The exuberance continues…

As I sat down to write this month’s newsletter, my eye caught a headline about the share price of Avis, a car and truck rental company, shooting through the roof (see the chart below). Avis’ share price closed at approximately USD 171 on the 1st of November. On the 2nd of November, after the company released its financial results for the third quarter of 2021, the share price shot up to USD 545. The share price has fallen back to around USD 360, still more than 100% up on the day. The company’s financial performance in the quarter was not bad at all, with revenue increasing by approximately 90%, keeping in mind that the comparative revenue in the 2020 quarter was negatively impacted by the Covid lockdowns, and since then economies have opened up and people have become “mobile” again. It is said that retail investors are again the cause of this extreme move in the share price (remember the Gamestop saga?). Avis shares have also been heavily “shorted” and as a wave of retail investors are buying the share, it forces the “short sellers” to close their short positions by buying shares, thereby pushing the share price even higher – its called a “short squeeze” amongst traders.

Source: Koyfin

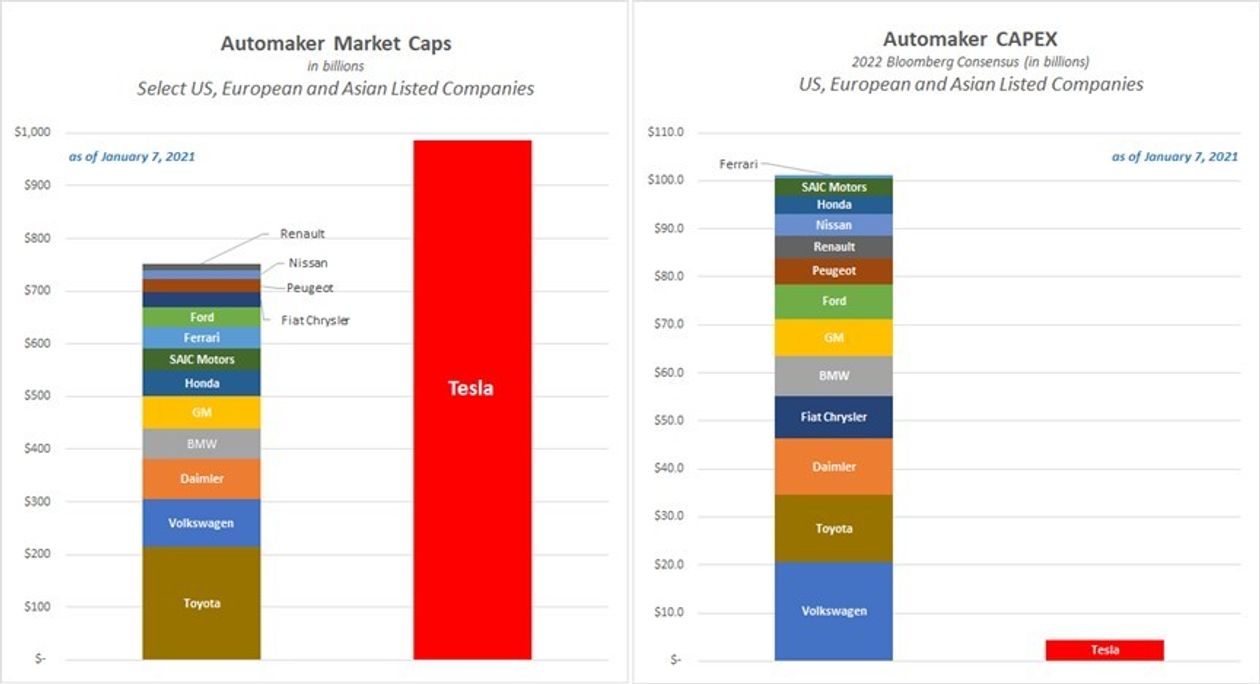

Another amazing story of the last few days was Hertz (another car rental company) announcing that they have ordered 100 000 Tesla electric vehicles for its fleet. Although Elon Musk announced that no deal has been signed yet, Hertz’s share price is up approximately 60% since mid-October. Tesla’s share price has also increased by approximately 50% since the start of October, see the chart below. To put things into perspective: Tesla’s market capitalisation is equal to almost ALL the major automakers. That would not have been unusual if Tesla actually generated equivalent revenue or sold a comparative amount of cars at comparable margins.

Source: Albert Bridge Capital

Onto Cryptos…

The latest Crypto Craze is a coin called Shiba Inu. The value of this coin increased by, wait for it, 94 million percent over the last year (according to Crypto platform Coinbase)! I don’t know if anyone actually invested at the start when the coin was launched and remained invested? If they did, I wonder if they have the foresight to take profits at these levels.

My newsletter of last month also referenced a number of other interesting and noteworthy developments in financial markets. Are these signs of irrational investor behaviour and/or excessive speculation? I don’t quite know, but one certainly does not hear of these stories during the depths of a bear market.

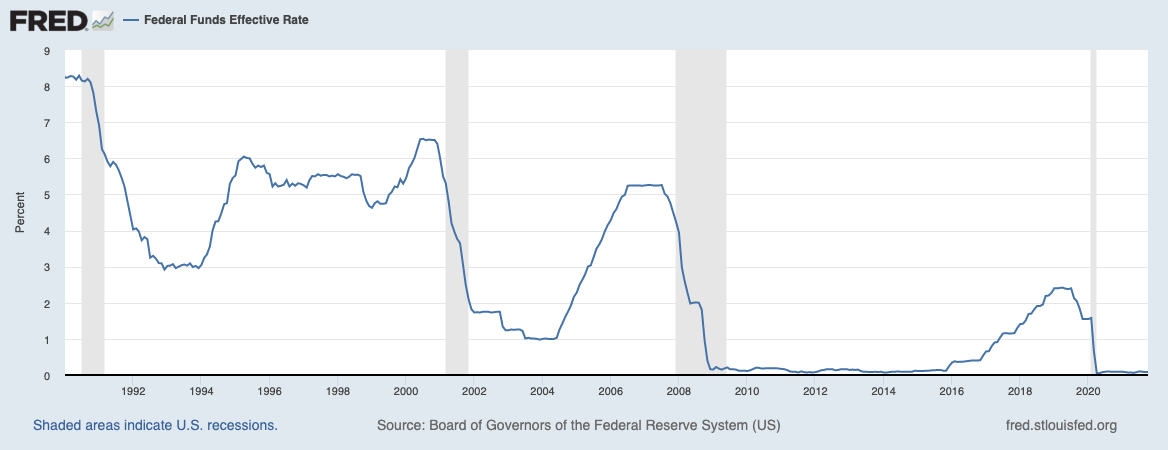

In previous newsletters, I have also written extensively about the current inflationary environment we are experiencing and what may have caused it. Extremely “loose” global monetary policy since 2008/9, Quantitative Easing and now Fiscal Policy have all had a huge role to play in increasing inflation worldwide. In addition, the tsunami of liquidity injected into capital markets as a result of these accommodative policies seems to be causing dislocations in the way that financial markets operate.

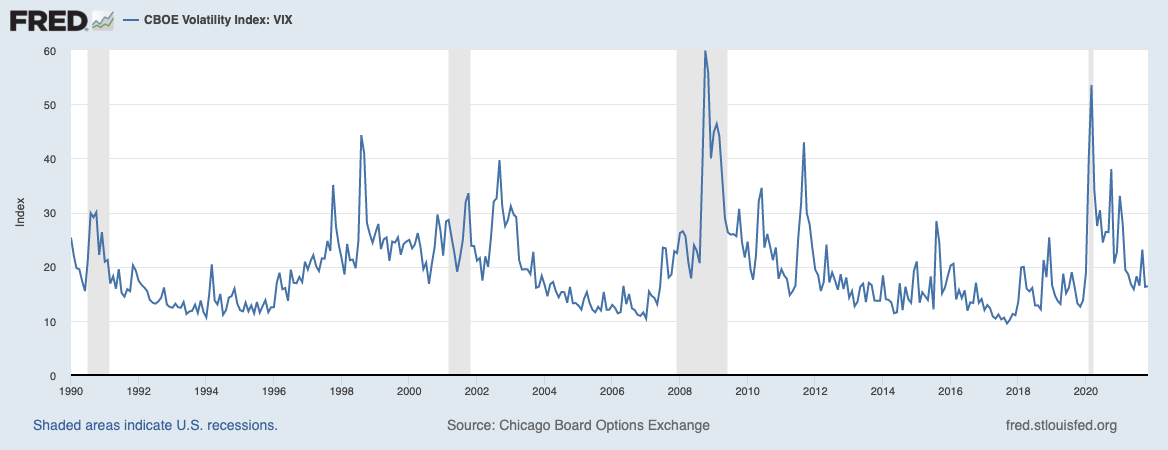

One way of evaluating this dislocation is to consider what market participants are saying or implying about the cost of protecting risky investments like equities. A widely used measure of expected risk or volatility is the CBOE Volatility Index (or “VIX” Index). The VIX index measures the expected 30-day volatility of the US S&P 500 Index. A low number means that the expected 30-day volatility and therefore the cost of insurance are low and vice versa (this is a VERY simplified explanation so the mathematicians out there be kind). See the chart of the VIX index below. Dare I ask if markets seem complacent?

Source: Chicago Board Options Exchange

Recent developments as far as global monetary policy is concerned are worth taking note of. The US Federal Reserve’s Federal Open Markets Committee (FOMC) indicated at their last meeting, in September, that Quantitative Easing would be phased out from November this year. This is a significant development in that the massive amounts of liquidity that have been pumped into the financial system will cease by mid-2022. It is also expected that at that time, interest rates (the Fed Funds rate), may be increased. The meeting minutes distributed after the September meeting indicated that the majority of the FOMC members are expecting rates to increase by more than what was anticipated at earlier meetings.

Source: Board of Governors of the Federal Reserve System (US)

While the debates are heating up with regards to the timing and speed of Quantitative Easing and interest rate increases in America, other nations have already started to act. The Bank of Canada ended their Quantitative Easing program last week Wednesday – no phasing out or tapering. In Australia, the Royal Bank of Australia terminated its “Yield Curve Control” program, causing short term interest rates to significantly increase. Brazil increased their policy interest rate by 1,5% last week and signalled another 1,5% increase by December. In South Africa, expectations are for at least 0,75% of interest rate increases within the next 6 months. Numerous other Central Banks have increased interest rates over the last six months.

While inflation and interest rates are on the increase, it appears as if global economic activity is slowing. The World Bank and International Monetary Fund have made several adjustments to expected economic activity levels over the next twelve months.

We are extremely cautious of expressing a strong opinion about the likelihood of an impending crisis, economic recession or market crash, as that would be akin to prophesizing and fear- mongering. We do not own a crystal ball. We do believe it is of value to contextualise the environment we find ourselves in:

- We have had years of low interest rates globally

- Massive liquidity injections into global economies by central banks over the last decade

- A glut of cheap money may have distorted asset price discovery in certain shares, asset classes or popular investments leading to asset price inflation

- It is possible that risk may be underpriced

- The global monetary environment is becoming more restrictive and liquidity is withdrawn (i.e. higher interest rates and QE tapering)

- Global economic growth may be under pressure over the next year

- A case could be made that global capital markets are valued above fair value at present

- Evidence of speculative behaviour

I would like to emphasise again that we do not have the ability to forecast the future, but we believe that a more conservative stance at present is justified and prudent. Wide diversification across geographies, economic sectors, asset classes and different shares offer risk mitigation benefits. A focus on investment in shares of high quality multinational companies, with strong balance sheets and cash flow generation, is a strategy that has proven to aid in capital preservation. Valuation is also an important consideration, as appropriately valued investments tend to offer at least some level of protection against increased capital market volatility. Lastly, holding a responsible cash reserve in an investment portfolio also assists in de-risking while providing the means to take advantage of opportunities that might present themselves if a market correction should occur.

Best wishes

Bennie