Q2 kicks off

Taking over all headlines at the beginning of 2022, the Russia Ukraine tension seems to have taken a back seat as the world encounters the politics of billionaires, the fear of EU instability and temperamental weather. The war however is far from over, with conflict exacerbating the rise of inflation and supply challenges. Hot on the press for the month of April was Elon Musk’s hostile takeover of Twitter, as well as the French election and devastation in KwaZulu Natal.

Transitioning to Transnistria

Early April, Putin announced that peace talks were going nowhere and that he would continue his war on Ukraine. The tension became focused East towards the Donbass region and South towards Mariupol. According to Bloomberg, Putin seized Mariupol in the third week of April.

Source: UK MoD / Institute for the study of war (21:00 GMT, 26 April 2022)

The West went on to pledge more weapons to Ukraine in their attempt to assist Ukraine’s defence; with Germany offering anti-aircraft tanks, and Canada and the UK offering heavy weapons. On 27 April, gas supplies to Poland and Bulgaria were suspended by Gazprom after the two countries refused to pay in Rubles.

On the same day, it was reported that Transnistria had been subject to explosions targeted at their state security headquarters, radio masts and a military unit. Although there is no certainty on whether these were attacks, Odesa (the port city already targeted by Russia) lies east of Transnistria. Odesa has been well defended by Ukraine, and it is possible Russia sees Transnistria as a new point of entry to obtain the region.

Up, up, up we go

US CPI data came out on 12 April. The expectation was for YoY inflation to come in at 8.4%, up 1.1% for the month of March. The actual number, 8.5%, was the largest increase since 1981.

With real rates still negative in the US, the Fed prompted the market for more aggressive rate hikes in the coming months. A 0.50% rate hike is now largely anticipated at the Fed’s May meeting, with 0.75% hikes in June and July.

In South Africa, Stats SA released inflation numbers on 20 April. Annual inflation at the end of March was 5.9%, largely due to food and non-alcoholic beverages (6.2%), housing and utilities (4.8%), transport (15.7%), and miscellaneous goods and services (3.2%). Overall, inflation in goods (8.7%) outweighed that of services (3.4%).

Error 420: You’ve been laser eyed

The month started with Elon musk purchasing a 9.2% stake in Twitter. No stranger to the platform, using it as a marketing tool many times, not to mention his single combat challenge for Vladimir Putin, many questioned Musk’s motives. Overall, the response was fairly positive, with Twitter shares gaining around 27% on the news. The purchase resulted in Musk becoming the largest shareholder, but that title was short lived when Vanguard increased their stake to 10.3% a few days later. Along with Musk’s shareholding came a position on the company’s board. Although Musk initially accepted the position, which would become effective on 9 April, he announced on the morning of the appointment that he would no longer be joining the board.

Musk proceeded to offer to buy the remaining shares in Twitter for USD 54.20 per share, resulting in the Twitter board considering the use of a “poison pill” in defence (giving existing shareholders the right to purchase additional shares at a discount, thus diluting the hostile investor’s holding).

Source: Twitter.com

Musk had previously addressed the potential hostility at a TED talk. Musk ran a poll on Twitter asking who the decision to go private should lie with – respondents voted 83.5% in favour of shareholders as opposed to the board.

In the TED talk, Elon attributes the takeover attempt to increasing the trust in Twitter, retaining as many of the shareholders as possible if it goes private. He does not wish to monopolise Twitter, but rather sees the privatisation as a move towards inclusivity and the rebirth of a forum that exudes free speech.

You would think, with The Boring Company, Neuralink, Tesla and SpaceX, Musk is already a fairly busy man; would he have the time to focus on promoting free speech and Twitter reaching its “full potential”?

On 25 April, Twitter closed 5.7% higher on the back of the news that Musk would buy Twitter for USD 44 billion and take it private.

“Free speech is the bedrock of a functioning democracy, and Twitter is the digital town square where matters vital to the future of humanity are debated. I also want to make Twitter better than ever by enhancing the product with new features, making the algorithms open source to increase trust, defeating the spam bots, and authenticating all humans. Twitter has tremendous potential – I look forward to working with the company and the community of users to unlock it. I hope that even my worst critics remain on Twitter, because that is what free speech means.” – Elon Musk

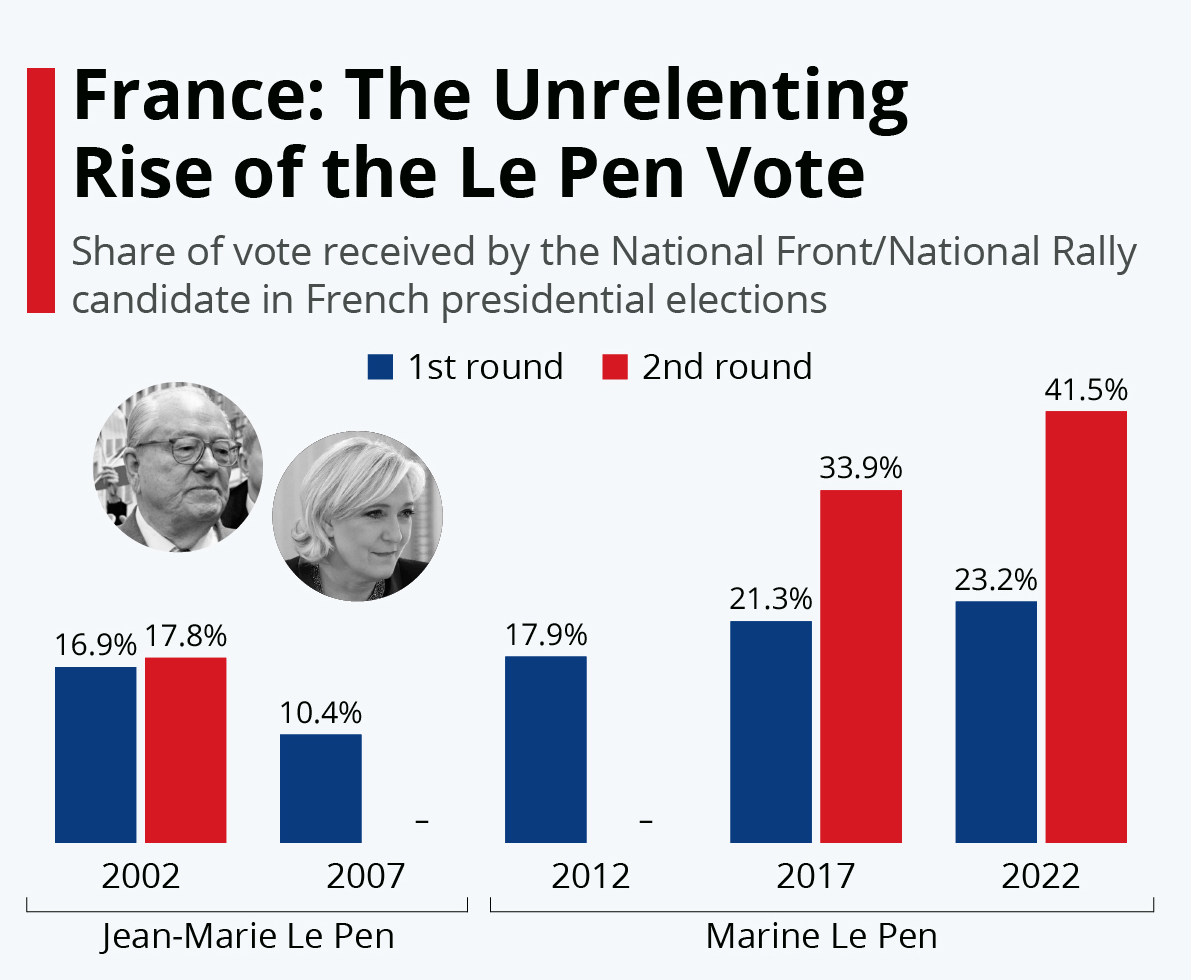

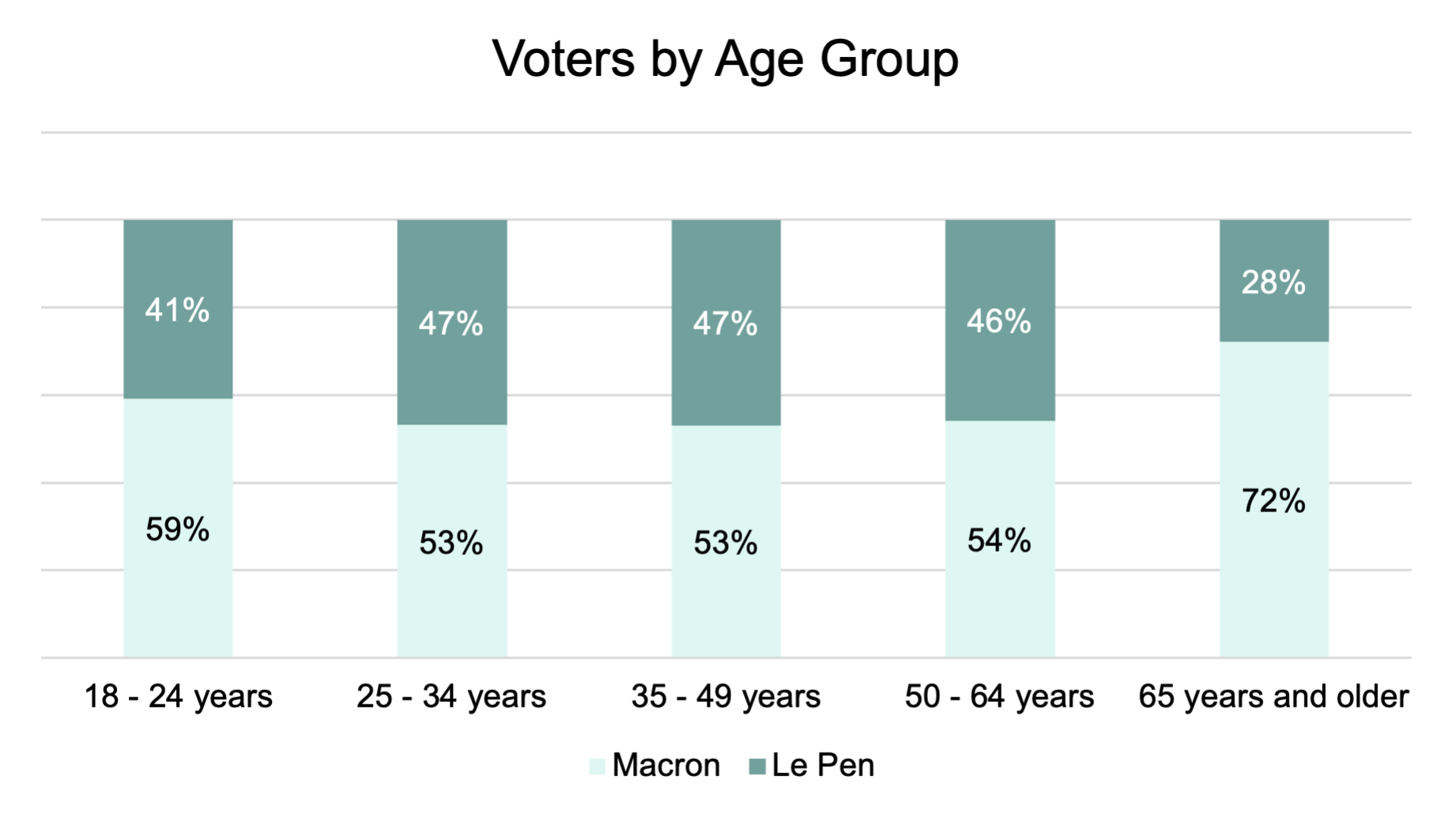

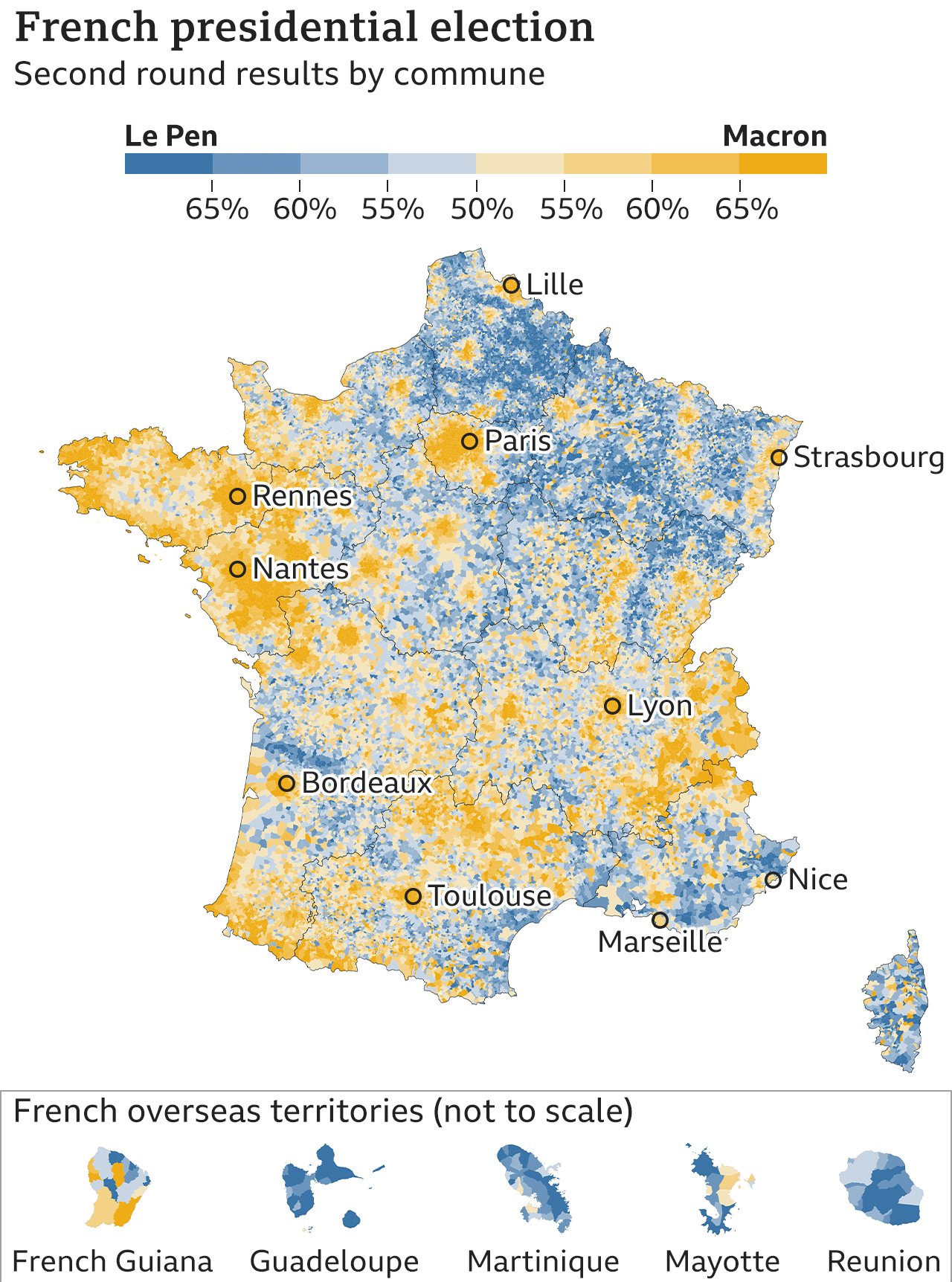

Macron – let’s Pen that in

In France, Emmanuel Macron won the election against Marine Le Pen, the first re-election of a president since Jacques Chirac was re-elected in 2002 (beating Le Pen’s father). Macron’s main support came from older voters, those from higher LSM groups and residing in big cities.

Source: French Ministry of the Interior via Statista

Source: Politico

Macron’s far-right opponent, Le Pen, believes in a “France first” approach and her election could have resulted in a move away from NATO and the EU. Le Pen was vocal about ensuring France’s independence when it comes to defence, as well as her desire for France to be independent from the West in that regard. She has strong views about immigration and employment of French nationals. Many of which are in contrast to the practices of the EU.

Source: French Interior Ministry

Having been in opposition at the last election, in 2017, the two candidates’ varying policies were already largely known. Although Le Pen changed her stance slightly this election, focusing on French domestic affairs such as the increasing cost of living, the main point of interest globally was their varying stance on France’s involvement in the EU and NATO.

With Macron’s re-election we don’t expect any drastic changes to the EU in the foreseeable future. Focus is now on the parliamentary elections which will determine the amount of influence Macron and his party have and their ability to pursue their proposed domestic policies.

Downpour on KZN’s parade

Following the initial blows of the Covid-19 restrictions, KwaZulu-Natal had the looting of July 2021 to deal with and now the flooding of April 2022. Up in Gauteng, we sure had copious amounts of rain over the Easter weekend. KwaZulu-Natal on the other hand, had a period of excess water taking over anything that dared get in its way just prior to the long weekend.

According to BBC, 300 mm of rainfall was recorded on 11 April – approximately 75% of South Africa’s average annual rainfall. To put it in perspective and compare that to prior periods of flooding: 165 mm fell in 2019; and 108 mm fell in 2017.

From an investment point of view, the obvious concern would be on those companies who have operations within the region. The next level of concern would be for the insurers who may need to pay claims relating to the damage, supply chain impacts due to the destruction of key transportation routes and the impact on the economy of rebuilding.

KZN contributes 16% to South Africa’s GDP. Although small business were hit hardest, the larger listed companies are not in the clear. Container terminals were closed, impacting the supply of goods which flow through the Durban port. Transnet suspended operations within the area and many logistical channels were damaged. Sappi had to halt operations in the area due to road closures; Toyota’s yard was flooded; and KAP experienced temporary operational disruptions, to name a few.

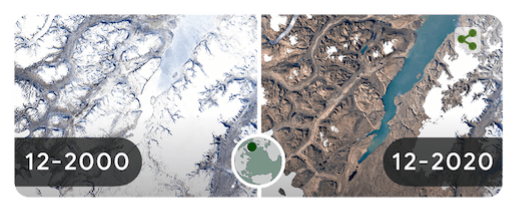

Many have voiced their concern around climate change, both locally and abroad. Whether the recent floods are a result of climate change or not, they most certainly highlight the short comings we as South Africans face when it comes to changing weather patterns. Lack of maintenance leaves roads and buildings less resistant to harsh conditions, and many settlements are built in areas which are unprotected from adverse weather.

Source: Google – Earth Day 2022 Doodle

The 22nd of April marked Earth Day and Google’s doodle of satellite images portraying the impact of climate change were frightening. All this talk of changing weather patterns has prompted me to delve deeper into climate change from an investment perspective. How will industries change, where will we find arable land, which cities will be the most desirable to work and reside in? These are just a few of the questions I have. In the coming months, I hope to provide some insights on how we can try and position ourselves to best weather the storm.