Many years ago, I encountered a thought experiment that had a marked impact on my approach to strategy. It is not overly technical, with some valuable lessons that can be applied to investment management.

The experiment takes place on a gameshow where the participant stands a chance of winning a prize. The participant first decides between three options; as the participant progresses to the next round, they must simply decide to stick-to or change from their initial choice. Casually, I refer to it as “Stick or Change”.

Gameshow: Stick or Change

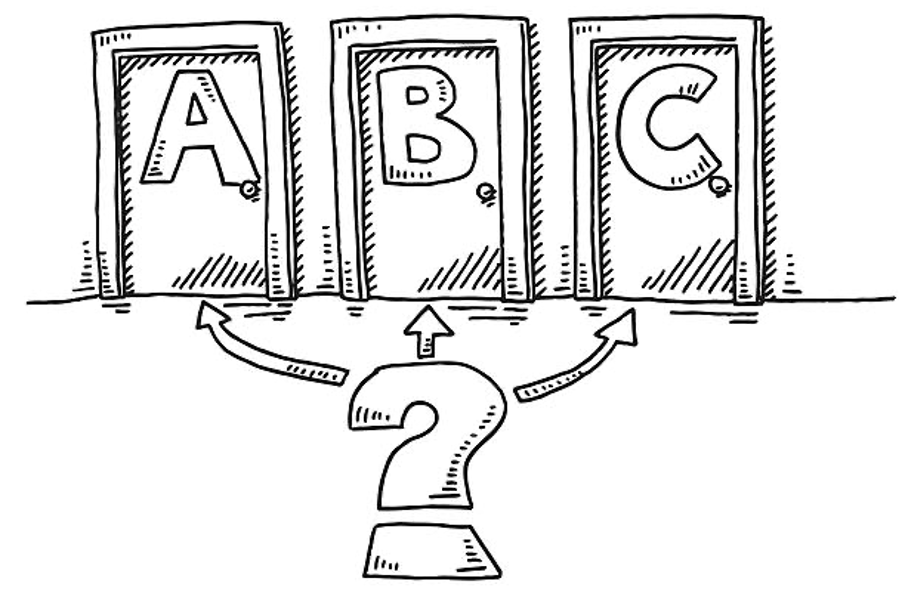

There are three doors on the gameshow stage:

Behind one of the doors there is a grand prize, say a car.

You have to guess the correct door. After your first guess, the host will open one of the remaining two doors. The door will confirm one incorrect option. You will now have the opportunity to change your guess to the remaining door. Do you stick or change?

If we conceptualised the game with an example:

As the contestant, you choose a door. Let’s say you choose door A.

Next, the gameshow host opens one of the doors that you did not choose and does not contain the prize (either door B or C), let’s say it is B.

Now the question:

Do you stick to door A or change your initial guess to C?

Choose a strategy before you continue…

Form having run this little thought experiment with many people over the years I have found that most people tend to stick to their initial guess.

Why? They usually argue that you start with a 33% probability (the car is behind one of three doors). Your probability of winning stays the same, so you might as well stick with your initial guess.

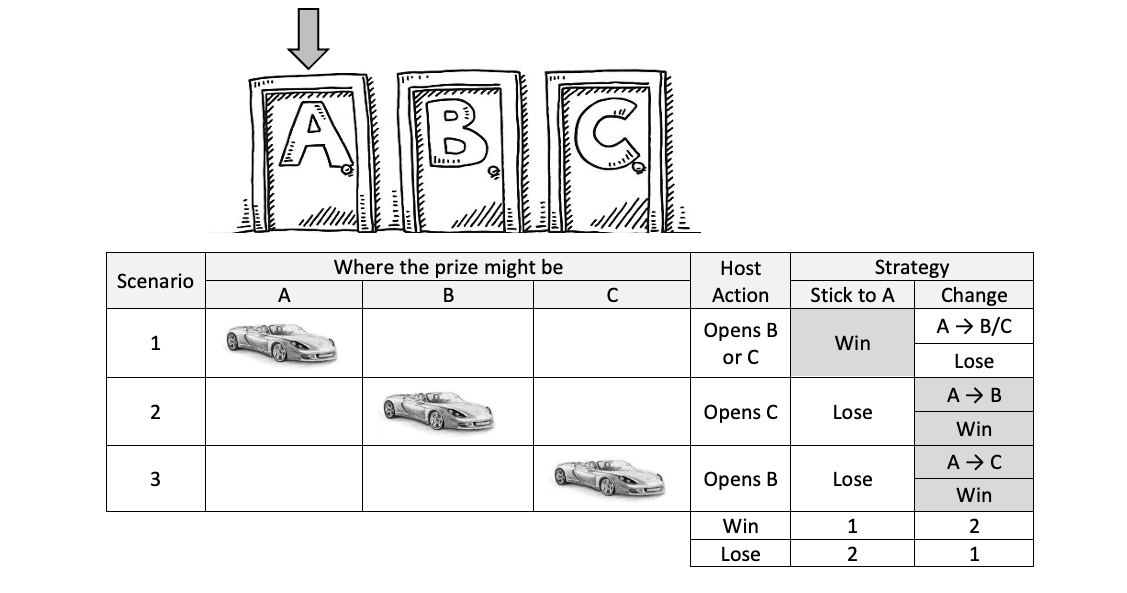

Is this true? Let’s investigate. Below we will track the performance of both strategies under the various cases of where the prize might be. Initially we choose door A.

As can be seen from the table above, if your strategy is to stick, you’ll win on average once out of every three rounds (33%). If you however change, you’ll win on average twice out of every three rounds (66%).

Effectively you double your chances of winning by adopting a strategy of changing your initial guess.

The significant difference in the success of the two strategies is that if you stick to your initial guess, you ignore the new information that became available halfway through the game.

What can we learn from this experiment and potentially apply to investing?

- Initial snap judgements are not always accurate when used to formulate strategies;

- If new information is presented, it needs to be considered; and

- Although not always easy, consider the potential outcome of your strategy under different scenarios.

At Pyxis Investment Management we continuously scrutinise our strategies and work at incorporating new information into our investment views, where the situation has changed or new information has become available. Although we are not active traders, but rather long-term investment managers, we are active thinkers and attempt to pre-empt scenarios – no matter how far fetched they may appear.

ABOUT THE AUTHOR:

Henk Myburgh, CFA®- Head of Research

After completing a BCom Econometrics and MSc in Quantitative Risk Management at the North-West University, Henk Myburgh (CFA), started his career in financial risk management at HSBC. He also worked at Sanlam Capital Markets, where his focus was on consolidation of financial risk across the firm and management of risk on a holistic basis. In 2018 he founded AlQuaTra, a quantitative private hedge fund.