When evaluating investments, it is often difficult to consider which of the vast number of possible solutions is the best one to suit your needs.

As usual, the answer lies in the detail. We have done an analysis which compares unit trusts and segregated portfolios. We have listed key differences between the two in order to provide key details which will facilitate the determination of which approach best suits your situation.

It is worth noting that one is not better than the other, they simply fulfil different roles. At Pyxis Investment Management we offer both solutions for our clients.

One of the biggest misconceptions when it comes to segregated portfolios is that they are more risky than unit trust investments. In the analysis, we illustrate that our Best Investment View (BIV) portfolio, a balanced segregated portfolio, does not exhibit more risk than similar unit trusts over the same time horizon.

In this prelude to the analysis, we will address the misconception that holding multiple unit trusts from different investment managers will always lead to substantial risk benefits over direct segregated portfolios.

It is common to find that investors have been advised to invest in multiple unit trusts. The argument being that your portfolio will be safer overall as you will have exposure to a broader range of investments.

If the different unit trusts have exposure to the same market(s) and are managed to similar benchmarks, the potential to improve the risk profile of the overall portfolio is limited. This is particularly evident when unit trusts have attracted vast amounts of capital invested in them (higher assets under management). Such unit trusts will, to a large degree, be replicas of each other.

The explanation for this lies in the way that unit trusts are generally constructed relative to a benchmark. Unit trusts are managed to track the performance of their benchmarks, with relatively small deviations between the weights of the benchmark and the weights in the unit trust.

For example, when comparing the top 10 holdings between two funds that have similar benchmarks, one will typically notice a large overlap. The top 10 usually accounts for a substantial proportion of the total invested.

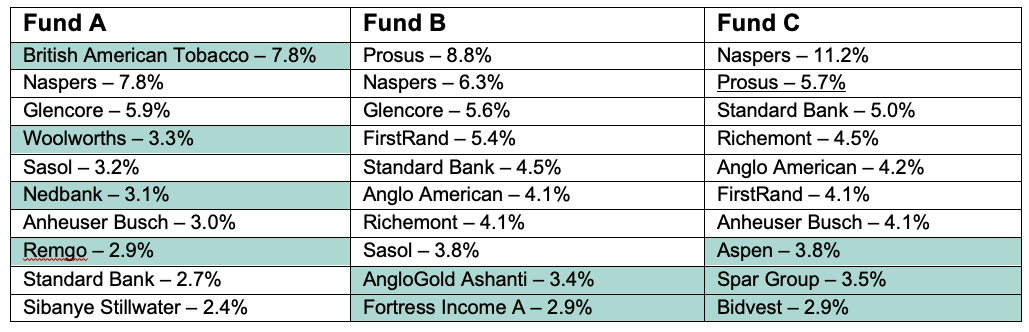

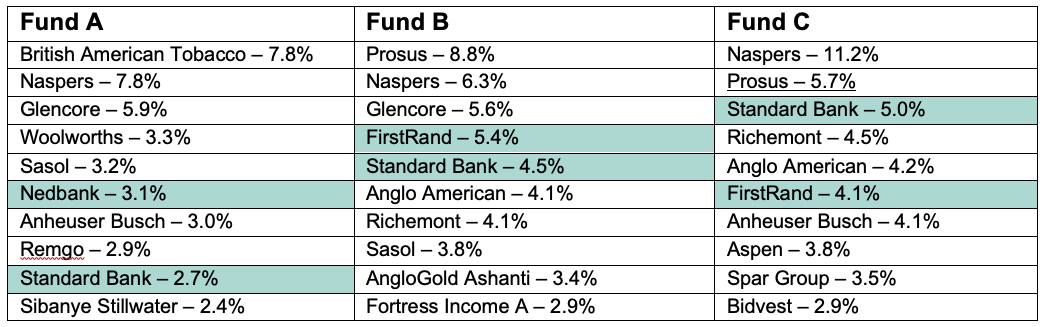

The below table compares three well know unit trust funds. Only unique holdings are highlighted across the three funds.

Even when there appears to be larger differences between individual holdings of different funds, these deviations typically occur within a specific sector.

For example, comparing the three unit trusts above, Fund A invests in Nedbank and Standard Bank, while Fund B and Fund C invest in FirstRand and Standard Bank. It is reasonable to expect that the banks will have similar performance as they have very similar profit drivers.

In addition to the points raised above, opportunities for real diversification are limited, as a result of the size of the large asset managers and the concentrated nature of the market they invest in. The big asset managers tend to focus on companies which are large and liquid, as it is almost impossible for them to invest in smaller (different) companies.

If the size of a fund is R100 billion, then a 1% investment of the fund equates to R1 billion. Spur restaurants are well known in South Africa and does not form part of the Top 40 companies. The market value of Spur is approximately R2 billion.

It would not be viable for the investment manager to invest in Spur.

- Collectively investors in the fund would own 50% of Spur.

- The share price of Spur would probably increase significantly from the sharp rise in demand for Spur shares – pushing the entry price up as the fund manager increased their holding to the desired allocation.

- It would take a long time to acquire the shares, as the average value traded in Spur is only about R1 million per day.

- If the fund decided to sell the position, the price will probably decrease significantly due to the increase in supply of Spur shares – pushing the exit price down as the fund manager exited the position.

Not to mention the limited impact such an investment would actually be able to have on overall fund performance when the fund is of this size.

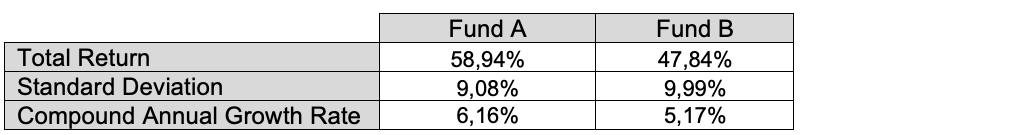

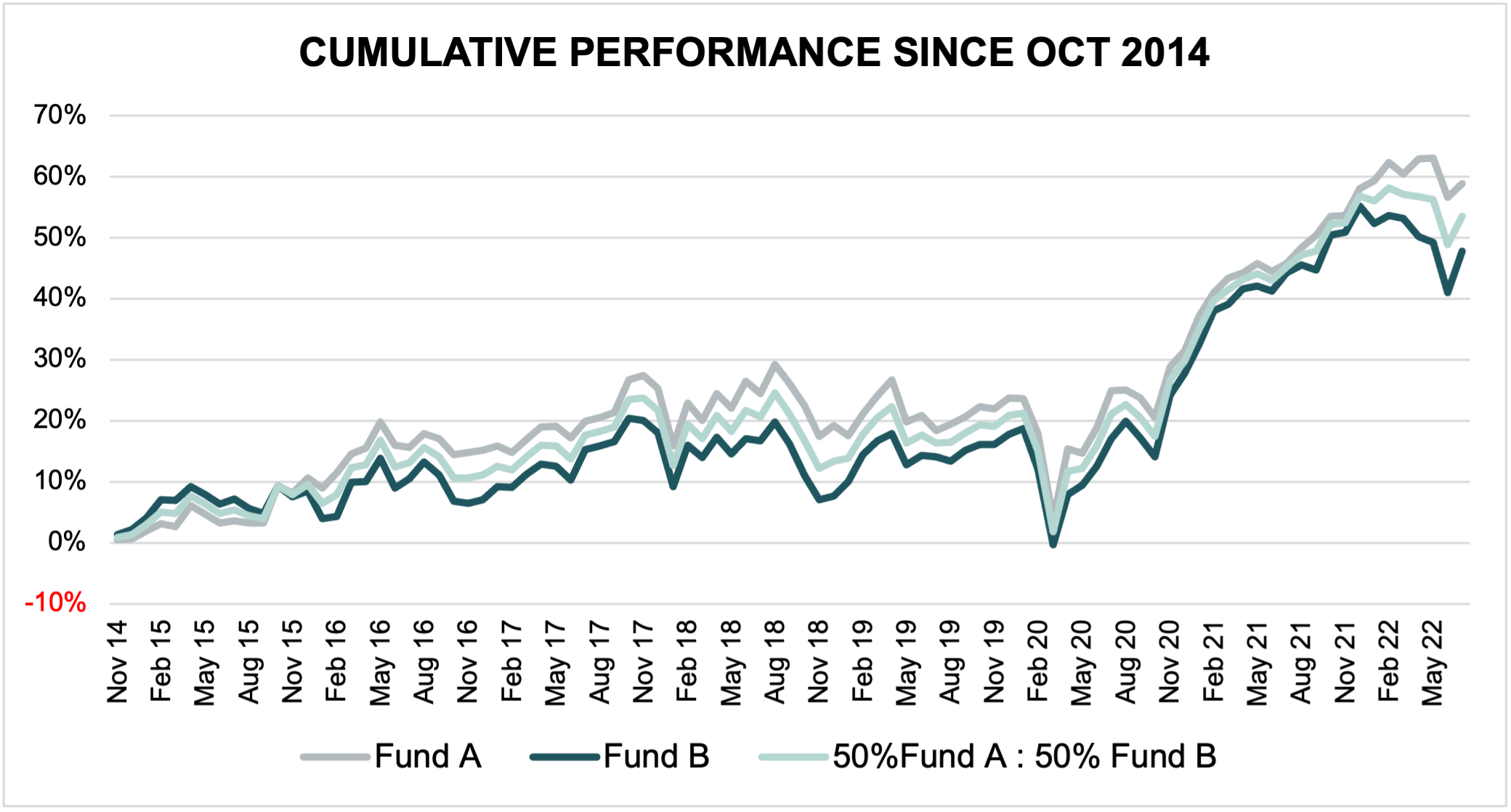

Finally, we compare two unit trusts from two well know large investment managers. Both unit trusts have a balanced mandate. These are also the same two funds we compare within the aforementioned analysis. These two unit trusts exhibit the problems mentioned above.

Here are the respective performances since October 2014:

Fund A outperformed Fund B, but they had similar standard deviations (similar variability of returns). Additionally, as predicted, the returns were highly correlated. Had you been invested in both, you would only have benefitted from a small diversification benefit.

It is clear from the above that “diversifying” an investment portfolio across more than one similar unit trust does not necessarily lead to the expected result of reducing risk. Furthermore, a segregated investment portfolio, is not necessarily higher risk than a unit trust (view our analysis here).

Other potential benefits of segregated investment portfolios include lower fees, personalised service, and a tailor made approach to suit each investor’s specific needs

ABOUT THE AUTHOR:

Henk Myburgh, CFA®- Head of Research

After completing a BCom Econometrics and MSc in Quantitative Risk Management at the North-West University, Henk Myburgh (CFA), started his career in financial risk management at HSBC. He also worked at Sanlam Capital Markets, where his focus was on consolidation of financial risk across the firm and management of risk on a holistic basis. In 2018 he founded AlQuaTra, a quantitative private hedge fund.