Many investment “trends” of 2021 were expected to persist into 2022. One such trend was crypto investing.

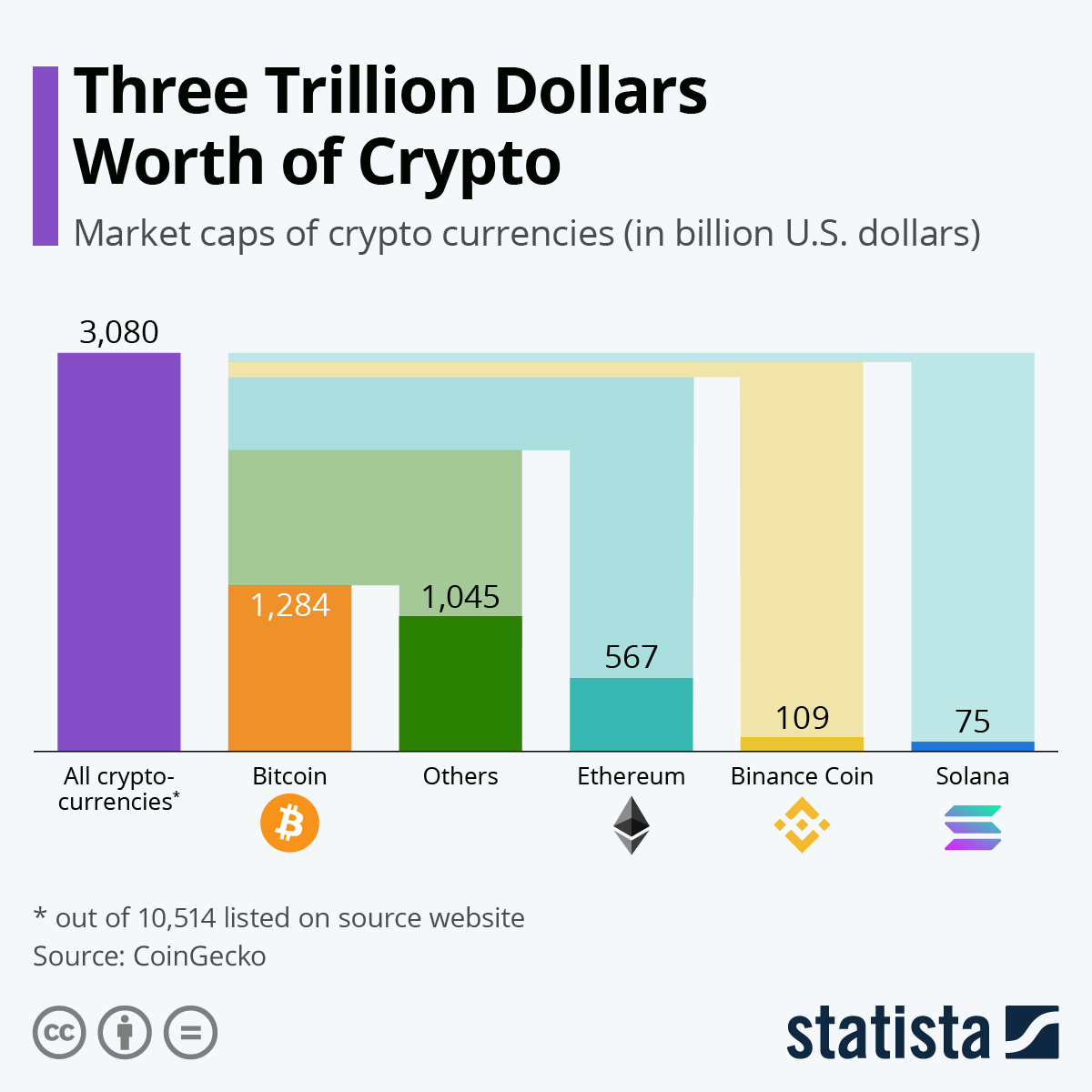

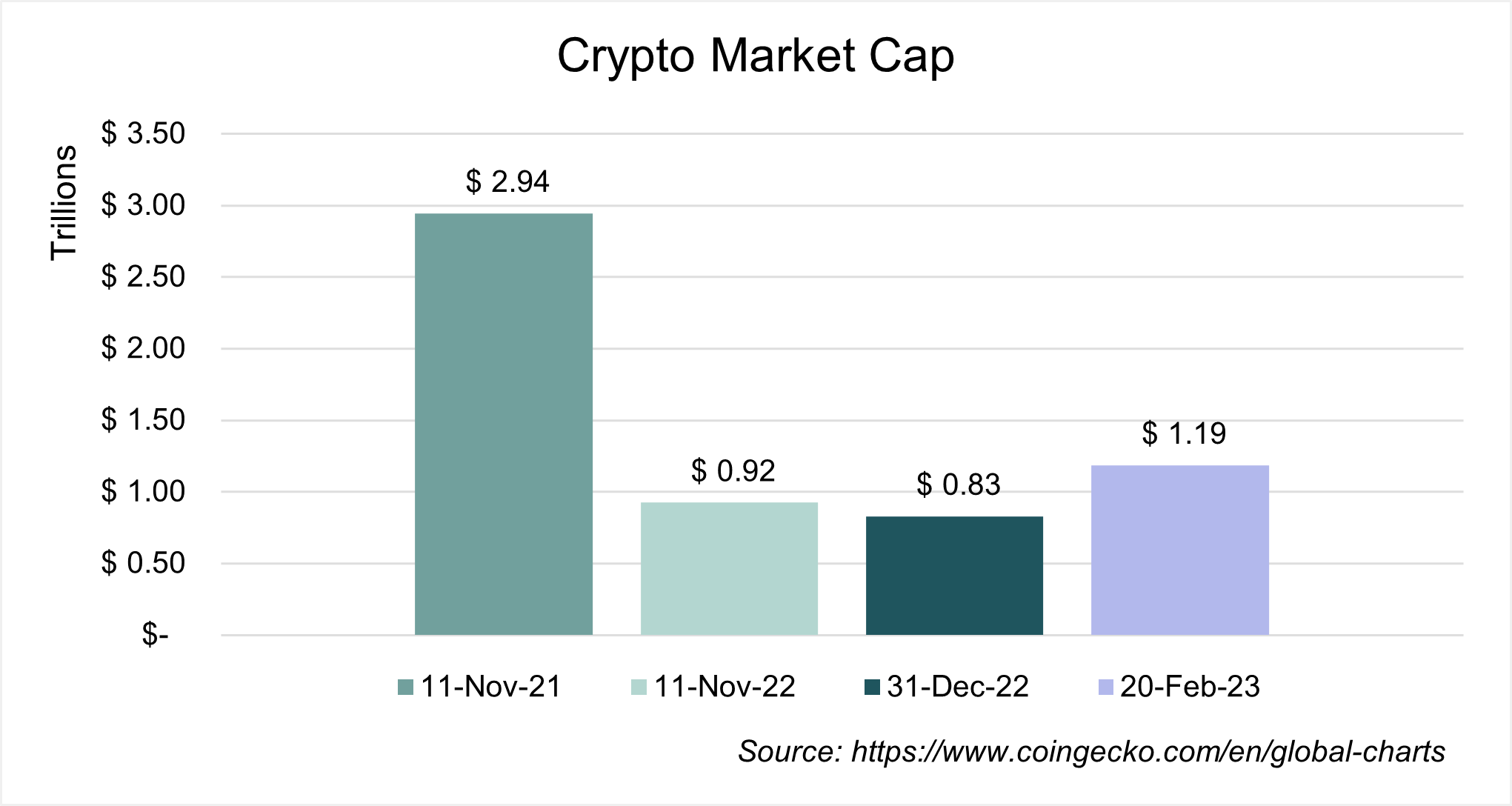

2021 saw institutional investors become more involved in crypto investing. A study by Fidelity Digital Assets found that 7 out of 10 institutional investors expected to buy or invest in digital assets in the future. As of November 2021, the total cryptocurrency market cap was USD 2.8 trillion, approximately one-third of the size of the US tech sector at the time. Despite their volatility, crypto assets continued to gain more widespread adoption as an asset class, finding their way into more investors’ portfolios. The below infographic shows the data as of 9 November 2021, which we now know to be around the peak of crypto.

One of the most talked about headlines during 2022 was the fall of centralised cryptocurrency exchange, FTX International. After gaining popularity alongside crypto investing, Sam Bankman-Fried (co-founder and CEO of FTX) used celebrity endorsements to encourage funding for FTX. Through endorsements and marketing, FTX managed to raise USD 400 million in January of 2022, implying a valuation of USD 32 billion for the company. On 2 November 2022, Coindesk (a digital currency specialist news platform) released an article which prompted a spiral of events. The article revealed that the majority of FTX’s trading sister company, Alameda’s, balance sheet comprised of FTX’s native token (FTT). A native token is one which is inherent to a particular blockchain, or a specific blockchain’s internal currency. Crypto exchanges’ native tokens are often used to transact within the network and are tied to particular value add services within that network. The fact that it was a material part of Alameda’s balance sheet raised a red flag as the value of these tokens is maintained by FTX. In addition, FTX was using FTT as collateral on its balance sheet, resulting in uncertainty around its capital structure and sustainability.

On 6 November 2022, a competitor exchange, Binance, announced its intention to sell USD 530 million of FTT. As the price of FTT tokens dropped, the (then) third largest crypto exchange (by volumes) froze all withdrawals due to their inability to meet the USD 6 billion liquidity requirement. On the 8th of November 2022, Binance announced that they had a non-binding agreement to purchase FTX, but on the 9th of November they announced they would not proceed due to the outcome of their due diligence (mishandling of customer funds and an alleged agency investigation). The resultant surge in withdrawals from customers and Binance withdrawing from their acquisition agreement with FTX ultimately led to the exchange filing for bankruptcy on the 11th of November 2022. Although FTX was not the only exchange to file for bankruptcy over the 2022 year (others include Terraform Labs, Celsius Network and Voyager Digital), FTX was the third largest by trading volumes at the time which resulted in extensive media coverage. The collapse of FTX raised concern around other exchanges and has left scepticism amongst investors around crypto assets.

In early December, the Wall Street Journal reported that FTX loaned customer funds to Alameda. At a bankruptcy court hearing on 11 January 2023, the alleged line of credit between FTX and Alameda which was financed using customer funds was addressed. Sam Bankman-Fried started the 2023 year off with a “not guilty” plea to eight criminal counts. His trial (which could last a couple of weeks) is set for October 2023. The estimated amount owed to the top 50 creditors amounted to USD 3.1 billion, while the extent of losses to clients is still unknown (although Federal regulators have estimated it to be in excess of USD 8 billion). One would expect enhanced regulation and monitoring of the sector which once gained popularity largely due to the lack thereof. One year after the peak of crypto, the sector’s market cap fell to USD 925 billion and by the end of December 2022 it was at USD 830 billion.

What is crypto?

Crypto is a digital form of currency, whereby payment is facilitated through encryption algorithms. Transactions conducted in crypto currency are not validated or authenticated by a centralised authority (eg: The South African Reserve Bank or Federal Reserve), instead they are recorded and verified by users who make use of a decentralised ledger, allowing them to exist in isolation from central authorities. The decentralised ledger contains a full transaction history within a specific network, Bitcoin uses the Blockchain for example. The independence of decentralisation is thought to be one of the main attributes which attract investors and individuals who use it as a means of exchange.

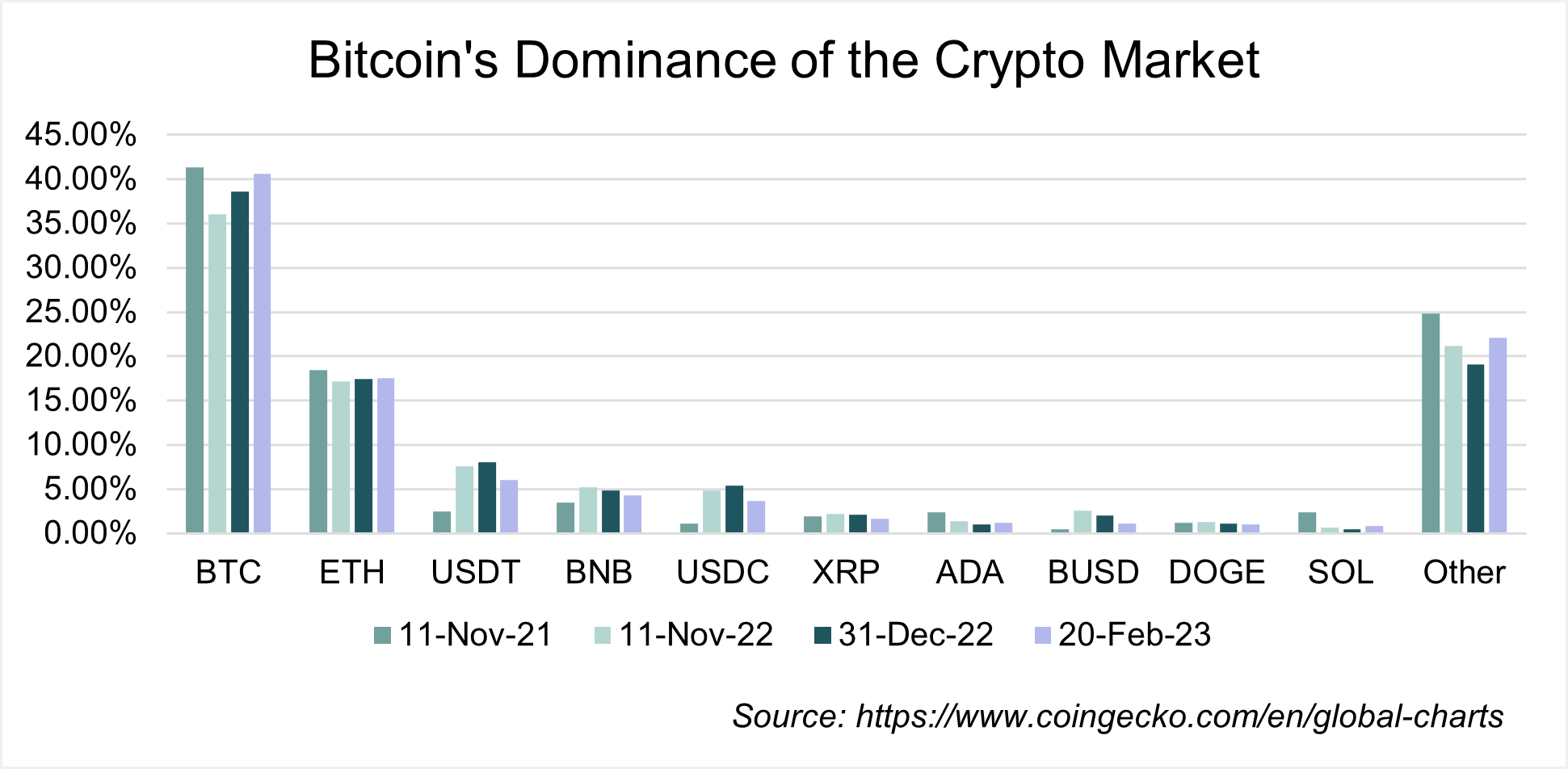

Although some crypto currencies are linked to an underlying (stablecoins), many are free floating, essentially not backed by an underlying to maintain price stability. As a result, they are extremely volatile. A free floating coin’s price will be determined by supply and demand, while a stablecoin’s price will be determined by the price of the asset it is linked to (the underlying). Most stablecoins are linked to the US Dollar. As the US Dollar strengthens, the price of the stablecoin will increase; as the US Dollar weakens, the price of the stablecoin will go down. Stablecoins may also be linked to commodities or other physical assets. Stablecoins have many similarities to money market investments, reducing the appeal of decentralisation. According to CoinGecko, as of 20 February 2023, stablecoins’ market cap was $ 137 billion, representing 11.6% of the total crypto market cap. Seven out of the top ten cryptocurrencies (by market cap) in circulation are free floating.

Although there are more than 12,000 different cryptocurrencies, trading across more than 650 exchanges, the most widely known cryptocurrency (and the largest by market cap) is free floating Bitcoin.

Investing in cryptocurrencies

When you invest in digital assets, such as cryptocurrencies, you trade through a brokerage house and/or a crypto exchange. Similar to traditional brokerage houses, you pay a transaction fee for buying or selling. Once your asset is purchased, it must be stored. Storage largely depends on how the asset was acquired, but can take one of the below forms:

- In-house broker storage and custody

- Wallet

- Exchange-attached wallet

- External hot wallet (online application with real-time access)

- External cold wallet (offline hard drive)

A research paper released in January 2023 by the CFA Institute, “Cryptoassets: Beyond the Hype”, (https://www.cfainstitute.org/-/media/documents/article/industry-research/crypto-beyond-the-hype.pdf) identifies key shortfalls of trading crypto:

- Fees – usually relatively high and vary between access and storage solutions;

- Exchange-attached wallets often prevent the transfer of cryptocurrencies to external wallets;

- There is a high risk of theft or fraud when it comes to hot wallets;

- The durability and accessibility of cold wallets can be unreliable; and

- Loss of control when held on an exchange.

The fifth shortfall requires some context. When you invest in traditional assets, regulation ensures that your holdings are maintained in safe custody and transactions are facilitated by a custodian. The governance of client assets facilitates their protection, by placing them in a custody account which remains independent from the service providers involved. The concept of traditional safe custody (which was developed and modified to better suit the industry over many years) is not present when it comes to crypto investing. The urgency of introducing such a system was emphasised with the fall of FTX, but the development of an all-encompassing system will take time to perfect. In the event of exchange bankruptcy, customers’ crypto assets would be at risk.

Another point to note from the article is that the services offered by crypto service providers are often not as decentralised as the notion of blockchain. Blockchain in itself is a decentralised system, but when it comes to trading cryptocurrencies, the method in which it is traded often introduces a principal-agent relationship and centralises the transaction. Investors holding crypto assets on an exchange which allows for transactions in fiat (traditional) currency, have a claim on a pool of assets which is in the custody of the exchange. The top 10 exchanges by trading value, are all centralised exchanges. The total value traded by the top 10 decentralised exchanges over the past 24 hours amounts to around USD 3 billion, while the trading value of the largest centralised exchange (Binance) amounts to USD 23 billion. Decentralisation is one of the main attractions to crypto investing, yet the majority of crypto traded is via centralised exchanges.

What is a fair price?

Another area where investing in crypto assets contrasts to traditional ones is in their valuation. In traditional finance, one can theoretically determine the intrinsic or fundamental value of an asset based on sound principles. In equity valuation for example, the intrinsic value can be calculated by discounting the share’s future cash flows. When analysing the intrinsic value of a fiat currency, one would make use of its relative value to another currency; taking into account both countries’ inflation and interest rates, as well as economic conditions and prospects. For crypto assets, there are few metrics to use as data inputs for fundamental valuation. It appears as though demand and supply are the only units of measurement available. There is no cash flow stream, no basket of goods to compare relative value and the assets are not linked to any one economy – price is solely determined by willing buyers and sellers. Alternative valuation techniques may evolve, but are currently not reliable due to the volatility within the crypto market.

With this concept in mind, the value of a crypto asset must go up as demand increases and supply declines. Certain cryptocurrencies, Bitcoin for example, have a finite supply, which should enhance value, but only to the extent that there is sufficient demand for its use. Demand for cryptocurrencies will increase as it is employed by more as a means of exchange. Some of the additional areas which may lead to increased demand for cryptocurrency, identified within the CFA Institute’s research paper, include:

- Store of value (similar to precious metals)

- Investment and speculation (although, whether it has diversification properties as an alternative asset class is not yet confirmed)

- Tokenisation of real assets and processes

- Smart contracts

- Decentralised finance (DeFi), lending and borrowing

- New forms of digital asset transactions

- The search for privacy in transactions

The investment case – Distributed Ledger Technology (DLT)

In 2008, the white paper on Bitcoin, written by Satoshi Nakamoto, criticised the traditional finance system for its complexity and reliance on intermediaries. The focus was on a system whereby transactions would be conducted timeously without transaction costs or the need for a trusted intermediary. The intention behind Bitcoin was to create a decentralised means of exchange and not a financial asset to be traded for investment or speculative purposes.

Although media coverage is largely focused on cryptocurrencies, the value lies in the technology on which these networks are based. DLT, effectively an encoded database which maintains transaction records across various locations, has a multitude of potential. Blockchain is a type of DLT. As these databases are decentralised, the ledger is maintained and updated at each node within the system, the independence between nodes ensures that all changes to the ledger are maintained in its history and all participants to that ledger are notified timeously. Due to cryptography, once data is recorded it cannot be altered. Participants of the ledger may have access to the full ledger or a subset of the ledger. Employing this technology allows for timeous completion of tasks and scalable improvements to efficiency.

Tokenisation could effectively change the way in which real assets are managed and traded. Blockchain produced tokens, representing ownership over physical assets, would be traded. The employment of this technology would minimise access constraints amongst investors, as well as entail more efficient pricing and liquidity. Tokenisation could extend to traditional financial assets, traditional currencies, unit trusts, loyalty programmes and digital file storage.

DLT can be integrated into operational systems of entities and has a place to improve the efficiency of legal work through smart contracts. Based on pre-determined conditions, actions are initiated. For example, with Bitcoin, the rules of the ledger stipulate that once proof of work is submitted one can move on to the next node. Within the corporate world, smart contracts could be used for monitoring and initiating workflows. Take supply chain management for example, one can easily monitor and track all stages of the supply chain. Managers would be able to follow up where necessary and ensure any errors are caught and rectified. Within the insurance sector, DLT can be used to monitor for fraudulent claims. Within healthcare, it can be used for maintaining health records of individuals. Within politics, it can be used to facilitate and validate voting. Across industries, DLT can be adopted in the form of cyber security. Its ability to secure data and maintain privacy offers a layer of protection against cybercrime. The opportunities for adoption are extensive.

DLT is employed within the development of DeFi and the proposed transformation of the financial industry. Smart contracts facilitate transactions by automatically enforcing agreement terms. The technology can be used to provide more cost effective and timeous solutions to clients through simplifying the process of transacting.

Another area of DLT integration is the development of the metaverse. According to Verified Market Research, the metaverse is predicted to be USD 824.53 billion by 2030, indicating a compound annual growth rate of 39.1%. The development of virtual realities will include gaming, live events and social media. It is believed that participants within the metaverse will adopt a digital economy and exchange fully digitised assets within virtual worlds.

Although we do not necessarily see value in holding cryptocurrency, we do see the potential for value creation through investing in the technology on which it is based. Technological advancements and innovation stemming from DLT have the potential to change the way we live, work and invest. By remaining engaged in these areas and their development, we aim to benefit from the changing landscape through investments in holdings which are associated with and involved in this disruptive technology. Many new companies have emerged in DLT. As these companies are young and focused on research and development, they tend to be volatile investments. They have not been around for sufficient time to exhibit proven track records or sufficient data for analysis. Not all of them will succeed and only time will tell which of these companies will be at the forefront of new developments. Many of the ETFs focusing on DLT additionally contain cryptocurrency exposure and/or are highly correlated with cryptocurrencies in general. Some of the less obvious companies which have exposure include: Alphabet, through its cloud division and Coinbase; Anglo American, through De Beers who has been using DLT since 2019 to track stones as they are mined; Estee Lauder, who uses DLT for supply chain management; Genentech, who partners with pharmaceutical companies such as Pfizer to verify medication sales; and JPMorgan, through its technology focused business unit Onyx.

Until such time as we see value in a DLT focused company or an ETF which trades independently of cryptocurrencies, we will rely on our exposure through blue chip companies who are investing in the development and integration of this technology in their regular course of business.