It is unlikely that you have not seen a news headline or heard a news commentator refer to the US debt ceiling over the past month. The majority of the commentary has been around the impasse between the Republicans and Democrats with regards to raising the ceiling. The inability for the two parties to come to an agreement has caused great uncertainty, which has led to capital market volatility. The fear amongst market participants is based on the potential default by the US and the subsequent consequences thereof.

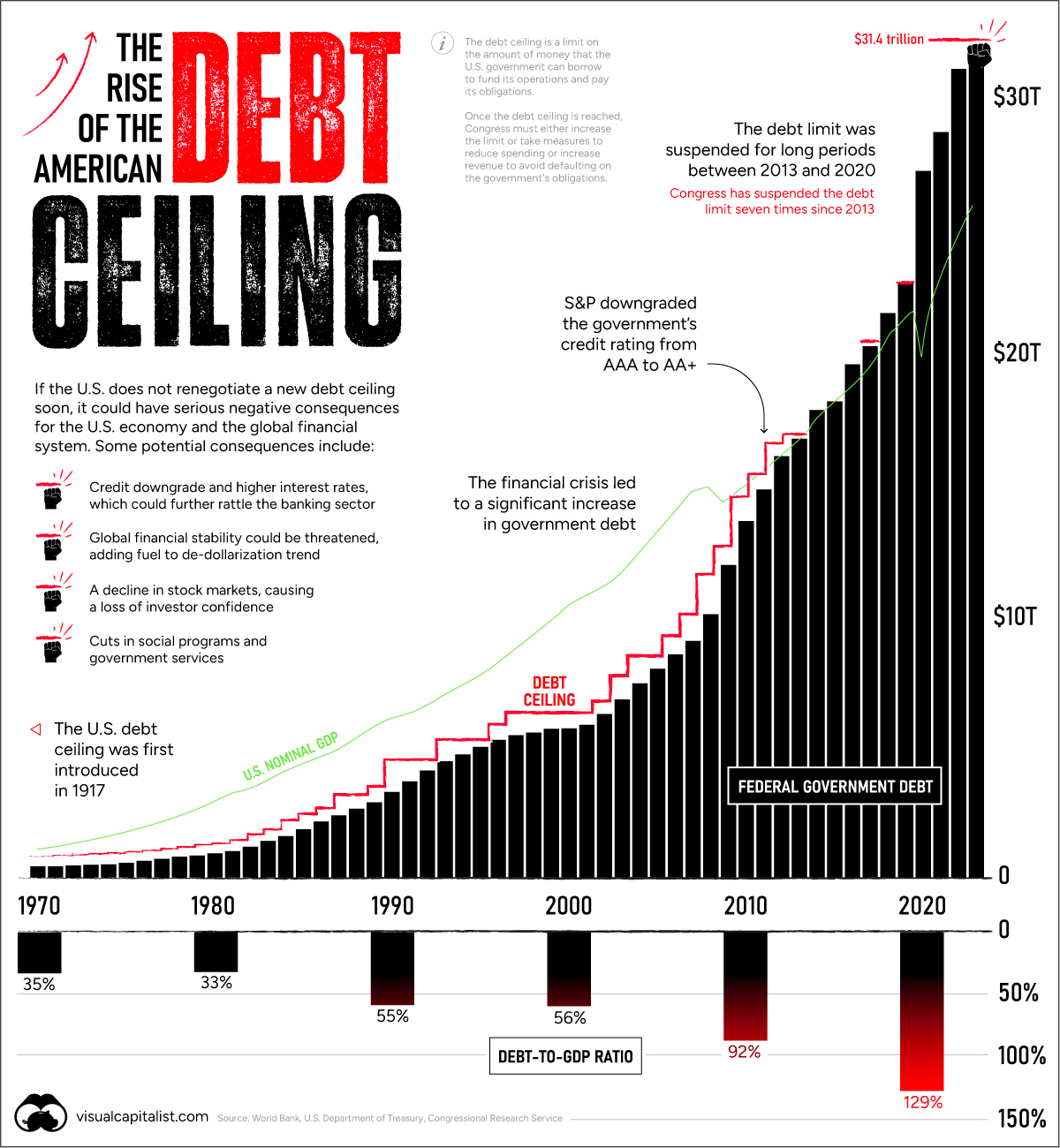

Introduced, by the US, during the first World War, in 1917, the debt ceiling intended to place fiscal responsibility on the federal government. This is not the first, nor should one believe it to be the last, time that the US has reached their ceiling and faced the risk of defaulting on its debt.

In essence, the debt ceiling is the limit placed on how much federal debt the government can accrue, ie: the maximum amount they can borrow to fund spending. Most countries restrict borrowing to a percentage of GDP, but some (including the US and Denmark) set a nominal limit. The US debt ceiling has been raised 78 times over the years, with the S&P downgrading the quality of US debt in 2011 when agreement was only reached days before the deadline. There are additionally two instances where negotiations could not culminate in agreement and the government was forced to shut down (between 1995 and 1996). US government debt currently sits at around 130% of GDP, with a ceiling of USD 31.4 trillion. Since the US has not run an annual surplus since 2001, they are unable to meet expenses (government operations) using solely income (tax proceeds). The US borrows money to bridge that gap. In January 2023, the US reached their borrowing limit of USD 31.4 trillion and was using available liquidity to keep afloat. In May 2023, Janet Yellen, US Treasury Secretary, indicated that this liquidity would run out by early June 2023, with 1 June being the X-date.

Without the ceiling being increased or suspended, the US would either go into breach or default. Going into breach would delay the default, but ultimately the debt ceiling had to be raised or suspended so that the US could issue more debt to fund payments due and avoid default. In the case of a breach, the US would continue to pay debt owed, but hold back on other payments, for example social security benefits or healthcare. Pausing such payments for a week was estimated by Moody’s Analytics to detract 0.7% from GDP and result in 1.5 million jobs lost.

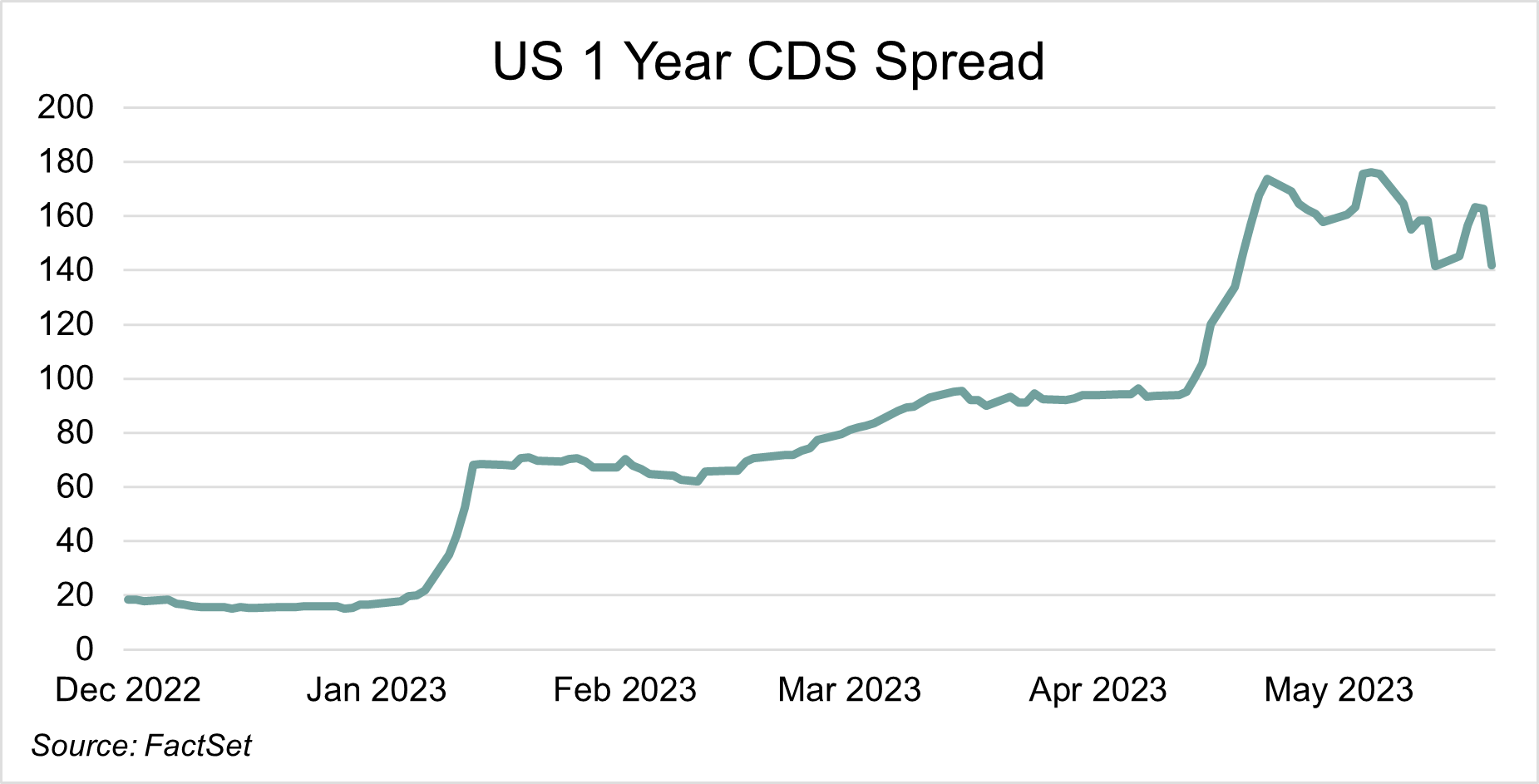

The indecisiveness and uncertainty around the debt ceiling and potential impact a default would have on the global economy has been evident in capital markets. As of April 2023, Credit Default Swap (CDS) spreads (cost of insuring against a credit default on debt, measure of risk) for the US has climbed, indicating the decline in confidence over the safety of federal debt.

Breach or default – less liquidity in the market would result in dire consequences globally. As the dreaded X-date drew closer, observers around the world focused on the ramifications of a US default. Without a historical reference, many began speculating and attempting to decipher how best to prepare.

The most notable consequence of a default is that the credibility of the US would come into question. The US Dollar is the world reserve currency, and US Treasury securities are the foundation of global bond markets; any turmoil in the US would result in global hardships.

Potential ramifications

- Credit downgrade

A downgrade of the US’s credit rating means their debt becomes more expensive to finance. According to the Government Accountability Office, the US spent an additional USD 1.3 billion in borrowing costs in 2011 due to the S&P’s downgrade.

The knock-on effect would be higher interest rates for businesses and households, negatively impacting economic growth as spending is disincentivised. Less economic growth results in less tax income for the government, necessitating further borrowing – as is evident, this is a vicious cycle. Higher US rates would impact the global economy as US Treasuries’ rates are used globally to price financial products.

- Negative sentiment and flight to safety

Default would call the safety of the US dollar into question, likely detracting from its credibility as the world reserve currency, and potentially leading to capital outflows. Dollar weakness may be muted by its world reserve currency status, but the currency would ultimately come under pressure alongside capital outflows. The stability and safety of the dollar would likely come into question and countries who rely on it as a means of exchange would similarly be affected.

A default would cause, as Yellen put it in January, “irreparable harm”. The US is already on shaky ground, dealing with turmoil in the banking sector, as well as higher interest rates, contributing towards recession woes. Markets do not respond well to uncertainty and they take time to trust again. In 2011, the S&P remained under pressure post a deal being reached.

- Job losses and recessionary pressures

In the case of breach or default, jobs would be lost. This, coupled with capital outflows and negative sentiment, would enhance existing recessionary pressures. As a net importer, slowing down of the consumer driven US market would flow into global markets. A depreciation of the dollar would lead to USD priced commodity prices increasing, exacerbating the cost of living crisis.

Any decisions regarding the ceiling must be agreed to, by way of majority approval, by both Chambers of Congress (Republican-controlled House and Democratic-led Senate). With opposing views, it is not surprising that these negotiations often turn into political bargaining sessions where the non-ruling party attempts to push through their agenda. In 2011, the Republican-led House threatened that they would not sign off on increasing the ceiling unless spending cuts were authorised by the Obama administration. In the 2023 negotiations, the Republican-led House requested discretionary spending cuts for the Fed, adjustments to the requirements for welfare recipients and increased mining and production of fossil fuels. As the month progressed, it did not seem like either side was willing to accommodate the other.

The 11th hour

On Wednesday, 24 May 2023, Fitch Ratings placed the US’s AAA credit rating on watch. Perhaps this prompted a recollection of S&P’s downgrade in 2011, because it appeared as though negotiations were finally progressing on Thursday. Reports showed that a 3% increase in defence spending and maintenance of non-defence discretionary spending levels was agreed to. Upgrades to the national grid to accommodate renewable energy were additionally included, along with negotiations around pipeline permits and fossil fuel projects. The White House was considering cutting USD 10 billion from the Internal Revenue Service’s USD 80 billion budget increase. Prior to US market open on Friday, 26 May 2023 there was optimism surrounding a deal being concluded by close of business.

Alas, Friday did not provide clarity on a deal, but Janet Yellen did announce that X-date was expected to be 5 June 2023 (slightly further away than the initially anticipated 1 June 2023).

By Sunday, things were looking a little better with Biden and McCarthy reaching a tentative deal to suspend the government’s debt ceiling to January 2025. Additional details of the agreement included: spending caps for the 2024 and 2025 budgets (excluding defence); clawing back of unused COVID funds; shorter time frames for energy project permits and additional requirements for food aid programmes. The deal was expected to be ready for votes on Wednesday, 31 May.

Post the holiday on Monday, the House Rules Committee met on Tuesday in preparation for the vote on the bill. Both Biden and McCarthy knew that they had to convince a majority vote from their respective parties to ensure congressional approval. US yields started to decline (with the 10 year closing at 3.7%) along with CDS spreads (closing at 133bps, versus 174bps a month prior) as market participants’ concerns moderated.

Despite one third of the Republican votes being against the deal, the bill was passed by the House on Wednesday with a 241 to 187 vote. Perceived risk was down further, with CDS spreads closing at 56bps. The debt ceiling package was passed by the Senate on Thursday evening, although opposed by 17 members, just in time to revert attention back towards jobs numbers, which were out on Friday, and inflation concerns.

The Fiscal Responsibility Act of 2023 was signed into law on Saturday, 3 June 2023.

Although there has been agreement, one may argue that negotiations have merely been postponed. Republicans maintain that there must be spending cuts to reduce outstanding federal debt, while Democrats believe that taxes should be raised to fund increased expenditure. The US has managed to avoid default once again, but uncertainty and the accompanying volatility has not been eradicated. The agreement is estimated to reduce federal spending by approximately USD 234 billion, but overall debt is still estimated to be more than USD 50 trillion by the end of 2030. Fear around recession and the cost of living crisis continue and we remain alert to developments in our efforts to invest accordingly.