As we slowly inch towards year end and quietly amongst ourselves hope for a relaxed festive season, economic and market developments are certainly cause for much excitement. November was all but a quiet month: rate hikes, a renomination at the Fed, Black (or should I say Red) Friday and a new variant of the Coronavirus; much to keep us focused.

What’s happening in Turkey?

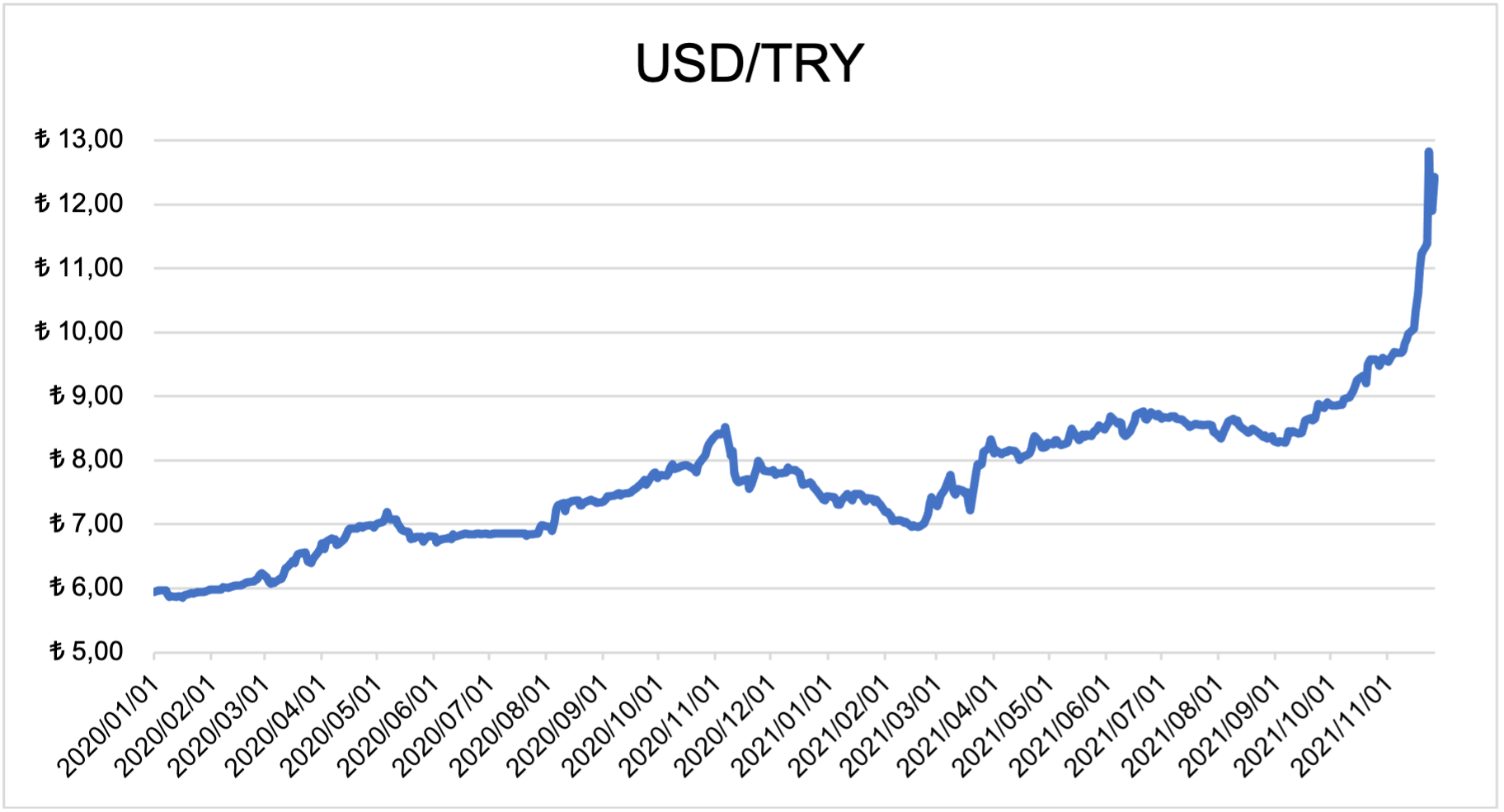

At a time when many countries face rising inflation and are raising interest rates, Turkey opted to cut rates, for the third consecutive month, at their November meeting. The reduction from 16% to 15%, follows a 2% cut in October – resulting in a real interest rate of -5%. Economic theory states that lower rates lead to increased economic growth, as consumers have more disposable income available. Improved economic growth, in turn, supports lower unemployment and higher exports, but likely cause higher inflation. Mainstream theory states that increasing interest rates can curb higher inflation by reducing consumers’ disposable income and forcing producers to lower or stabilise prices. Although Turkish President Erdogan believes that lower rates lead to increased economic growth, which supports lower unemployment and higher exports, he opposes economic theory when it comes to interest rates. He believes that higher interest rates increase inflation. Negative real rates have led to investors opting to invest their funds in other countries, and the Lira to lose value as a result of the outflow of funds. Turkish citizens have opposed the government’s policies in protests as they question their ability to manage policies in line with the country’s best interests. As investors flock to more attractive investment opportunities and Turks lose faith in their government, the deterioration of the Lira has been exacerbated.

The events in Turkey have highlighted the importance of appropriate monetary policy decisions and the implications that they can have on a country’s economy. Back home, the South African Reserve Bank’s Monetary Policy Committee met on 18 November 2021. Prior to the MPC meeting, it was uncertain whether the committee would raise rates or not. Although raising rates was in line with the majority of other countries’ decisions and the obvious move with rising inflation, it restricts GDP growth – which has already been constrained by restrictions imposed due to the Coronavirus, supply chain disruptions and unreliable utilities. The committee had a difficult decision to make under these circumstances, but once again, acted in accordance with their mandate of maintaining price stability and decided to raise rates by 0.25%. Was it not for the independence and consistency of the SARB over the years, our already struggling Rand may have been much weaker, à la the Turkish Lira.

Powell stands for another term

Many speculated that Lael Brainard would be nominated as the new Fed Chair, replacing Jerome Powell and taking office next February. Brainard has similar views to Powell when it comes to maintaining an average of 2% inflation, the transitory nature of inflation and full employment. Powell and Brainard’s opinions on wealth inequality however differ.

Source: The Global Herald

While Powell believes the Fed has few tools to address wealth inequality in the short term, Brainard believes that the Fed could do more to reduce wealth inequality and should do so. Through monetary policy and the implementation of the Community Reinvestment Act, she believes that this can be effectively addressed. Powell was however nominated for another term as Chair of the Federal Reserve, with Brainard being nominated as Vice Chair. Markets’ initial reaction was positive as shares rose on the back of the news. The dollar strengthened alongside an increase in treasury yields. The renomination of Powell is indicative of a continuation of current policies. Many expect the Fed to continue on their current trajectory when it comes to tapering and increasing interest rates. It will be interesting to see however if Brainard’s concern over wealth equality could lead to an accelerated timeline and less concern for the impact of monetary policy on Wall Street.

Black Friday

The two main concerns going into the Thanksgiving weekend were supply shortages and inflation. Little did we know that a new variant of Covid would rear its head, only to bring on concern that the holiday season may not be as festive…

Supply chain shortages have been seen across the globe. Everyday consumer products have been in dwindling supply. The shortages stem from the disruptions during global lockdowns, as a result of the pandemic. As non-essential factories were forced to close and global shipping was halted, consumers (stuck at home with little to do) continued to purchase goods. In fact, many found themselves with excess money due to limited travel and entertainment expenses, so they spent more than usual on a dwindling supply of goods. Ever since markets reopened, it has been a game of catch up to try and regain prior stock levels. Not only was there backlog at manufacturing plants, but producers additionally had to take a step back when it came to transporting their goods as PPE took preference. These supply shortages have led to many products being in limited supply as consumers embark on their holiday shopping trips, if available at all. Limited supply can only mean one thing – higher prices.

Many flocked home in the US for the Thanksgiving weekend. Over 2.3 million people were recorded travelling from airports across America on Wednesday the 24th of November, while the estimated number of people to be travelling by car amounted to 48.3 million (travelling 50 miles or more). With oil trending higher at the time, similarly on the back of shortages, President Biden announced on 23 November that the Department of Energy would release an additional 2 days’ worth of oil supply, 50 million barrels, from the Strategic Petroleum Reserve. The increased supply was aimed at “lower(ing) prices for Americans and address(ing) the mismatch between demand exiting the pandemic and supply” (The White House).

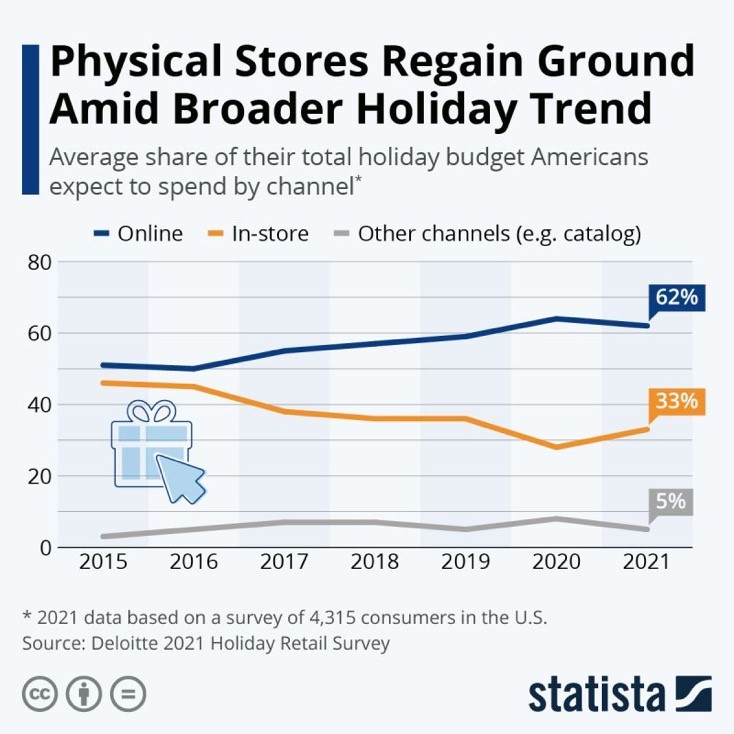

According to the National Retail Federation, it is estimated that US consumers will spend approximately USD 997.73 on average on holiday sales during November and December. Despite rising inflation, consumers have been eager to get a head start on their holiday shopping with supply chain shortages front of mind. The number of people who intend on shopping in physical stores is up from 28% last year to 33% this year. It seems as though they are not leaving the availability of their gift of choice up to chance with delayed deliveries or supply running short.

Although it was a shortened trading day in the US, markets went haywire as the news of a new Covid variant (discovered in SA) captured headlines across the world. Most nations placed travel restrictions back on SA and everyone back home started to panic about their year end travel plans. This variant of the virus contains a larger number of mutations, leading to increased antibody resistance. Globally there has been concern on whether this variant poses a risk to the effectiveness of vaccines which have been rolled out to date. As the trading day progressed, it was nothing but red on the screen. Investors flocked to safe haven assets, bonds and gold, as equities across sectors came under pressure. Oil fell over 10% to under USD 70 a barrel and the Rand reached as high as R16.37 to the dollar. The Dow Jones closed 2.5% lower, it’s worst day this year so far; while the S&P 500 and Nasdaq lost 2.3% and 2.2% respectively.

Omicron

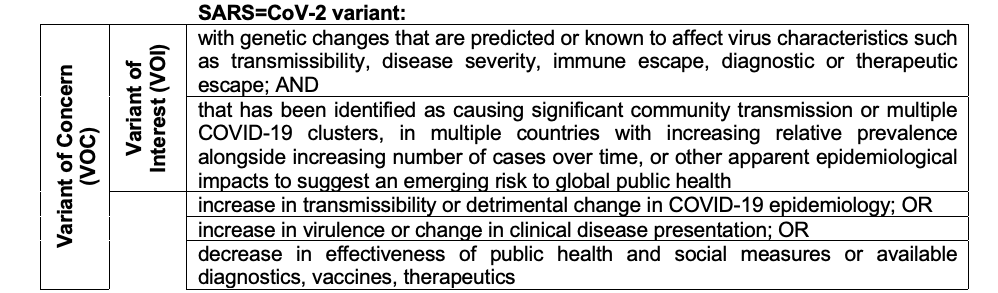

The World Health Organisation met to discuss the new variant which they have termed Omicron. Omicron has been categorised as a Variant of Concern, meaning that it exhibits the characteristics of a Variant of Interest, as well as one or more of the properties of a Variant of Concern. Omicron’s classification was based on the fact that there has been a detrimental change in the Covid-19 epidemiology.

Source: World Health Org.

As the Northern hemisphere was already struggling with increased infection rates, the detection of a new variant introduces more uncertainty. As uncertainty is heightened, market volatility increases and additional pressure is placed on a global economy, which has not yet recovered from previous lockdowns. Supply chain shortages and logistical challenges will continue for longer and be more onerous to rectify, leading to a continuation of rising inflation. We are already trying to catch up and this is another hurdle standing in the way.