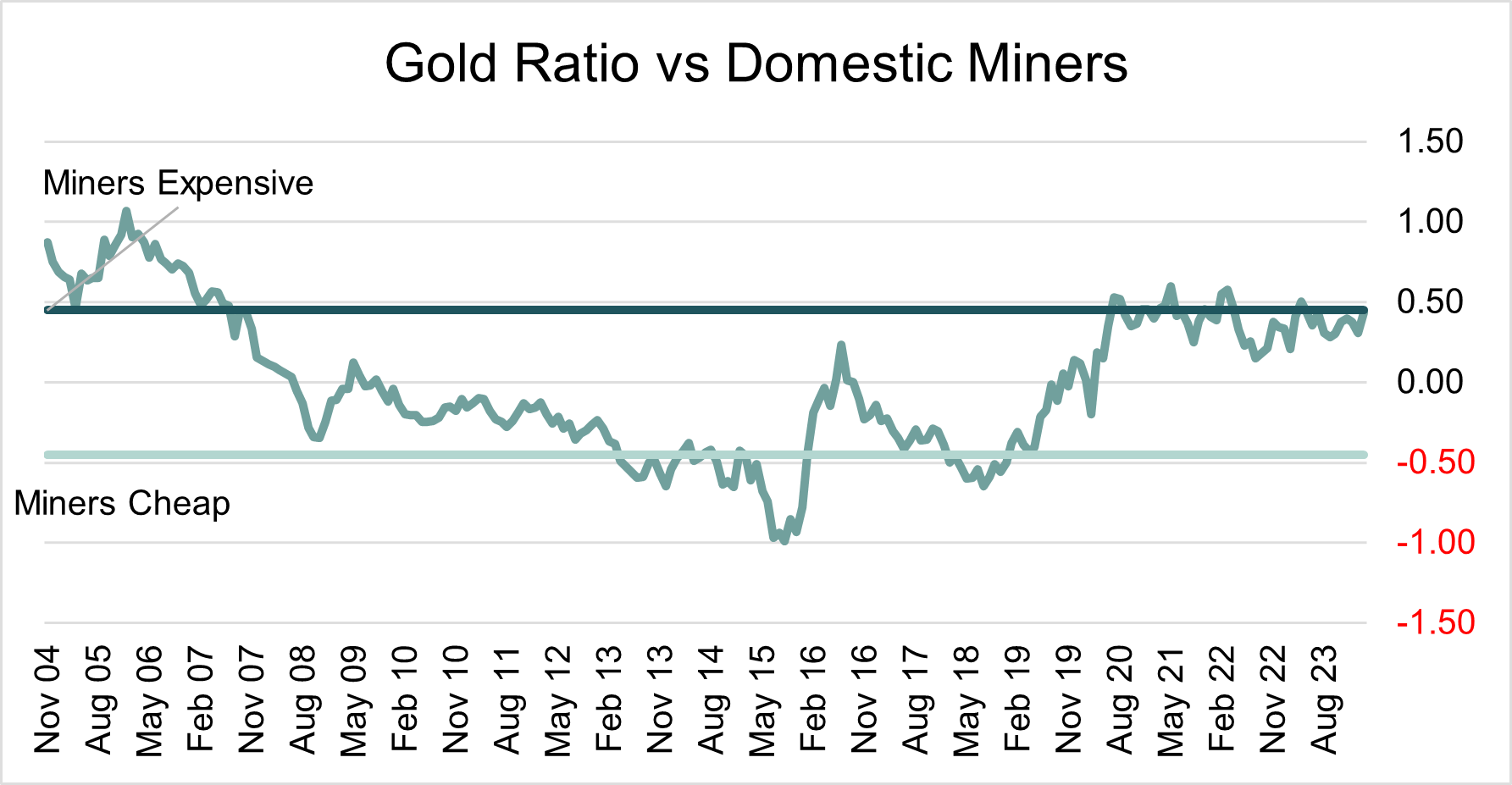

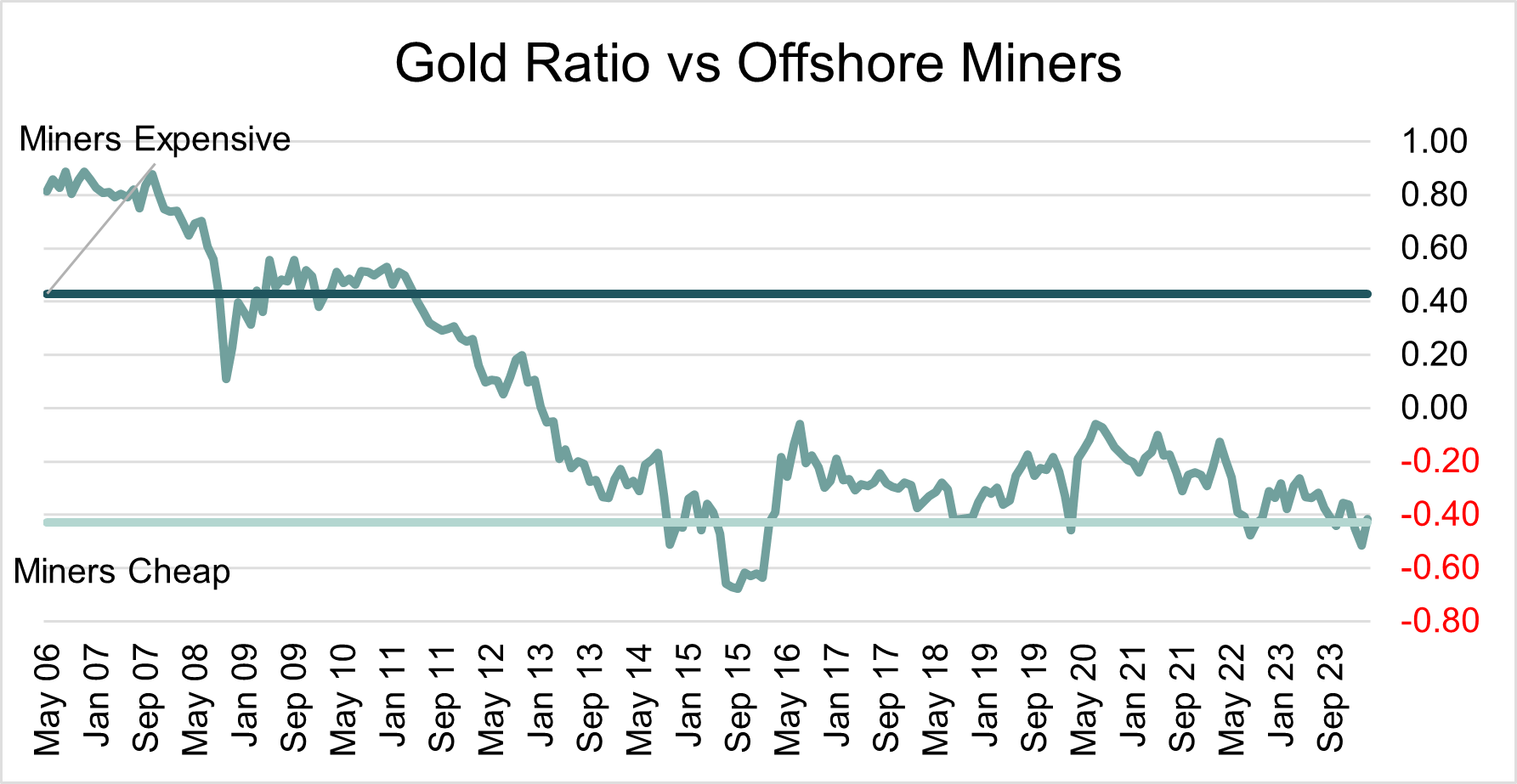

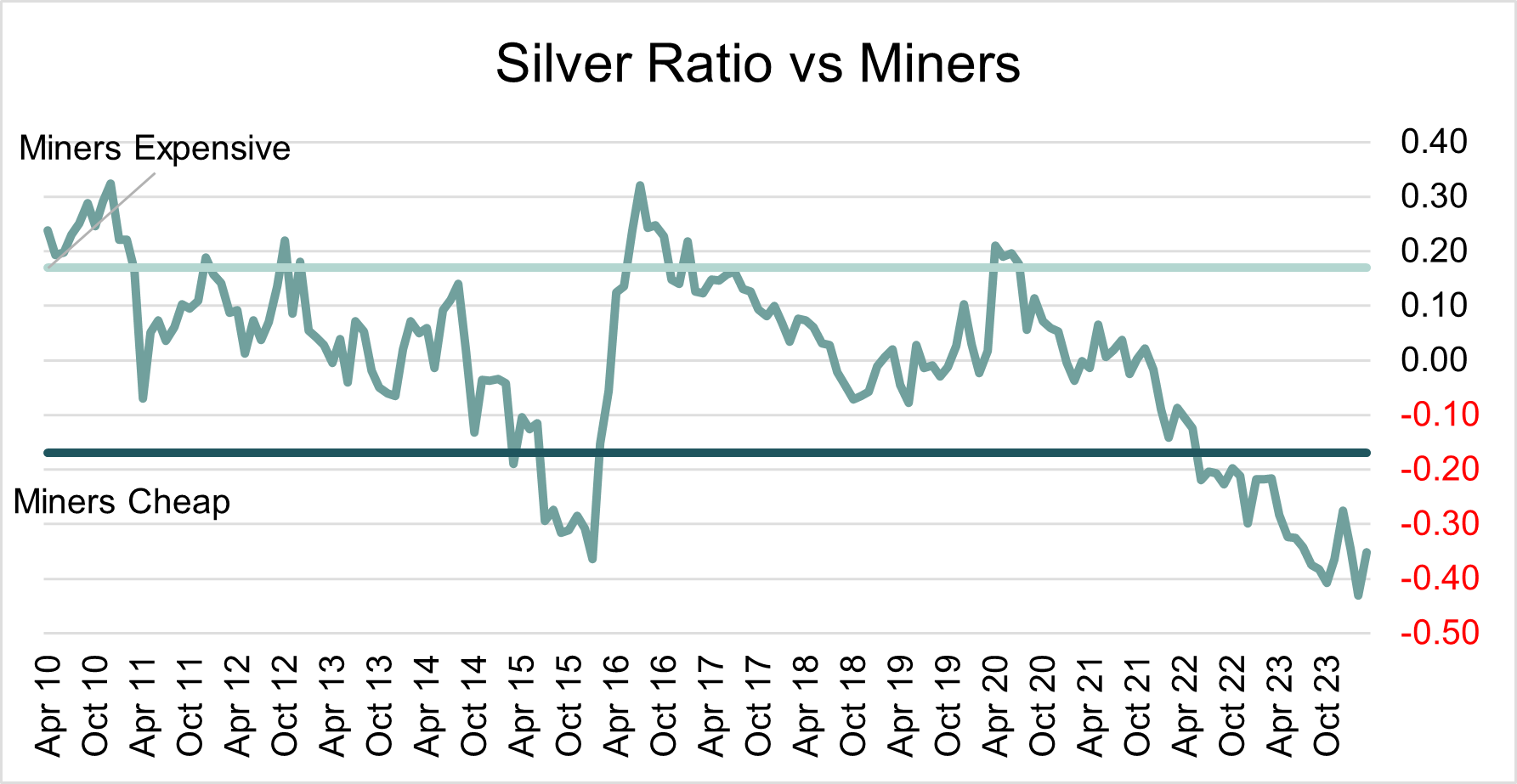

More recently, the question of relative value when compared to precious metal miners has been posed. The below charts show the discrepancy in price for each of the precious metal miners when compared to the metals.

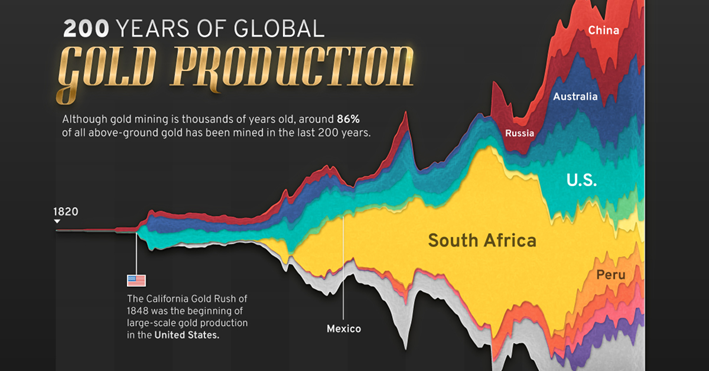

It is important to note the changes in South African gold production over time. Once a large contributor to global gold production, South Africa no longer has as large of an influence over supply. As such, we have separated out South African gold and analysed it in isolation.

Source: elements.visualcapital.com

At first glance, it appeared as though there was an increasing difference between the two prices for gold, and a more constant discrepancy for silver.

Looking at the ratio of the two prices, this was confirmed.

- Domestic gold miners are currently expensive relative to the gold price;

- globally, gold miners are relatively cheap, but the ratio does not appear to have any mean reverting properties; and

- silver miners appear to be relatively cheap.

Although offshore gold shows potential, the declining trend line over time necessitates further analysis of specific companies, as opposed to a general miners ETF. Offshore silver shows potential on an ETF level. Despite the declining trend line, current levels are well below the trend line, indicating there could be value in simply adding the ETF.

The above overview confirmed that further analysis was warranted and could reveal opportunities for client portfolios.

The economic/macro backdrop

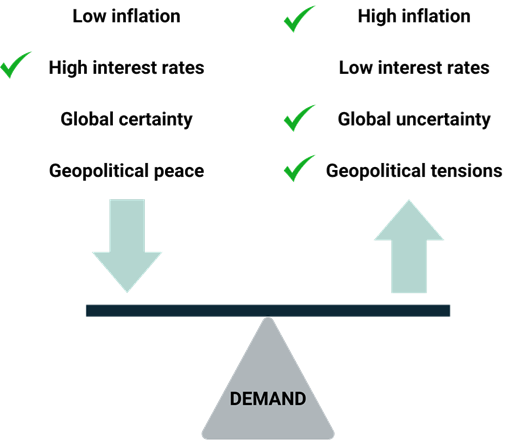

Demand

Gold and silver have been beneficiaries of the high inflation environment. Although rates are set to remain higher for longer, with high inflation real yields are still extremely low. With low real yields, the opportunity cost of holding gold is negated. As interest rates come down, precious metals will gain more appeal. Global uncertainty and geopolitical tensions have additionally increased demand for safe haven investments, such as precious metals. To the extent that the uncertainty and tension persists, these metals will remain in heightened demand.

Gold

Governments across the globe have some of the highest debt levels in history. At some point, they are going to have to reduce interest rates. As interest rates come down, the appeal of gold will be further heightened.

The perception of gold being a safe haven investment has additionally encouraged investment (ramping up demand) as we find ourselves in a time of global uncertainty – with upcoming elections and conflict in various regions. Furthermore, as the soft landing narrative appears to be less likely, on the back of persistent inflation, gold gains more traction.

In addition to this, one cannot ignore the global shift from the USD in favour of alternative currencies and the resultant increase in gold reserves for countries such as China. Over 90% of trade between China and Russia is now conducted in either Russian Ruble or Chinese Yuan. According to the World Gold Council, looking at data from 2000, central bank demand for gold was at its highest in 2023. Central banks purchased 1,136 tonnes of gold over 2023. The 2023 survey conducted by the council revealed that 24% of central banks intended on increasing their holding reserves over the next 12 months (ie: in the 2024 calendar year).

Silver

As the world continues to adopt greener energy, silver’s demand will increase due to its electrical and thermal conductivity being optimal. According to Saxo Bank “potential substitute metals cannot match silver in terms of energy output per solar panel.” According to research conducted at the University of New South Wales, solar panel manufacturing will require 86-98% of the current global silver reserves.

5G technology is another consumer of silver, with semi-conductor chips, cabling, microelectromechanical systems and Internet of Things devices all requiring silver.

The auto industry is another sector where demand for silver remains high. Many erroneously fear that the move towards electric vehicles will be a detractor from silver’s demand. Although any economic pull back will detract from auto demand and lead to lower silver demand, Battery Electric Vehicles (BEVs) contain up to twice as much silver as Internal Combustion Engine (ICE) powered vehicles. In general, autonomous vehicles require more than twice that amount due to their complexity. In addition to the actual vehicles, charging points and charging stations will additionally contribute to higher demand.

According to the Silver Institute, silver demand is expected to increase to 1.2 billion ounces in 2024.

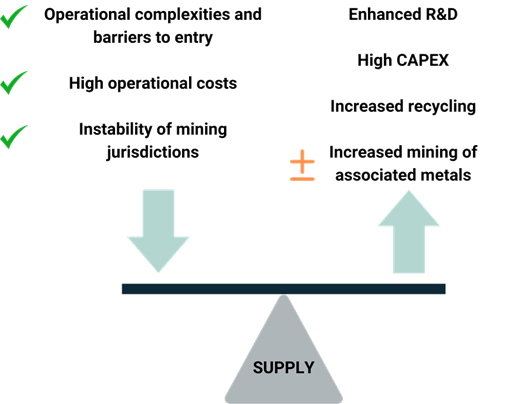

Supply

Although, historically a higher commodity price has incentivised investment into capital projects to increase supply, increased supply has repeatedly lagged increased demand as these projects take time to implement. In addition, rising costs and other operational complexities have made it difficult for miners to operate, resulting in many mining companies reducing capital expenditure and removing themselves from jurisdictions where these complexities have limited their growth.

Gold

Mining accounts for approximately 75% of gold supply in any given year, the remaining 25% comes from recycled gold. At least 90% of recycled gold comes from jewellery. In 2023, the supply of both mined (up 1%) and recycled (up 9%) gold increased, leading to a 3% increase in supply for the year.

Recycled gold is quicker to adjust to changing gold prices (increasing in times of high prices, reducing in times of low prices). In 2023, recycled gold was around 30% lower than the 2009 record, despite the gold price reaching highs last seen around the same historical period. Some have attributed this to physical gold holders not opting to sell their stores (either due to not being incentivised enough in economic rich nations or storing the metal due to it being a safe haven in geographies of economic hardship), while others have said the real value is not close enough to historical highs.

Silver

Approximately 80% to 85% of supply comes from mining, with the majority of mined silver being a by-product of lead, zinc, copper and gold. The balance of silver supply comes from recycling.

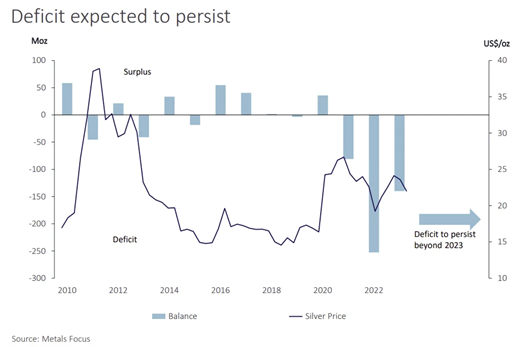

There appears to be a persistent imbalance between supply and demand for silver. The silver market has recorded a deficit each year, since 2019. According to the Silver Institute, supply is expected to increase 3% in 2024, although the deficit should persist, marking the 4th consecutive year of a structural market deficit. With recycling numbers down, and demand for new technologies on the rise, the deficit is not expected to ease any time soon.

Overall, it appears as though the economic backdrop is supportive of increased demand for precious metals. Although higher for longer rates may mute demand temporarily, inevitably rates must normalise and promote investment in precious metals. Price will be positively impacted by heightened demand, and this impact will be enhanced to the extent that supply dwindles.

The miners’ discount

Looking at the last twelve months, the gold price has surged 17.2%, while gold miners are only 3.0% higher (using GLD and GDX ETFs). The silver price is 8.2% higher, while silver miners are 6.9% more valuable (based on SLV and SIL ETFs). Potential reasons for these discrepancies or lags between precious metal prices and their respective miners’ include operational complexities, ESG barriers, and market sentiment.

One of the most prominent operational complexities is costs. Both inflation and the transition to more remote locations to extract precious metals have contributed to increasing costs for miners. According to the World Gold Council, the average All-In Sustaining Cost (AISC) for gold reached USD 1,343 per ounce in Q3 of 2023, up 5% from Q3 of 2022. The AISC for silver is estimated to be between USD 22 and USD 23 per ounce in 2024. Other complexities include geopolitical risks (which are often prominent in these miners’ operating locations) and shifting environmental regulations. Operational costs for miners detract from operating profits and are reflected in the price of miners’ shares. There is, however, hope for operationally efficient miners. In 2016, miners outperformed their respective precious metals due to operational efficiency, indicating operationally efficient companies may be able to do so again. The average operating margin of gold producers in Q3 of 2023 was up 9% on the back of higher gold prices.

It is clear that idiosyncratic risks inhibit investments in miners. Whether or not improvement in operating cash flow from higher selling prices (due to increased demand and limited supply) can outpace the drag from increased costs is the question.

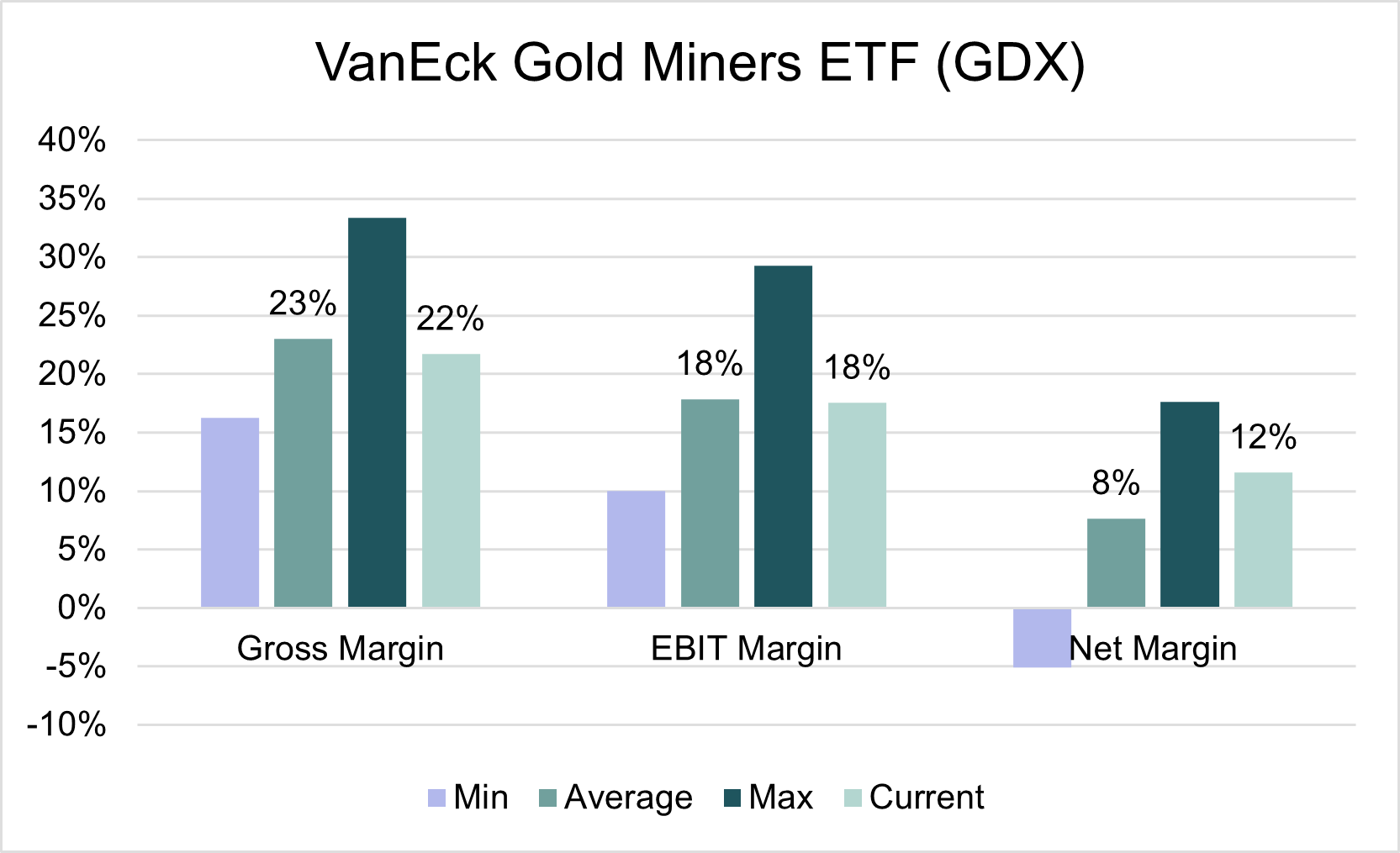

The impact of costs on miners’ margins

Based on the past 10 years, the constituents of the gold miners ETF (GDX) have had an average EBIT (earnings before interest and tax) margin of 18%. The current margin is in line with that historical average. The net margin sits above the historical average of 8%, currently at 12%. There appears to be little room for gold miners to show margin improvement and improved earnings for shareholders.

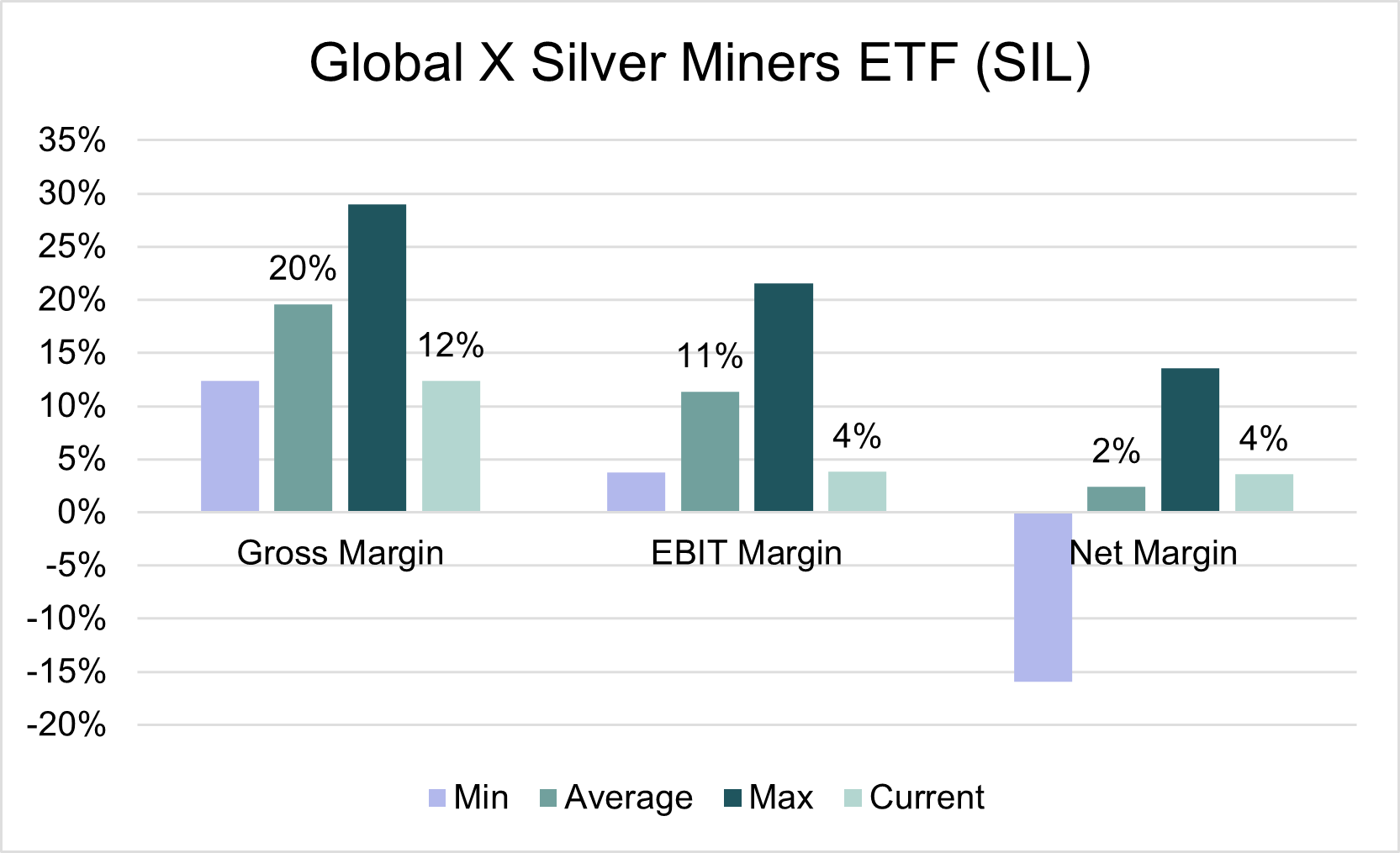

Looking at the constituents of the silver miners ETF (SIL). The companies have had an average EBIT margin of 11%, currently the margin is well below at 4%. The net margin sits similarly at 4%, but above the historical average of 2%, indicating more favourable interest income. Silver miners could potentially benefit from improving operating margins.

Higher costs will detract from margins, unless selling prices can increase or miners can improve operating efficiency at a quicker pace. Over the past 3 years, all 3 of the above margins (across gold and silver miners) have deteriorated, indicating the difficulties faced within the operating environment of these miners. Miners are yet to show that they can sufficiently compensate investors through improved profitability.

The opportunity for investment portfolios

The opportunity lies in silver investment. In addition to their investment properties, industrial demand is set to increase on the back of the changing global landscape. Considering the fact that silver can be more volatile than gold, it is prudent to maintain investment in gold as a diversifier and inflation hedge.

When investing in miners, the potential gain must be appropriate compensation for the idiosyncratic risks associated with the mining companies themselves. Only in instances where we remain confident in the miners’ ability to do so, would we consider a portfolio allocation to miners.

There does not appear to be any additional benefit for holding miners as opposed to the precious metal itself. Idiosyncratic company specific risk negates the perceived upside potential given the current value gap between silver miners and the precious metal. Although this is the case currently, the environment can change and company fundamentals can become more supportive of holding miner exposure directly. As such, we will continue to monitor the environment.