Dischem

Bennie’s domestic pick

Dischem is a leading retail pharmacy group operating in South Africa as well as Namibia and Botswana. Dischem’s core business is focused on a “big box” retail pharmacy offering, supported by ancillary services like their wellness and clinics offering, a courier business, loyalty programme and an e-commerce platform. The group follows a pharmacy first approach, meaning a dispensary forms the backbone of each and every Dischem store. The retail front store offers personal care and beauty, healthcare and nutrition, baby care and other products. Dischem also operates a wholesale division that supplies mainly Dischem pharmacies, but also some third party businesses. Dischem listed on the JSE on the 18th of November 2016 and at the time had just over 100 stores countrywide (with a bias to Gauteng). the company’s growth strategy was to double the store footprint within a period of 5 to 8 years. As of 31 August 2020, Dischem had 182 stores, with a planned 10 new stores in the 2nd half of the 2021 financial year, thus just about reaching their objective within 5 years. Post the listing, the founders still own a majority stake in the business while the management team own approximately 20%. Dischem is therefore still an owner-managed business.

Dischem’s growth strategy is based mainly on the following aspects:

- Increasing footprint;

- Driving innovation (Dischem direct, clinics, e-commerce);

- Driving revenue, margins and market share via efficiencies and driving the value offering strategy; and

- An integrated supply chain

Dischem recently announced a number of corporate transactions which will assist in their growth drive:

- Finalising the acquisition of Baby City;

- Acquisition of Medicare, a group of 50 pharmacies that operates in geographies where Dischem is under-represented. Dischem and Medicare both strive to offer an integrated, value for money, one-stop offering and there are many synergies between the two businesses;

- Acquisition of Healthforce, a software company offering solutions for clinic management, system capabilities and a telemedicine capability – linking patients with nurses via video call and access to an on-demand doctor network. This business offers exceptional potential, as was proven over the COVID period; and

- Acquisition of 25% of Kaelo, a healthcare business offering health insurance, managed care and clinics.

It is expected that these businesses will lead to efficiency gains on many levels once integrated into the Dischem business. In addition, macro-economic tailwinds like an ageing population, growth of the middle class, increased urbanisation and a quest for convenience, may also be supportive of growth. An owner-managed culture is also seen as a positive factor. Lastly, being an essential services provider, Dischem has a defensive business profile, for the year ended 31 August 2020, revenue grew by 8,1% and operating profit by 3,1%, despite the impact of COVID and Lockdowns.

Dischem came to the market at approximately R 23 per share. The share price rose to approximately R 37 in April 2018 and since then steadily declined to around R21 currently. Although still not cheap on a PE ratio basis (Dischem is trading on a 27 times historical earnings multiple), there seem to be supportive factors that may drive growth into the medium- to long-term.

Beyond Meat

Bennie’s offshore pick

What if I told you you could improve your health, make a positive impact on climate change, help address global resource constraints and improve animal welfare – all while sinking your teeth into a delicious and juicy burger?

Well, there is a way to do all of the above, by trying a burger patty made from plant-based protein. “Probably tastes awful,” I expect would be the response. Go see for yourself, go have a Beyond Burger next time you visit Woolworths. In fact, order a meat burger as well as the Beyond Burger. You probably would not be able to differentiate the two by looks, texture, smell or taste.

Beyond Meat is a food company that manufactures, markets, and sells plant-based meat products in the United States and internationally. The company sells its products through grocery, mass merchandiser, club and convenience stores, natural retailer channels, direct to consumer, restaurants, food service outlets, and schools. Beyond Meat utilises proprietary science to redefine meat and aim to replicate animal meat’s principal components from plant proteins. Innovation is a key differentiator and sits at the core of the company. The company’s main objectives, apart from creating shareholder wealth and positive returns on capital, is to offer an alternative to animal meat that:

- Improves health – diet is a main contributing risk factor towards heart disease and cancer;

- Positively impact climate change – up to 50% of global greenhouse gas emissions is driven by livestock rearing;

- Address global resource constraints – 78% of agricultural land is used for livestock and 30% of water used in agriculture is used in animal production; and

- Improve animal welfare – the approximately 70 billion animals reared annually for food does have some negative aspects to it

The main factor that I believe favours the business model is that the global population is growing at a fast pace, while resources are not keeping pace with the demand placed on the earth’s natural systems. Furthermore, Beyond Meat has selected to play a disrupting role in a very lucrative market – the global meat category of food which has an annual size of $ 1,4 trillion.

Beyond Meat has been very successful in rolling out its range of products across a vast number of outlets, currently about 122 000 globally. Their products are stocked by world-leading companies such as Walmart, CostCo, Whole Foods, Target, TGI Fridays, Starbucks and Alibaba to name but a few. They are also making inroads into the fast-food market, an industry that has been under pressure over recent years because of the poor nutritional value of their products. Their products are being tested by YUM Brands in China who owns and operates the Kentucky, Pizza Hut and Taco Bell brands. They have also partnered with McDonald’s in developing a meat-free burger.

It appears as though Beyond Meat is indeed creating some inroads into the food market and that adoption rates are steadily improving. This is evident from the growth in sales numbers. Net revenue grew by 239% over the last 12 month reporting period and 53% year to date. But as with most innovative, high growth businesses that disrupt established markets, the path to profitability will be a bumpy one. Profitability will remain muted as the business reinvests, supports growth initiatives and continues to invest in research and development.

We believe Beyond Meat is a business with supportive tailwinds that is establishing itself as a leader in the market they operate in. This is a company one should invest in for the long-term to reap the true benefits of the strategy.

Pepkor

Ashley’s domestic pick

Although most of us know Pep Stores, Pepkor Holdings has exposure to furniture and appliances, as well as FinTech. The roots of Pepkor run deep with their first emergence in 1901 under the Bradlows brand. Since then, more brands have been added to the company’s portfolio, including Ackermans, Shoe City, Tekkie Town, Incredible Connection, HiFi Corporation, Rochester, Flash and Refinery (amongst others). The group aims to provide affordable quality products to consumers and has a presence in Africa, as well as Europe.

As the economy remains under pressure and consumers attempt to recover from the additional strain Covid has caused, Pepkor is well situated to benefit from a price-conscious consumer.

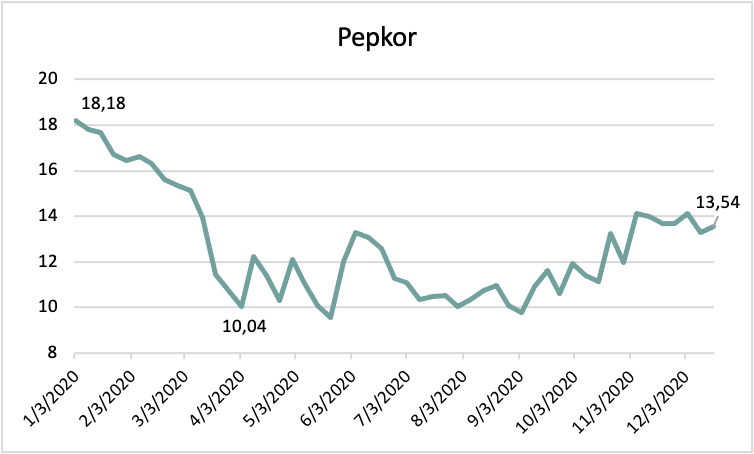

The company generates approximately R 70 billion in revenue per annum, the majority of which is in cash; and the balance sheet remains strong, with an interest coverage ratio of 5.4x. PPH started the year at R 18.18 per share, fell to R 10.04 in March, and currently sits at R 13.54.

PPH’s business model is well suited to benefit from a consumer who is cash conscious. The fact that they are mainly cash based, with a strong balance sheet and cash flows will stand them in good stead as we enter into the new year.

Realty Income

Ashley’s offshore pick

Realty Income has a USD 21 billion market cap, owns more than 6 500 properties throughout the US, Puerto Rico and the UK. The real estate company’s tenants operate across 51 industries and their freestanding buildings are located in areas of high visibility and easy access. Realty Income structures their leases as triple-net, meaning tenants are responsible for all operating expenses (ie: taxes, maintenance and insurance). This structure allows the company to have a more predictable income stream and be less impacted by increasing operational costs.

Rentals on existing leases are subject to regular increases, either as a fixed percentage, a variable percentage based on sales or a hybrid increase capped at CPI. The company has a strong tenant base, comprising of well-established retailers such as Walgreens, FedEx and Sainsbury’s. Contrary to many other real estate companies, Realty Income did not see a material increase in vacancies during the lockdown period and has maintained rent collections of over 93%.

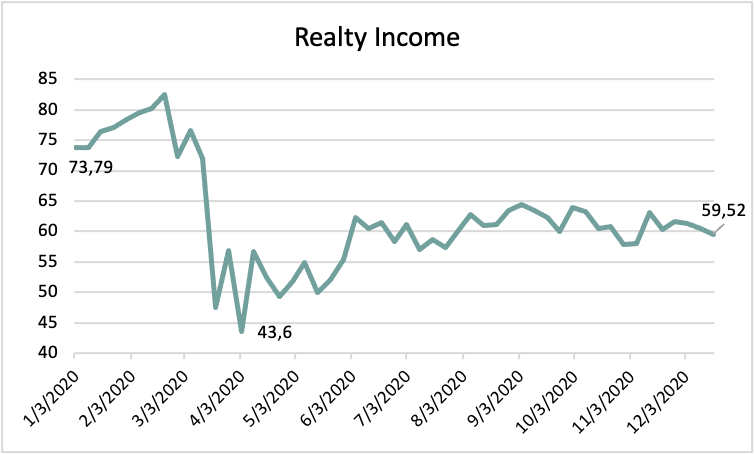

Although the share has seen an improvement of around 40% from its March lows, YTD the share remains approximately 18.8% down. The share yields approximately 4.71% (paid monthly) and has a historical annual dividend growth rate of 4.5%, making it a contender for income seeking investors as well as those focused on growth.