We spend a lot of our time analysing, discussing and interpreting the markets – locally and abroad. Our investment process starts off with a daily morning meeting where we go through the daily market movements, read through all the previous day’s SENS announcements (announcements such as result releases, mergers, take-overs, rights offers, capital issues and cautionary statements), discuss and analyse company results and unpack macro-economic trends. From this process we identify macro-economic trends and/or investments (current or prospective) that we would like to research further.

The next step in the investment process is our weekly investment research meeting. Here each member of the team gets the opportunity to present and defend his or her investment case after research has been done on the topic(s) identified in the morning meetings. These interactive discussions allow us to delve deeper into potential investment themes and opportunities. It really puts the topic into perspective when you hear research from someone else’s viewpoint. The same topic regularly runs over to the next week, in order for the team to perform some additional research to back their thoughts and opinions.

We have recently performed an exercise on the real estate industry. I will broadly demonstrate the process we followed.

At our first meeting we debated the property sector as a whole and broadly had a look at the following key performance aspects of the sector:

- At the time, the sector was trading at a 28% discount to its net asset value. This refers to when the market price of the equity is trading below its net asset value (company’s total assets minus its total liabilities).

- The sector’s average loan to value improved to 42%, after peaking at 43% in June 2020, but remains elevated. (Long-term average of 33% (since 2005)). The loan to value refers to the relationship between the loan amount and the market value of the asset securing the loan.

- Portfolio vacancies (by GLA) increased to 8.5% from 6.3% year on year, with all sectors reporting an increase in vacancies year on year. Retail to 5.1% from 4.2%, office space to 16.1% from 12.2%, industrial to 6.1% from 4.4% and other to 11.1% from 7%. The view was that there was downside risk to vacancies over the near to medium term, especially in the office space segment.

- Dividends/distributions expected to be 22% to 30% lower than the 2019 financial year.

- The South African REIT sector provided total rental relief of R3bn since the start of the pandemic, comprising of 82% in discounts and 18% in deferrals. This represented 6.2% of 12-month rolling rentals, implying an average of 0.7 months’ rent free over the period.

From the above we identified the following downside risks:

- A rise in vacancies (High vacancy rates indicates that a property is not renting well)

- Shorter lease terms (A short lease term is risky for the lessor, could lead to increase vacancies)

- Lower escalations (Lower escalations in rentals to retain current lessees)

- Above average cost growth (Unable to increase rentals to absorb the increase in property taxes, maintenance and general expenses)

- Higher amortised costs from providing tenant incentives (Lessors provide tenant incentives to retain current lessees)

Each member of the team then identified two listed property companies that they felt had potential to mitigate the above risks and in turn deliver attractive yields and profitable investment results in the future.

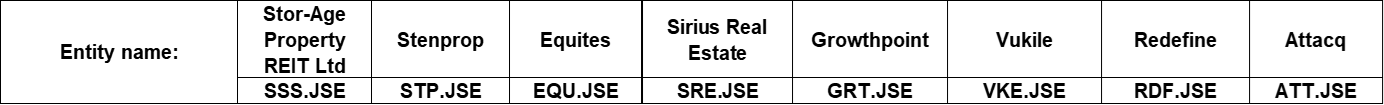

We identified the following eight companies to do some further research on:

We looked at various financial ratios, sector exposures, geographical exposures, vacancy rates, escalation rates, stock performance and various qualitative aspects. These factors were combined and used to design a rating system to facilitate the comparison of the 8 property companies identified.

Four property companies were identified for possible investment:

Stor-Age Property REIT Ltd

Stor-Age is the leading and largest self-storage property fund and brand in South Africa, as well as the first and only self-storage Real Estate Investment Trust (REIT) listed on any emerging market exchange. The South African portfolio comprises of 52 properties. In the United Kingdom, Stor-Age owns a 97.6% majority interest in Storage King, comprising of 22 properties. Stor-Age operates in a recession-resilient sector; self-storage is a niche asset class uncorrelated to traditional property drivers.

Stenprop Ltd

Stenprop is a UK REIT listed on the Specialist Fund Segment of the London Stock Exchange (‘LSE’) and the Johannesburg Stock Exchange (‘JSE’). The REIT specialises in the ownership and operation of UK multi-let industrial (MLI) property. They have over 1,100 unique customers, owning 95 properties and have an 80% customer retention rate.

Equites Property Fund Ltd.

Equites established itself as a market leader in the logistics property space. The group has curated a high-quality portfolio across South Africa and the United Kingdom, with focus on assets that are modern, well-located, and tenanted by A-grade users on long-dated leases. The Group is the only listed property entity on the JSE to provide shareholders with pure exposure to prime logistics assets and currently has 64 properties under their management.

Sirius Real Estate Ltd.

Sirius Real Estate is a leading owner and operator of business parks, offices and industrial complexes in Germany, providing flexible and conventional workspace to companies. The Company derives value through the execution of a stringent acquisitions process, followed by selective capital investment and the roll out of an intensive asset management plan which focuses on transforming vacant and sub-optimal space into high-quality conventional and flexible workspace. Once assets have been fully transformed, some are held for their stable income and some are recycled into opportunistic assets with value-add potential. Sirius only operates in Germany. The German economy is the largest in Europe and is characterised by strong GDP growth, low unemployment and high levels of investment and consumer spending.

It is fascinating to note that all four of the companies that came up at the top of our list have one thing in common – a niche service offering. Stor-Age only focusses on delivering storage services; Stenprop only focusses on multi-let industrial properties; Equites only focusses on prime logistics assets and Sirius has a unique strategy, namely to acquire underperforming industrial space, fixing it up and flipping it for a profit.

We’ve identified four fantastic companies, but one did stand out from the rest – Equites Property Fund Ltd. The below factors added to an attractive investment case for Equites:

- A healthy debt profile. (Low loan to value, low net gearing ratio, favourable debt maturity profile and favourable cost of capital rates)

- Strong historical growth in revenue and operating income, which should continue in the future.

- A consistently high occupancy rate (almost 100%).

- Triple net lease basis. (Lease agreement on a property, whereby the tenant or lessee promises to pay all the expenses of the property)

- Strong historical growth in distributable earnings and dividend per share.

- Strong historical growth in Cash from Operations.

- Trading at below average premiums to net asset value.

- Very strong, blue chip customer base.

- Attractive geographical split between South Africa and the United Kingdom.

- High dividend yield and historical track record of dividend growth (current dividend yield of 8.22%; compound annual growth rate of 9% for dividends over the last 4 years).

- We believe that there is potential upside to Equites net asset value from positive revaluation of its UK portfolio.

- Equites had minimally been impacted by the recent South African riots/lootings.

If we think back at the five initial risks identified, Equites was able to mitigate all of them. They managed to decrease their vacancy rates, enter into longer lease terms (average of 15.3 years), had a 6.4% lease escalation, operate on a triple net lease basis (therefore keeping their costs low) and provided below average tenant incentives because of their blue-chip customer base.

We believe that Equites is a well-managed property company with great prospects for the future.

ABOUT THE AUTHOR:

Heinrich van der Merwe, CA(SA)

Heinrich van der Merwe, CA(SA), completed his articles at PricewaterhouseCoopers (Johannesburg) where he gained exposure to a wide range of industries; mining services (Gold, Iron Ore & Coal), security services, renewable energy, construction and healthcare services, with exposure to listed and privately-owned companies. This was followed by a five-month short-term assignment with PwC Sweden and PwC Canada.

1 Comment

Comments are closed.