What does the scoreboard say?

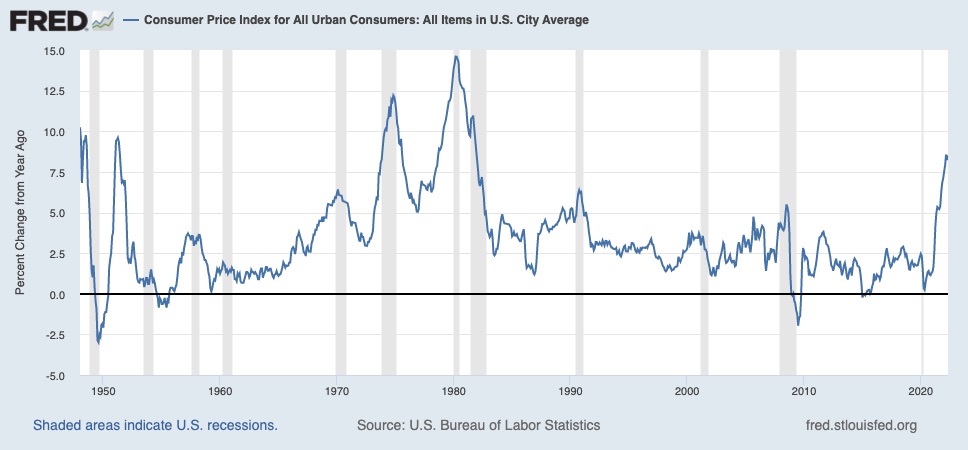

The first half of 2022 was by no means a walk in the park. The global economy, and capital markets in turn, had to face a barrage of shocks. Our central investment theme, “The Return of Inflation”, which we have written about at length since late 2020, has taken centre stage. Back in 2020, the US Central Bank or Federal Reserve, fearing the spectre of deflation (the dreaded economic monster the Japanese economy has been battling for almost 40 years), said that they would be willing to accept inflation to run “hot” or in excess of 2% (their official inflation target) for a prolonged period of time. This statement was in part, ostensibly, to justify the accommodative monetary policy that they were implementing at the time (in fact, the US Federal Reserve has been implementing a zero interst rate policy since the Great Financial Crises of 2009). The US government has also taken significant steps to support the economy during the Covid 19 pandemic and lockdowns by way of accommodative Fiscal Policy.

The accommodative Monetary and Fiscal Policies, in addition to some secular drivers supporting lower inflation seemingly coming to an end, let the inflation genie out of the bottle. At first, as inflation started to increase, the US Fed was adamant that it was “transitory” and that, in addition to managing price stability (or inflation), ensuring maximum employment was of equal importance. This left the door open to leave policy rates at multi-year lows.

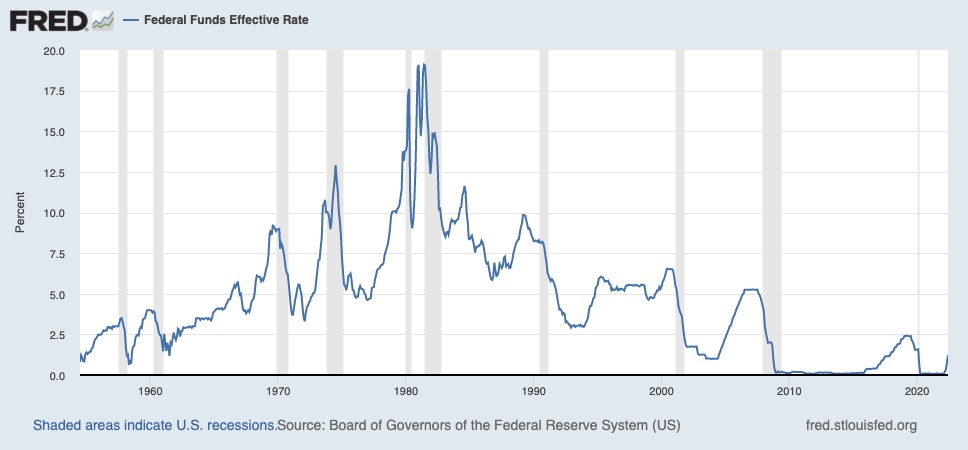

Inflation continued to rise however, and Covid/Lockdown related manufacturing and logistics bottlenecks in the face of strong consumer demand meant more pressure on the prices of goods. The Russian invasion of the Ukraine, sending prices of commodities like: oil; natural gas; and agricultural products sky high, added even more fuel to the inflation fire. Inflation has risen to multi-decade highs globally and central banks now have their hands full battling to curb it. In the case of the US, the Fed has started to raise short-term interest rates, coupled with Quantitative Tightening (in essence, removing liquidity from financial markets as opposed to injecting liquidity into markets, as was the case with Quantitative Easing). Most central banks in developed and emerging markets have embarked tightening monetary policy strategies by raising short-term interest rates.

US inflation at levels last seen in 1980. Not just a US phenomenon – inflation from the UK to the Eurozone and emerging markets are at multi-decade highs.

Barely moving the needle, is the Fed behind the curve? US Fed Funds rate has been raised from 0,25% to 1,75% and is expected to rise to 3,5%. Is that enough given inflation at a 40 year high? Maybe, if inflation has peaked.

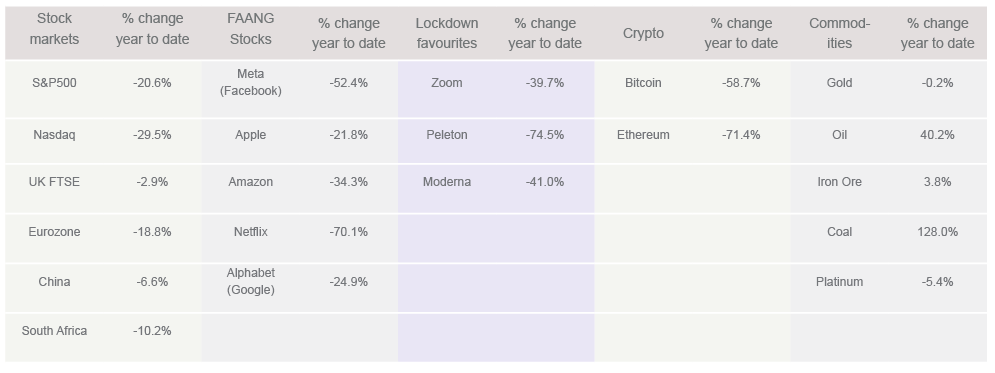

Currently, the big debate is whether higher interest rates, in the face of an increasingly struggling consumer as a result of higher food and energy prices, as well as mortgage rates, will lead to merely an economic slowdown or a recession. In the US, the Fed seems to believe they can manage a so called “soft” landing… The jury is out, but the fact is that capital markets don’t like unexpected shocks and the accompanying uncertainty it creates. This is clear from the table below, showing the impact on the performance of various financial assets under this “risk-off” scenario. Most major makets have sold off significantly, especially the more risky or speculative groups like profitless information technology companies, the Covid/Lockdown winners and crypto. Speculation comes to a screeching halt when all of a sudden there is a cost (interest rate) associated with money.

Going into the second half of the year, markets may well remain volatile as the economic adjustment to higher inflation and interest rates continue. Consumer confidence indicators are pointing to a strained consumer which means less spending. Manufacturing indices point to a slowdown in activity. Companies’ profit margins will adjust lower as a result as they deal with the higher cost of inputs like raw materials, energy and labour. As per the table above, however, capital markets have adjusted quite considerably to the environment already.

From a valuation standpoint, the PE ratio of the S&P500 index, has contracted to 15,6, well below the long-term average of 22. It’s impossible to forecast, but unless company earnings fall materially or interest rates rise more than anticipated (as a result of continuously stubborn inflation), one could argue that equity markets may have discounted the bad news a great deal. Bond markets have had their worst performance since 1974, also quite a telling statistic.

But things, which may impact economies and markets in a wide range of possible ways, can change quickly. An end to the war in the Ukraine may cause a reversal of some of the pressures we have experienced, but we are not in the forecasting game; instead we aim to run well balanced, risk managed investment portfolios. Our investment strategy always revolves around diversification and remaining exposed to quality investments. Our newsletter last month highlighted this by talking to the fact that there is no value in attempting to alter one’s investment strategy based on market action. Unless your circumstances have changed, long-term focus has been proven a superior strategy.

A short history on bear markets

A bear market is defined as a drop in the price or level of a market in excess of 20% from its most recent high. The US stock markets, as represented by the S&P500 and Nasdaq indices, are currently experiencing bear markets being down 20,6%, and 29,5% respectively. US bank, Wells Fargo‘s Investment Institute, has analysed historical S&P500 bear markets which makes for some interesting reading. Since World War II, there have been 11 bear markets which lasted on average 16 months, with an average drawdown being 35%. When a bear market was accompanied by a recession (an economic contraction of at least 6 months), the average bear market duration was 20 months. On average, the 12 month market performance after a bear market ends, was approximately 44%. Currently, we are just more than 6 months into the bear market and without the monetary and fiscal stimulus that accompanied the Covid/Lockdown bear market of 2020 (which lasted approximately 6 months), we may not be out of the woods yet, but based on historical experience, a strong recovery may be expected, its just a question of time.