Dirty energy, bright opportunity.

Our job as investment managers is to identify investment opportunities that offer excellent risk-adjusted returns over the medium- to long-term. We do not speculate or attempt to profit off popular, short-lived trends or fads in the hope of generating outsized returns. A short-term focus is often dependent on the expectation that there will be buyers, at higher prices, for the “investment” contemplated for inclusion in a portfolio. That is a risky strategy however and may turn out to be a shot in the dark – sometimes hitting the target and other times not, leading to inconsistent results (and often sizeable, permanent capital loss). Sometimes, it is worthwhile to look at out of favour investment themes in search for investment opportunities and sometimes, these opportunities lie hidden in plain sight for those who are willing to question contemporary wisdom.

In our view, the advent of ESG (Environmental, Social and Governance) Investing has created such an opportunity. ESG Investing promotes investing for the greater good and postulates that companies following ESG principles will deliver superior long-term financial performance. This, in turn, will lead to above average investment returns by investing in shares of companies that score high on ESG principles.

Source: Principles for Responsible Investment

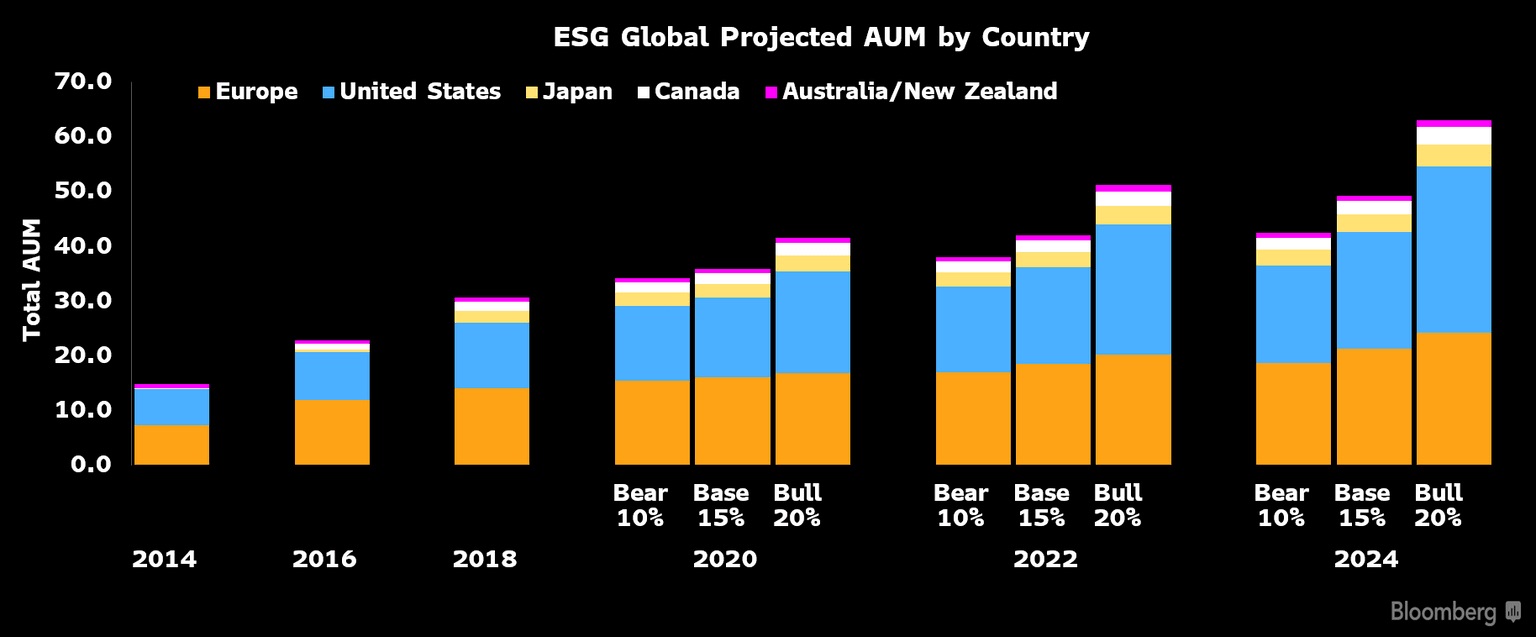

ESG Investing has grown exponentially over the last number of years, as investors (according to some research, notably younger generations), have sought to not only pursue investment returns, but also to put their money where their values are. At the beginning of 2020, according to the US SIF Foundation (US Forum for Sustainable and Responsible Investment), US investors held US$ 17 trillion of investments selected based on ESG criteria. According to Bloomberg Intelligence, by 2025, roughly a 3rd of global Assets Under Management will be represented by ESG strategies.

Source: Bloomberg Intelligence

These are truly astounding numbers.

Our objective is not to contemplate the merits of ESG Investing, but rather to note some serious criticisms directed at this trend. Robert Armstrong, the Financial Times’ US finance editor, has been questioning the ESG Investing philosophy, principles and (claimed) superior investment returns for some time. More remarkable was Tariq Fancy’s “The Fairytale of sustainable investing” op-ed, in which he wrote that “the financial services industry is duping the American public with pro-environment, sustainable investing practices.” In addition, the former BlackRock CIO of sustainable investing stated, in a CNBC exclusive, that there is no evidence that ESG investing has any social impact.

The jury is out on whether there are any benefits like enhanced investment returns or social impact from applying ESG criteria when making investment decisions. However, we believe there is more value in assessing how this ESG Investing trend has influenced investment markets as that is where the opportunities may present themselves.

As the proposition of ESG Investing is to create a win-win scenario, where the environment and capitalism wins, it could be argued that the goal of the ESG movement is to push investors away from “bad/wicked” investments into “good/virtuous” investments.

One group of shares that have scored well on ESG factors included the likes of Apple, Amazon, Microsoft, Facebook, Google and Tesla. These companies get high ESG ratings because they are low producers of greenhouse gas emissions (notwithstanding the fact that they are monopolies, employ poor labour practices, allow hate speech and misinformation on their platforms). Considering the sheer amount of capital invested in ESG products, the massive capital flow into them (ESG products receive approximately 25% of inflows into investment funds in the US), it is clear that these companies’ shares are receiving massive support. The ESG “capital tsunami” into these shares may explain, to an extent, their strong performance despite already stretched valuations. The exceptional performance delivered by this “virtuous” group of shares may well have a lot to do with the good performance delivered by ESG Investing and not necessarily the ESG factors… Do you spot the vicious circle?

This brings us to one of the opportunities brought along by the ESG Investing trend – the “bad/wicked” investments which have been shunned by investors with good intentions for the environment and sustainability; “dirty” energy and anything related to it, now being ignored like an uncle in jail. As carbon based energy sources, like coal and oil, are bad for the environment (as a result of exploration, extraction, transport, storage and the obvious carbon footprint ito greenhouse gases), companies involved in these industries rank poorly on ESG factors. These companies’ shares are not deemed appropriate for investment by the very large ESG sector of the investment world. The impact on energy investments are three-fold:

- Investors generally do not deploy funds to investments in the “dirty” energy sector;

- Outflows from these investments occur as funds are redirected to “good” investments; and

- Investment banks do not make capital required for expansion and growth available to companies operating in this space

The first two points may cause the share prices of companies operating in this “bad” oil and coal world to fall, as capital outflow (selling activity) drives down prices. In addition, companies in this space become neglected and under owned as the general investment public do not pay attention to these companies. But at some point the valuation of these companies’ share prices become too cheap or significantly undervalued, despite their healthy cash generation abilities (and dividends). The impact of the 3rd point is that companies operating in this space find it increasingly difficult to raise capital in order to fund exploration for and exploitation of new coal or oil resources. The result of capital scarcity will ultimately reflect in resource scarcity. Should demand for these resources remain stable or grow, their prices should rise, resulting in increased profits, returns to shareholders and eventually rising share prices.

The question then becomes one of what is in store for future demand for oil and coal. Despite the increased efforts by the world to become less dependent on fossil fuels, it will take many years to become carbon neutral by rotating the globe’s energy usage form fossil fuels to green energy like wind or solar energy (if ever…). There are a number of reasons for this. Firstly, global population growth and increased demand for energy as the rate of urbanisation increases means that the demand for energy is growing at a faster pace than supply of fossil and green energy combined. Secondly, and very importantly, is the inferior energy density levels of green energy compared to coal, oil, and natural gas. Follow the link for a presentation on this subject from one of the world’s leading energy experts, Professor Vaclav Smil, on the topic of energy transition – truly illuminating presentation.

We believe that oil, gas and oil services companies offer excellent potential for superior long-term investment returns. These companies’ shares are offering good value while there is great potential for already healthy cash generation abilities to improve even further. These companies have done a lot of hard work since 2008 (post the oil price decline from above US$ 140 to US$ 20 per barrel) to repair their balance sheets and become more efficient. Despite the increased activity in the green energy space, the capital scarcity caused by the ESG Investment trend (energy companies have been struggling to get access to capital since 2009) will lead to slower energy supply growth compared with demand, which will lead to higher energy prices over time.

Our “Houseview” portfolio, which our client portfolios are based on, has been exposed to the global energy sector for some time via various instruments, such as: Sasol; the SPDR Energy ETF (an offshore exchange traded fund); MPLX (an offshore income oriented energy ETF); and Royal Dutch Shell. These investments have delivered satisfactory returns to date. We will be adding additional exposure to the global energy sector in due course as we believe these investments offer better investment potential, especially compared to some of the very popular and expensive sectors like e-Commerce and Information Technology.