With interest rates rising across the globe, we thought it pertinent to provide some background on the impact of interest rates on the value of investments.

Causes of a change in interest rates

There are three main drivers of interest rates:

- Market supply and demand for money

Interest rates are the “price” of money. If the demand for money increases, those that have money can demand higher prices, or interest rates, and vice versa. “Cheap” money refers to a low interest rate environment. As interest rates are paid depending on the duration for which it is borrowed or lent, it also represents the time value of money. Usually, the longer the associated term of the investment, the higher the interest rate.

- Central banks: managing inflation

Inflation deteriorates the value of money. When inflation is “too high”, central banks increase base interest rates to increase the “’price” of money, in an attempt to counteract inflation. Similarly, central banks decrease the “price” of money by lowering interest rates when inflation is low.

- Central banks: supply and demand of money

When central banks buy securities (for instance government bonds), it’s called quantitative easing (QE). QE increases the money supply by placing more liquidity into markets. This is usually done in response to economic weakness. The additional demand for securities causes security prices to increase. As bond prices rise, interest rates decrease (as will be shown later).

When central banks sell securities or allow them to mature without replacing them, it is referred to as quantitative tightening (QT). QT decreases money supply, by removing liquidity from the market and leads to the opposite outcome.

Currently, the main driver of higher interest rates is higher global inflation. Globally, central banks have been increasing their respective policy rates over the past year to combat the rise in inflation. The US Federal reserve has additionally been implementing quantitative tightening.

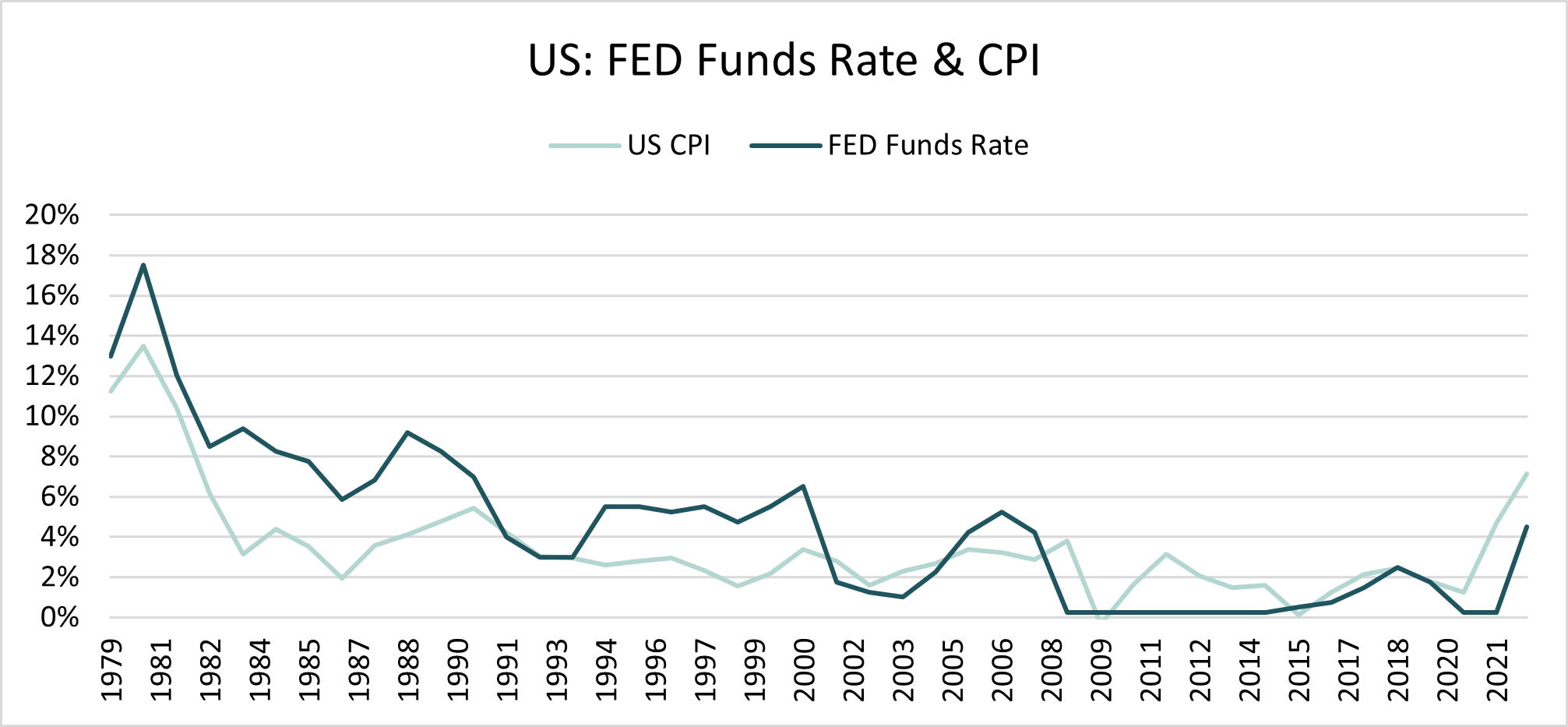

To illustrate some of the above concepts, the below graph shows the historic US consumer price inflation (CPI) and policy rate of the Federal Reserve (FED Fund’s rate). The US had its last spike of high inflation around 1980. US CPI and the FED Fund’s rate move together as the Federal reserve tries to manage inflation in the US.

The impact of interest rates on the value of an investment

Time value of money

Higher interest rates reduce the current value of future cash flows. The further the cash flows are into the future, the more amplified the impact will be.

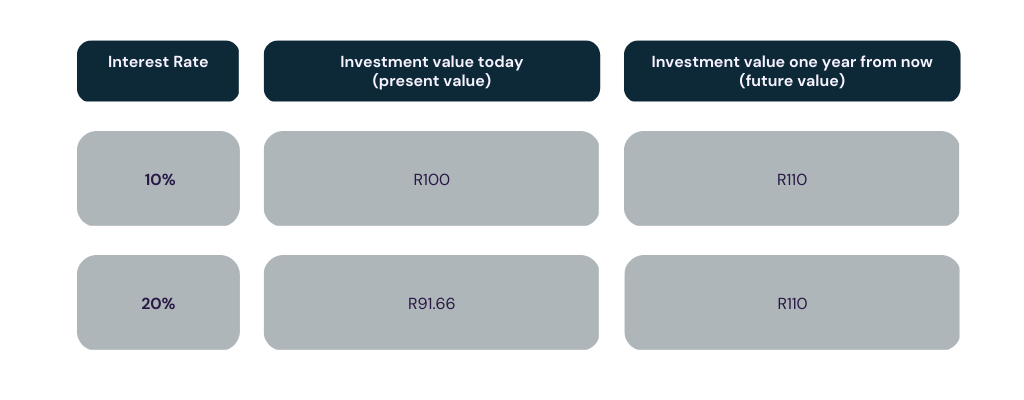

An example:

If you invest money at a known fixed interest rate of 10%, then:

- R100 invested today will be worth R110 in one year

- Using the same argument, if you are going to receive R110 in one year, it must be worth R100 today

What is the effect if interest rates increase from 10% to 20%?

- R100 today will be worth R120 in one year

- So, if you are going to receive R110 in one year, it must be worth less than R100 today. To be precise, it will be worth R91.66 as you will need to invest R91.66 today to receive R110 in one year’s time

A general approach to estimate the value of an investment consists of two steps:

- Estimate all the money (income) that you will receive from an investment in the future and when you will receive it.

- Estimate by how much you must reduce (discount) these future cash flows to have a fair value today. This reduction is calculated by applying what is known as the discount factor.

For example, the value of a building is the sum of the future rental income discounted for interest rates.

In practice, the discount factor will be a combination of items, but it will always include the time value of money (interest rates). The uncertainty in future cash flows (earnings), credit risk and the ease with which you can sell the investment (liquidity risk) are some of the additional factors which may impact the rate. A risk premium is also added to the discount rate to compensate investors for the risk they are taking and deliver a superior return when compared to a risk-free investment.

Growth versus Value Investing

Because different investments are exposed to different factors, their valuations will react differently to a change in the underlying factors. An example of this is the difference in performance of companies whose shares are classified as growth versus value. This type of differentiation between shares is also referred to as “style” investing.

Growth

Investors who believe in the “growth” style of investing will search for companies, based on what they believe are accurate indicators of above average growth, and invest in those companies’ shares (there are sub-categories like high growth, GARP etc.).

The companies’ growth is expected to translate into higher future earnings and dividends (cash flows) for shareholders. The growth in these future earnings contributes significantly to the current value. If interest rates rise (all else being equal) the current value will reduce accordingly.

Value

Value shares are defined as shares in companies that are trading at a deep discount relative to their intrinsic value and therefore offer value. Two of the characteristics that value investors look for are margin of safety (the depth of the discount) and value of cashflows (dividends), as they believe you can reinvest dividends which will lead to compounding over time (while they wait for the discount to unlock).

Because the growth in these companies is lower, a smaller proportion of the current value is attributed to the growth in earnings. Put differently, cash flows that are further into the future contribute proportionally less to the current value of the company, as current earnings are more in line with future earnings. As a result, the value of such shares is less sensitive to interest rate changes.

Relative performance of growth versus value

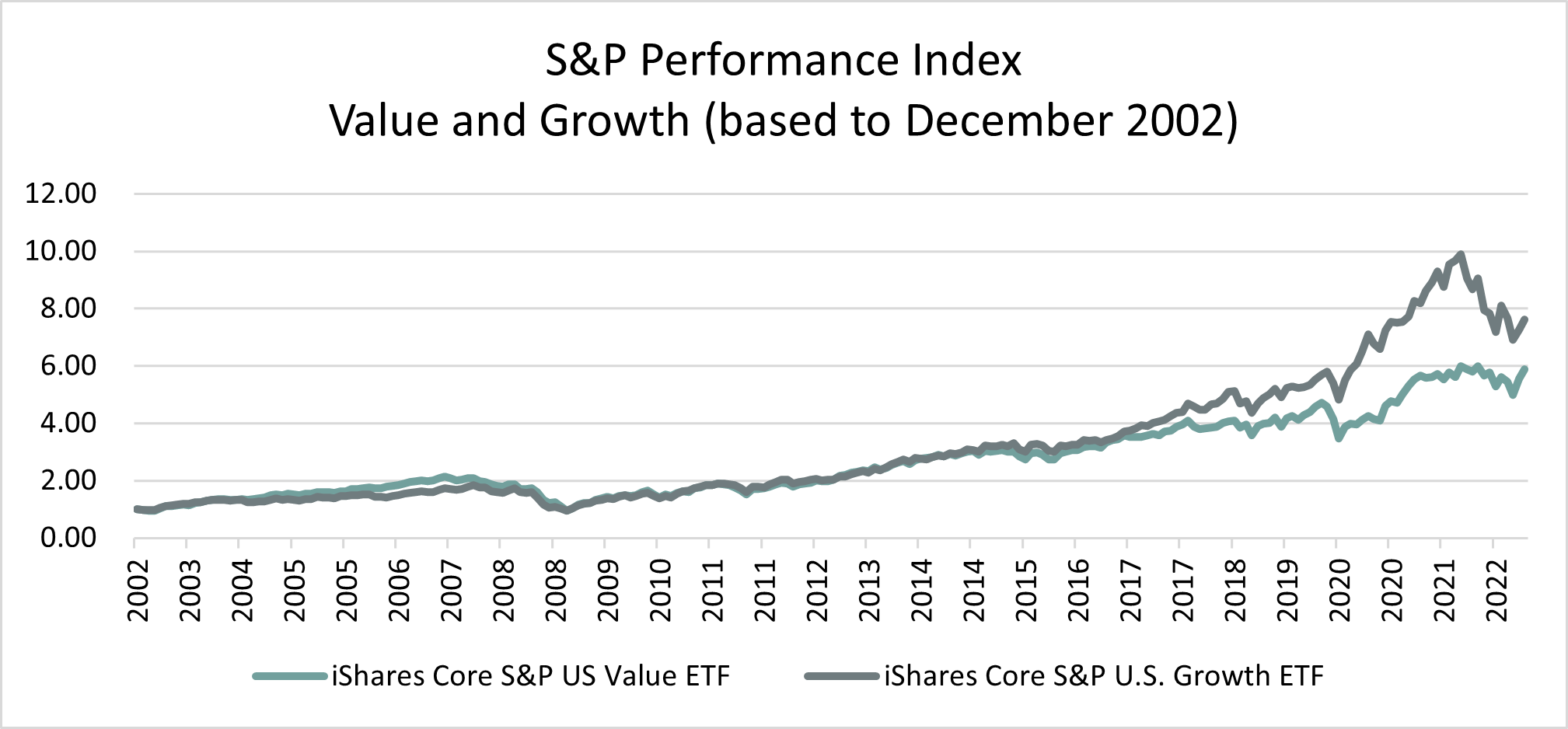

The graph below shows the performance of two S&P500 based Exchange Traded Funds (ETFs), one consisting of growth and the other of value shares.

Two key things to note are that:

- over the period, growth companies outperformed value companies; and

- rising interest rates during 2022, resulted in a greater decline in the value of growth, compared to value, shares.

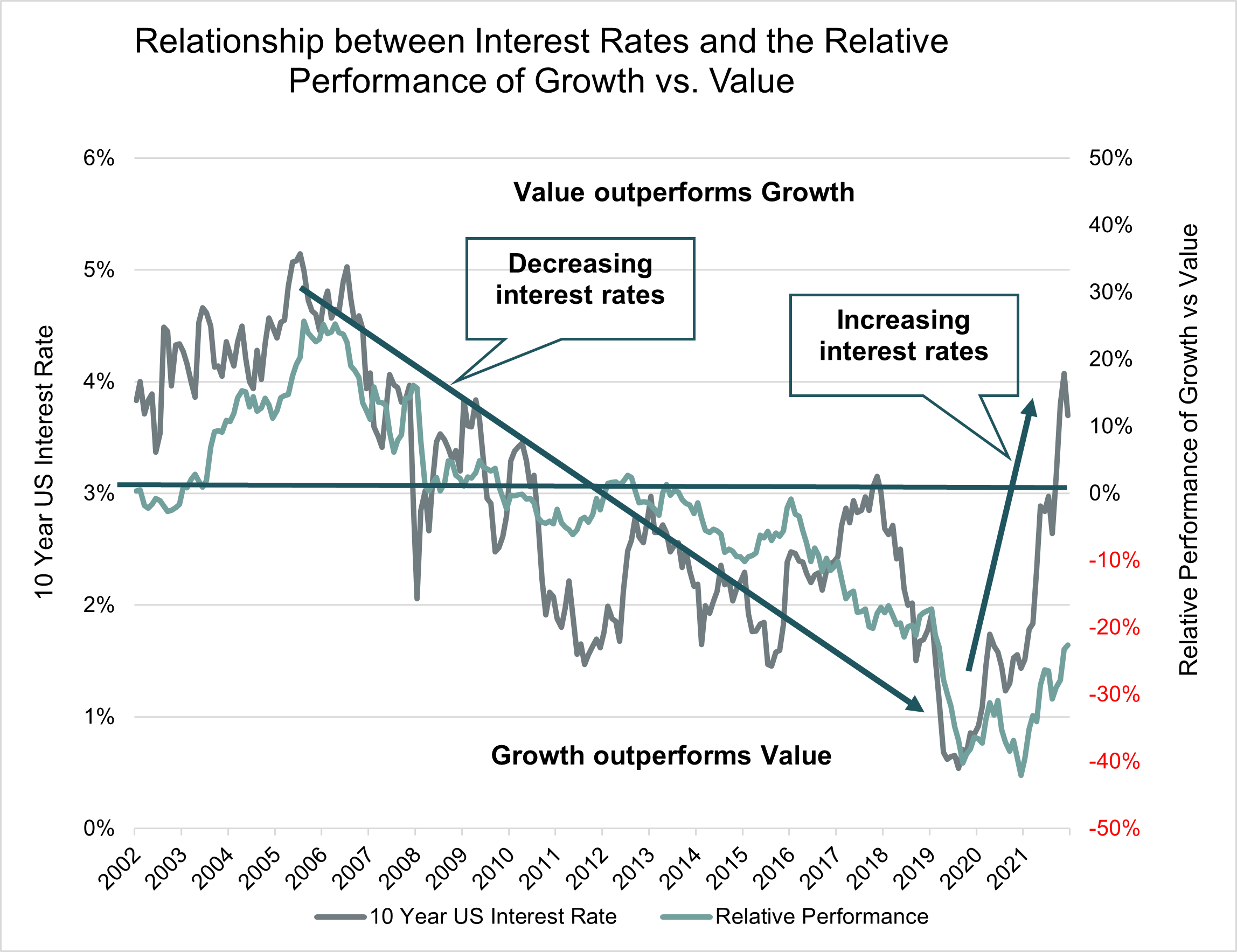

A low interest rate environment benefits a growth company to a greater extent when compared to a value company. This is evident in the final graph.

The grey line represents the 10 Year US interest rate, while the teal line represents the relative performance of Growth versus Value shares. Above the zero point (dark teal line) on the right-hand axis, value outperformed growth and vice versa.

Growth shares benefitted from the low interest rate environment seen since the financial crises of 2007. As interest rates decrease, far into the future cash flows increase substantially in value due to a lower discount rate.

Despite interest rates having increased in 2022 and value shares recently outperforming growth shares, the relative performance of value is still lagging growth by about 20% since 2002.

The probability of remaining in a higher interest rate environment for the foreseeable future is high. We believe that it is prudent to maintain being overweight value and underweight growth shares relative to the benchmark, until such time as the environment indicates otherwise.

ABOUT THE AUTHOR:

Henk Myburgh, CFA®- Head of Research

After completing a BCom Econometrics and MSc in Quantitative Risk Management at the North-West University, Henk Myburgh (CFA), started his career in financial risk management at HSBC. He also worked at Sanlam Capital Markets, where his focus was on consolidation of financial risk across the firm and management of risk on a holistic basis. In 2018 he founded AlQuaTra, a quantitative private hedge fund.