Since the Russian invasion of Ukraine on 24 February 2022, geopolitics has been one of the dominating factors occupying the world’s, and investor’s, attention. The impact of the war on the European and the World economy has been enormous. The energy, agriculture and metals price shocks triggered by the war reverberated through Continental Europe, the UK and the inflationary ripple effects were felt across the globe.

When it rains, it pours. The NATO allies’ support for the Ukraine, in terms of monetary support and the supply of military hardware, may lead to more severe actions taken by Putin’s armed forces in its pursuit of capturing the Ukraine. Importantly, the war seems to be polarizing the world (which was already in deglobalization mode before the war broke out) into two camps. The NATO alliance on one side and Russia’s “supporters”: Belarus; Syria; Iran; Venzuela; China; India; North Korea; Sudan; and Cuba, on the other.

While the Russia Ukraine war rages on, there are other geopolitical “hotspots” that are cause for concern. China’s claim on Taiwan is creating tension in the region and the US’s stance on the matter is not helping already fragile relations with China. Pressure points include: the trade wars; intellectual property disputes; and the US concerns with the Chinese company ByteDance’s TikTok social media platform, which is regarded a national security risk by the US. The well publicised recent saga of the Chinese “spy balloon” that was shot down by the US Airforce is further evidence of the strained relationship between the US and China.

Staying in Asia, North Korea has also been causing tension in the region, testing military equipment, short range missiles and, more recently, intercontinental ballistic missiles, as a show of force to the rest of the world, often infringing on Japanese air space.

Recent events in the Middle East, specifically Israel’s attacks on strategic points in Iran, may cause further instability in the region.

The already well established process of deglobalization which has been playing out over recent years, set off by a resurgence in nationalism, or patriotism, within countries around the globe, might well be supported by recent geopolitical events. Nations around the globe increasingly feel the need to prioritise national security and the protection of their citizens. This is clearly visible in the growth of budget allocations towards defence spending, which we believe might well be a multi-year trend.

The table below lists the ten nations that spent the most on defence during 2021. The US has, by a wide margin, the biggest budget (in absolute terms), followed by China. Based on these figures for 2021, compiled by the Stockholm International Peace Research Institute, global defence spend amounted to $2,1 trillion!

Since the outbreak of the Russian Ukraine war, many European Union countries have significantly increased their budget allocations for defence spending. NATO’s guidelines to member nations are for defence spending of at least 2% of GDP, which many member nations, including Germany, have not met in recent years. But last year Germany announced that they would more than double their defence budget from Euro 47 Bn to Euro 100 Bn. In addition, Sweden, Belgium, Poland, Lithuania, Denmark and Romania have all indicated that they will lift defence spending to levels of between 2% and 3% of GDP. Non-European countries like Canada, Japan and the UK are also considering aggressive increases in defence spending and China spent 7,1% more in 2022.

In addition to a supportive fundamental backdrop expected to benefit the defence industry into the medium- to long-term, research and development, as well as technological advancement will be a strong driving force behind growth and profitability for the industry. Over the years, the defence industry has been responsible for many technological advances: the internet; drones; GPS etc. It is no surprise that defence companies invest heavily into research and development to continuously stay ahead of the adversaries and gain first mover advantage.

Some of the top military technology trends at present include:

- Artificial Intelligence: the objective is to enhance computational military reasoning for intelligence, surveillance and reconnaissance missions. Technologies, like machine learning and “swarm” computing, are utilised to empower autonomous weapons systems and to reduce soldier casualties.

- Advanced Equipment: innovations ranging from hypersonic flights, energy directed weapons and space militarisation are being developed. Nanotechnology solutions to create self healing armour is a new field of research.

- Robotics and Autonomous Systems: the use of robotics to minimise risks to soldiers, like landmine clearance, explosives disposal etc.

- Internet of Military Things (IoMT): the objective is to connect military equipment like planes, tanks, satellites and drones with mobile devices like phones and wearables (watches and virtual reality headsets) into a cohesive network, using 5G and 6G mobile techniology, satellites and Artificial Intelligence. The objective is to collect and analyse enormous amounts of information about the environment from various sources to enhance perception and situational awareness.

- Cyber Warfare: development of security solutions to detect and eradicate cyber threats to military assets, especially in the nuclear environment. The protection of military information is crucial. Offensive cyber warfare technologies are also developed to obtain information through malware, ransoware and phishing methods.

This is but a small insight into the modern warfare landscape and only scratches the surface of developments in defence. There are many other interesting fields of development, like human machine collaboration, Big Data analytics and additive manufacturing (3D printing) that are utilised in a wide range of applications in the industry.

Although defence companies like Lockheed Martin, Raytheon Technologies, BAE Systems and General Dynamics, have performed very well during 2022, outperforming the S&P 500 Index by a wide margin, their valuation metrics still appear attractive, especially considering the potential for healthy long-term revenue and profit growth.

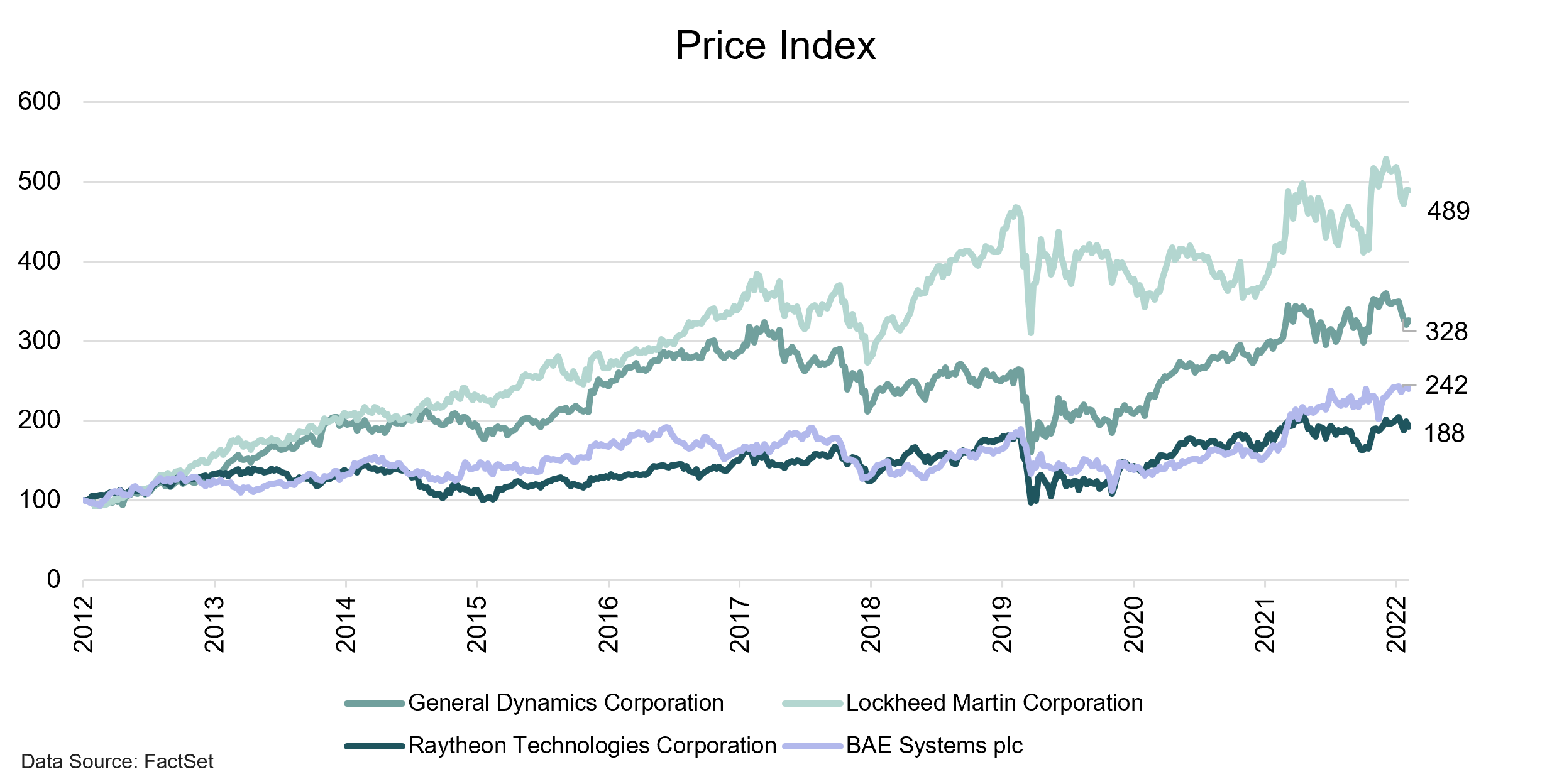

Defence companies delivered superior returns over the last 10 years, led by a stellar performance by Lockheed Martin. In 2022 Lockheed Martin, Raytheon Technologies, BAE Systems and General Dynamics returned 36,9%, 17,8%, 38,3% and 19,0% (in USD terms) respectively versus the -14,1% of the S&P500 Index.

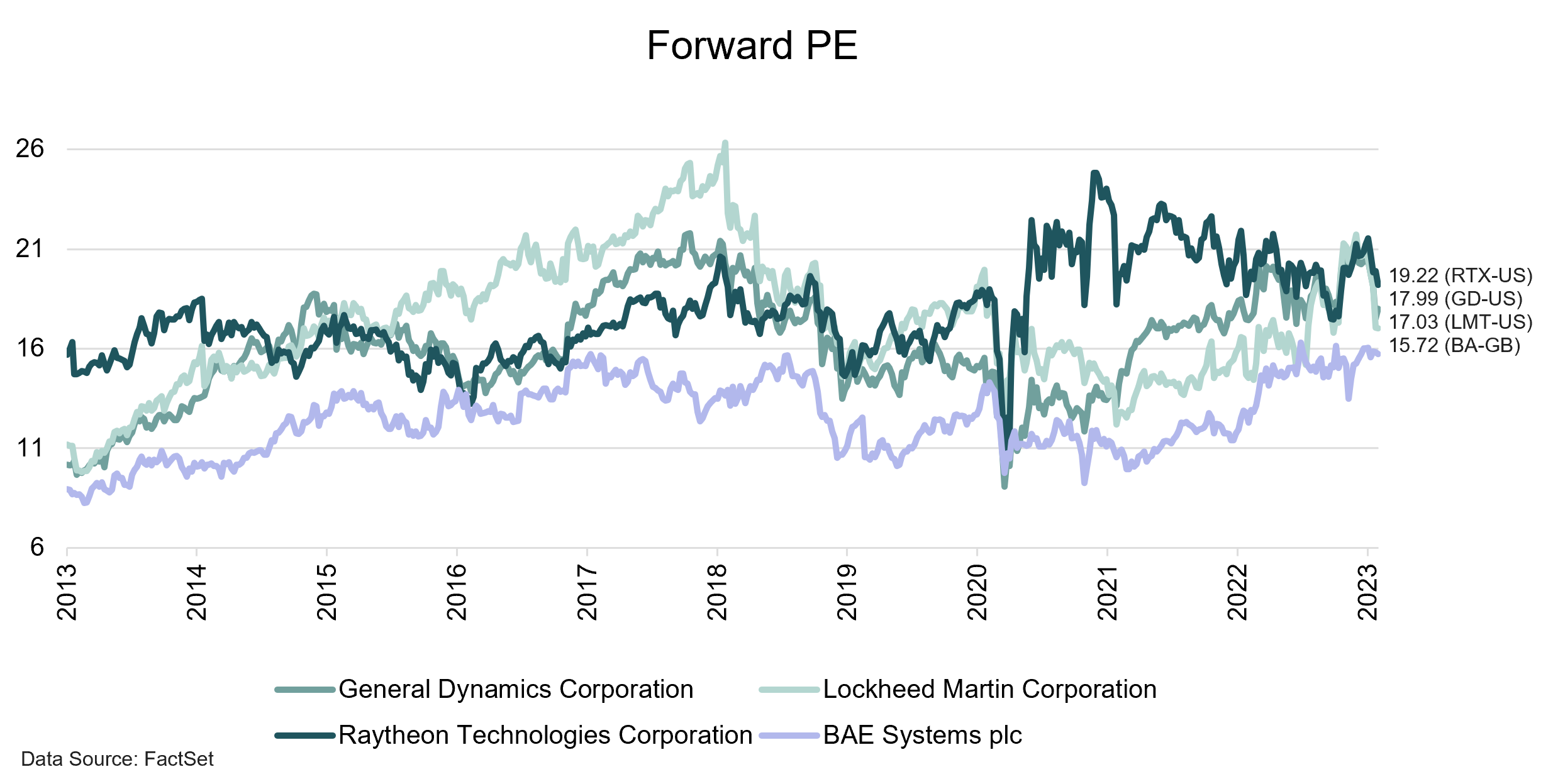

Forward Price to Earnings ratios of defence companies are slightly elevated compared to long-term averages, but justified by supportive fundamentals in our opinion.

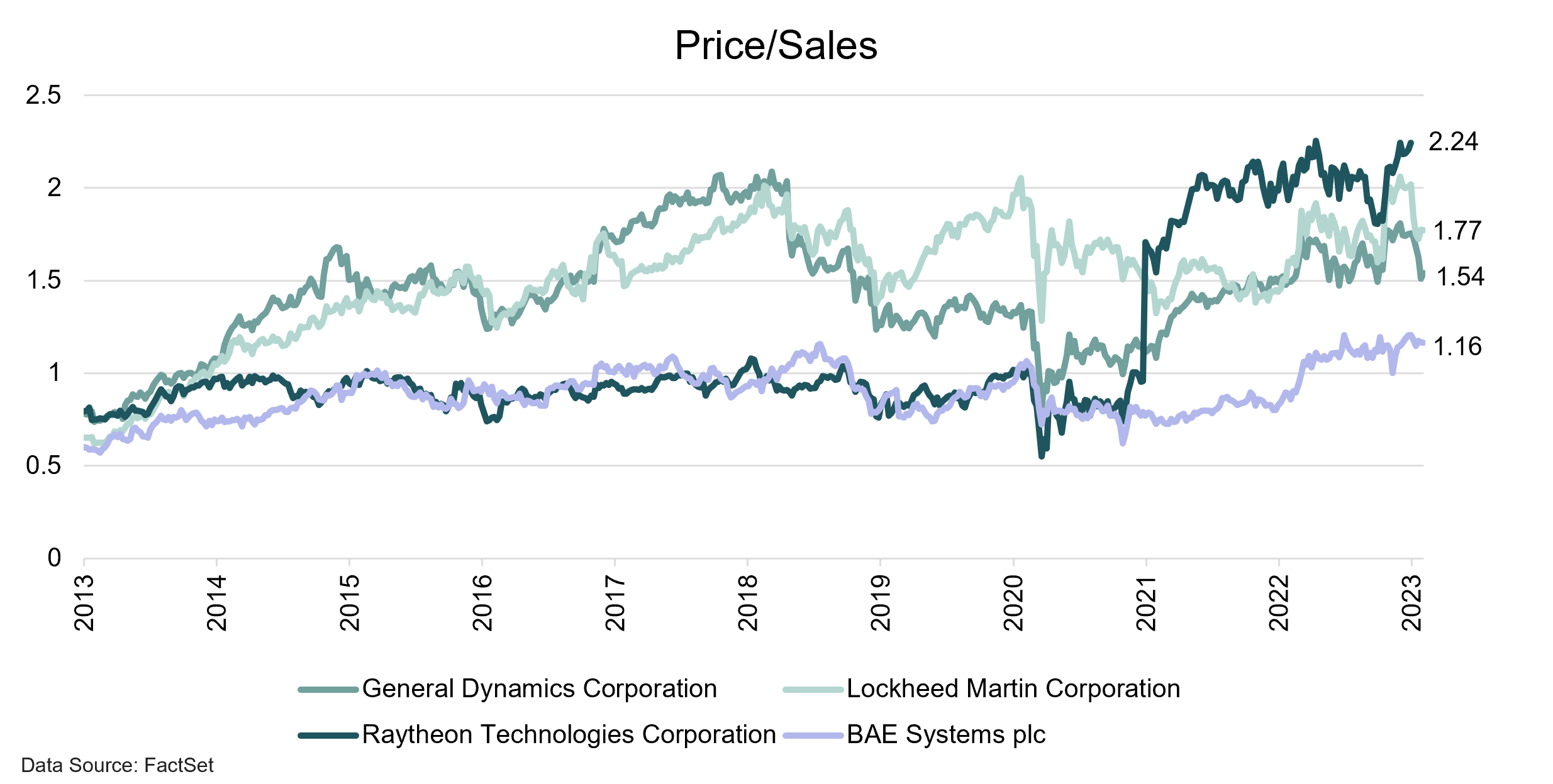

Based on the Price to Sales valuation metric, defence companies are not trading at expensive levels, especially when compared to sectors like traditional Information Technology and Communication Services. For instance, Apple, Meta Platforms (formerly Facebook) and Alphabet (formerly Google) trade at Price to Sales ratios of 6,0; 4,0 and 4,4 respectively.