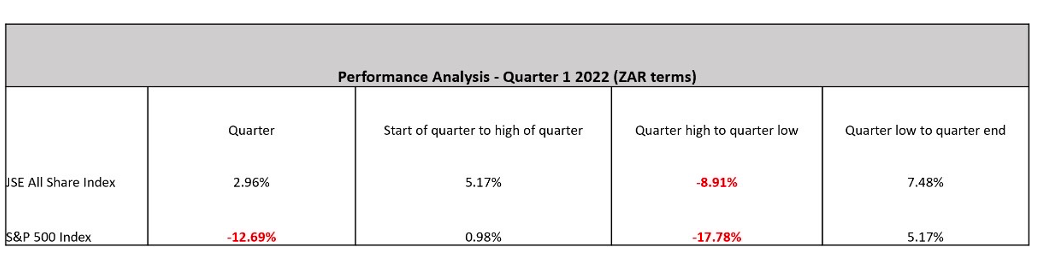

Capital markets have been exceptionally volatile during the first quarter of 2022. In fact, the last two years have been a truly wild ride. Covid 19, lockdowns, supply chain bottlenecks, inflation accelerating at break-neck speed, interest rates rising and even war! Refer the table below for an overview of the last quarter’s market performance.

I have learned over the years that there is always something to worry about, yet things tend to turn out well in the end. Yes, economies and capital markets fluctuate and exhibit a fair degree of cyclicality. Economies expand and contract and stock markets go through boom and bust cycles. Peter Lynch, investment management guru sporting a very impressive track record managing funds from the 70’s through the 90’s, said: “There is always something to worry about. Avoid weekend thinking and ignoring the latest dire predictions of the newscasters. Sell a stock because the company’s fundamentals deteriorate, not because the sky is falling.”

It is easy to get sucked into a vortex of negativity when crises rear their ugly head. It’s human, our decision making is oftentimes driven by emotions that get the best of our rational brains. Fear and greed – we hear about it so much. Warren Buffet advises us to ignore our emotions and screams from the mountaintops: “Buy when others are fearful and sell when others are greedy”. Unfortunately, it’s not always quite that easy, even for professionals (we are also human after all…), especially when World War III seems to be looming around the corner. Market crashes and the questions echo over financial media: “sell stocks!? park in cash!? No, gold is the answer!”. To be honest, who knows (certainly not the CNBC market commentator)? No one has access to a crystal ball or a time travel machine. Consider the Russian Ruble. At the outset of the Russian invasion of Ukraine, the Russian Ruble became the Russian “Rubble”, depreciating significantly against the US dollar. As I am writing, the Ruble has risen out of the ashes like the mythological Phoenix and is STRONGER relative to the US dollar than before the invasion. Yes, there are many reasons for this outcome, but the question is: who had the prescience and expected this to happen?

Predicting the future and anticipating the short- and medium-term ebbs and flows of the economy or stock market, in an attempt to position a portfolio to profit from a specific but uncertain outcome, is an exercise in futility. I do believe that understanding economic context is important, to the extent that it might inform one on the range of potential scenarios that may define the future environment one is exposed to.

To paraphrase Peter Lynch again: “Nobody can predict interest rates, the future direction of the economy or the stock market. Dismiss all such forecasts and concentrate on what’s actually happening to the companies in which you’ve invested”.

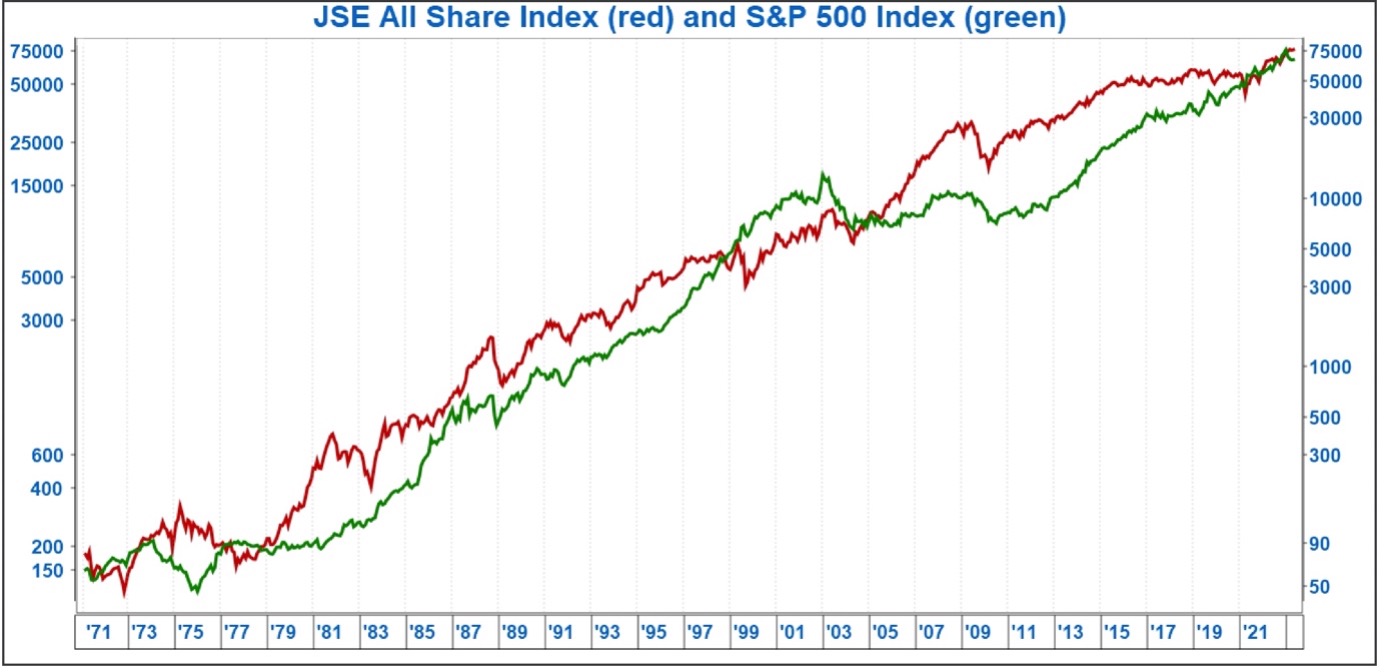

The chart below shows the performance of the JSE All Share Index and the S&P 500 since 1970 (South African Rand terms). Clearly, simply by way of visual inspection, it can be concluded that markets are quite volatile in the short-term. Over time however, the chart goes from the bottom left to the top right – exactly what we want to see. From time to time, the market corrects or even crashes, but over the long-term the compound average growth rate was 14,3% for the S&P 500 and 12,2% for the JSE All share index.

Source: Iress Igraph

Considering the above, it seems that the answer is to stay invested and not react to wild fluctuations. It is better to stay invested than to attempt to predict the future and position in advance for uncertain events; i.e. we cannot predict a stock market crash and therefore sell shares and “park” in cash, only to correctly identify the bottom of the market and then invest again. That’s the Holy Grail and no-one has discovered it yet.

“You will never reach your destination if you stop and throw stones at every dog that barks.” – Winston Churchill

But not every investor has the benefit of a long investment horizon and the ability to wait for a recovery in the stock market after it crashes or corrects. Nor do all investors have the stomach to sit through severe volatility. Some investors may require income form their investments and having to sell down capital at fire sale prices will lead to permanent capital loss.

The key is therefore to ensure that investment portfolios are effectively diversified, on a global basis, across asset classes like equities, fixed interest instruments (cash and bonds), listed property, alternative assets and commodities. It is crucial for investors to match their investment objectives, risk profile and specific circumstances to the most appropriate asset allocation. The allocation which will most likely result in the achievement of their investment objectives on a risk adjusted basis.