One month into the new year already! Christmas cheer is in the rear-view mirror and the tinsel in the local supermarket has been replaced with hearts and chocolates. 2022 has, so far, been anything but boring.

Top performers amongst Best Investment View for 2021

We are pleased with the performance of client portfolios over the course of 2021. The environment has been crowded with stretched valuations and we put a lot of focus into including holdings where we saw strong fundamentals and the potential for outperformance.

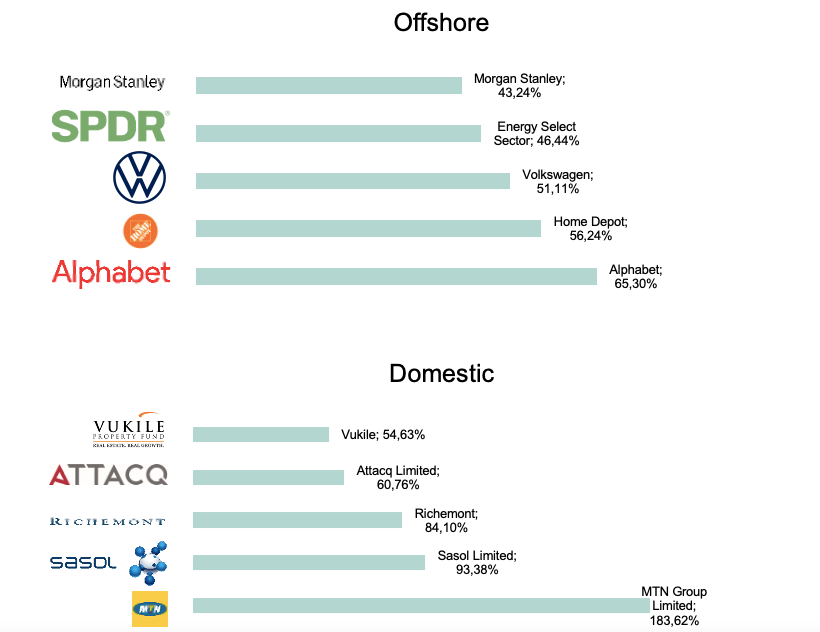

Our house-view Best Investment View portfolio, a balanced Regulation 28 compliant portfolio with a moderate risk profile, performed well. The portfolio generated a return of 21.23% for the year, versus 17.80% for its benchmark. The top 5 offshore and domestic performers for 2021 (purely on capital return, in constant currency) are shown below.

January in review

Microsoft to purchase Activision Blizzard

Activision has been a long-term counter within client portfolios. The interactive content and services developer and publisher who owns globally renowned names, such as Call of Duty and Candy Crush, has been in our offshore portfolio for some time due to its market leading brands within gaming. On the 18th of January, Microsoft announced its plan to purchase the company for a total of USD 68.7 bn, putting the per share value at USD 95. The share was trading at USD 65.39 before the announcement and closed the day up 25.88% at USD 82.31 on the news.

The rationale for Microsoft is that it will accelerate the growth of their gaming business across mobile, PC, console and cloud and will provide a foundation for the “metaverse” (a virtual reality where individuals can interact). The purchase additionally provides Microsoft with a franchise of popular games to add to its Xbox consoles. The purchase will result in Microsoft becoming the world’s third-largest gaming company by revenue, behind Tencent and Sony. The deal is expected to close mid-2023, but a lot still has to happen between now and then.

The deal still needs to receive approval from regulators, who have been cracking down on tech companies, as well as shareholders, who may be reluctant to settle for the offer price.

Global financial companies’ earnings

The year started off with earnings announcements from major financial companies for the quarter ending December 2021. Amongst most companies, it was evident that increased compensation for employees had taken a toll. Goldman Sachs saw a 23% surge in operating costs, Citigroup 18%, JP Morgan 11% and Bank of America 6%. These companies have also seen better-than-expected defaults which has resulted in the release of reserves. JP Morgan released USD 1.8 billion, Wells Fargo USD 875 million and Bank of America USD 851 million in reserves for the quarter.

Increasing interest rates should benefit those banks with more retail exposure, such as JP Morgan, Bank of America, Citigroup and Wells Fargo, as investment revenue and trading profits come under pressure.

Turmoil in the Ukraine

Ukraine has been independent since the dissolution of the Soviet Union at the end of the Cold War in 1991. Despite its independence, Ukraine has continued to be a target of the Kremlin since the early 2000s, with Vladimir Putin trying to prohibit Westernisation of the region in fear of its impact on his authoritarian rule within Russia. This month I take a look at the history between these two nations and some of the more recent tensions within the region and what they could mean for the global economy.

Fed Update

With markets taking a negative turn, many speculated on what the Fed would do amidst all the volatility spurred by uncertainty around interest rate hikes, quantitative tapering, inflation and conflict in the East. Focus was on whether interest rate hikes would start sooner rather than the previously anticipated March, given the 7% inflation level in December 2021. The Fed met from 25 January, when indices were already significantly down for the year (Dow Jones down 5.43%, S&P 500 down 7.47% and Nasdaq down 11.44%) and reported on their FOMC meeting on the 27th of January. In contrast to the start of the week, markets started the day off positive, but took a turn once Fed Chair Jerome Powell started his address. The meeting confirmed that the Fed will start raising rates and quantitative tapering in March, as well as discussions around reducing their balance sheet. The market had initially anticipated 3-4 rate hikes of 0,25% each during this hiking cycle, but post the meeting priced in 4-5.

“This is going to be a year in which we move steadily away from the very highly accommodative monetary policy that we put in place to deal with the economic effects of the pandemic.” – Powell

MPC Meeting

Back at home, the MPC met on 27 January for their first scheduled meeting of the year. The SARB Global GDP forecast for 2022 came in at 4.4%, reducing to 3.3% for 2023. South African GDP growth is expected to be 1.7% in 2022, 1.8% in 2023 and 2.0% in 2024. The decline is attributed to the expected stabilisation of economies post the pandemic rebound along with a reduction in high export prices. Looking at the current account deficit, the committee anticipates it will be smaller than previously expected. Inflation remains high and a point of concern. Fuel price inflation and electricity price inflation have been revised upward to 13.7% (from 4.6%) and 14.5% (from 14.4%) respectively. On this backdrop, the MPC decided to increase the repurchase rate by 25 basis points to 4%, effective from 28 January.

2022 has started off on a turbulent note, with uncertainty leading to large intraday swings and volatility at levels last seen in October of 2020. High inflation and anticipated shifts in monetary policy, as well as potential disruptions to energy caused by geopolitical tension, have contributed to the instability of asset prices. We remain focused on our investment strategy and proven portfolio construction principles to ensure that we remain well diversified and invested in shares of high quality blue-chip companies. It is essential to remain focussed on the long-term, despite the uncertainty and volatility experienced in the short-term.