A simplistic explanation of the rise of inflation and its impact on savings and investments.

Ever heard of the saying “saving yourself into poverty”? It is usually spoken during discussions when comparing the virtues of saving versus investment. Investments are deemed to be risky, especially in the short-term and risk-averse investors may opt for safer options to deploy their funds to, like cash deposits or money market funds, but the one factor that is usually not considered is inflation and the impact that it has.

While you may sleep well considering that cash in the bank is “safe” and that a steady rate of interest is earned, there is a thief in the night slowly stealing from you.

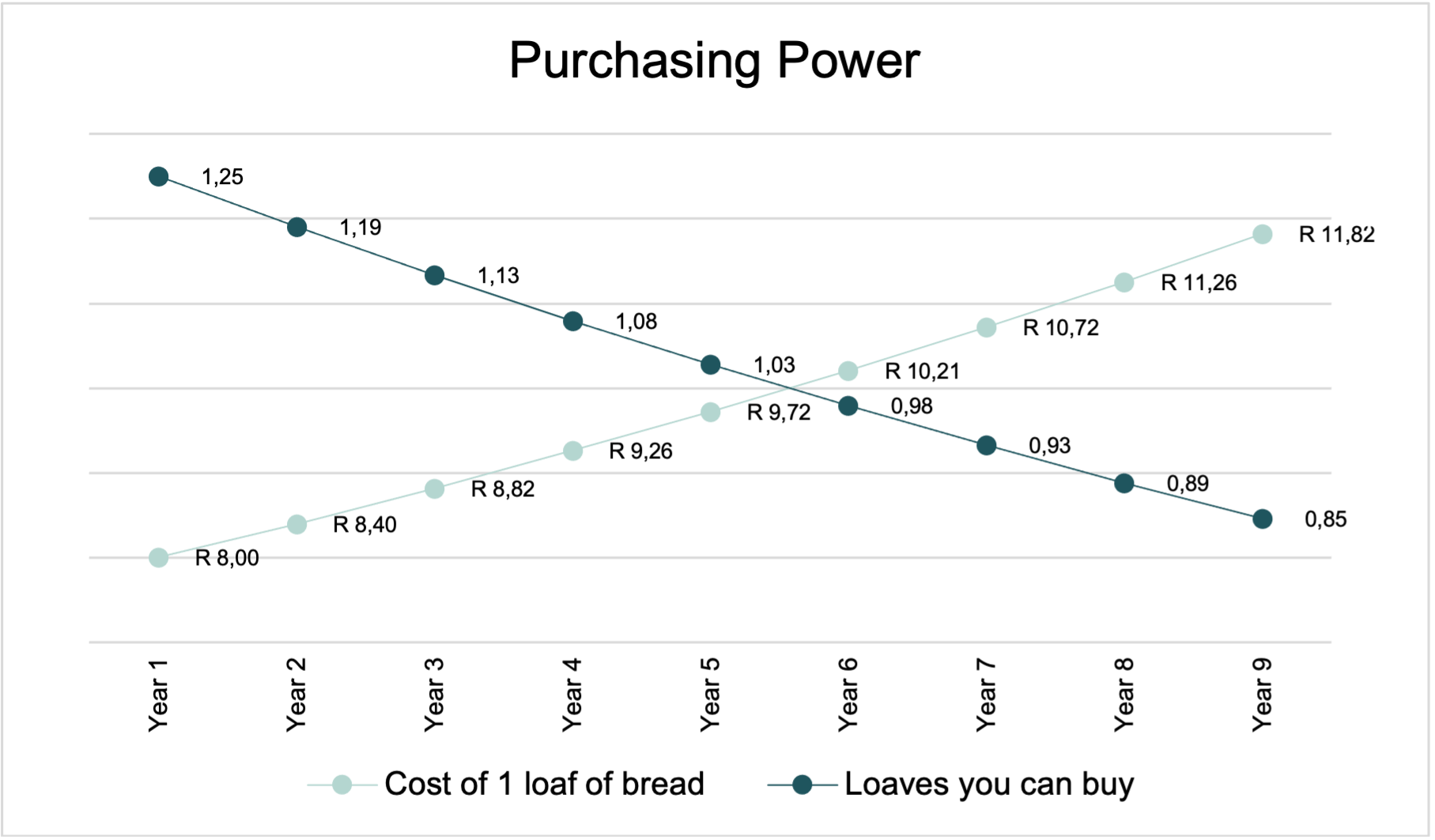

The thief is called inflation and it steadily erodes the purchasing power of your funds. Inflation is a statistical measure of the rate at which the general price of goods and services increases over a period of time. As the price of goods increases, the purchasing power of one unit of currency decreases. Or, said differently, one unit of currency today cannot buy the same amount of goods that it could a year ago. Simplistically, if the inflation rate over the last year was 10% and assuming you put 100 units of currency under your mattress a year ago, the purchasing power of those 100 units today is the equivalent of 90 units of currency a year ago. You can purchase less.

Putting money away in a bank or savings account or government bonds (interest bearing or fixed interest instruments) is one way to counteract the impact of inflation. Interest rates are inextricably linked to inflation, as Central Banks set the market interest rate in relation to the official inflation rate. Higher inflation normally leads to higher interest rates and vice versa (monetary policy is the tool used by Central Banks to manage inflation by making the cost of money cheaper or dearer depending on what outcome they want to achieve).

But Central Banks are often “behind the curve” and react to inflation with hindsight. Interest rates, therefore, follow inflation and in a rising inflationary environment interest rates may be lower than inflation.

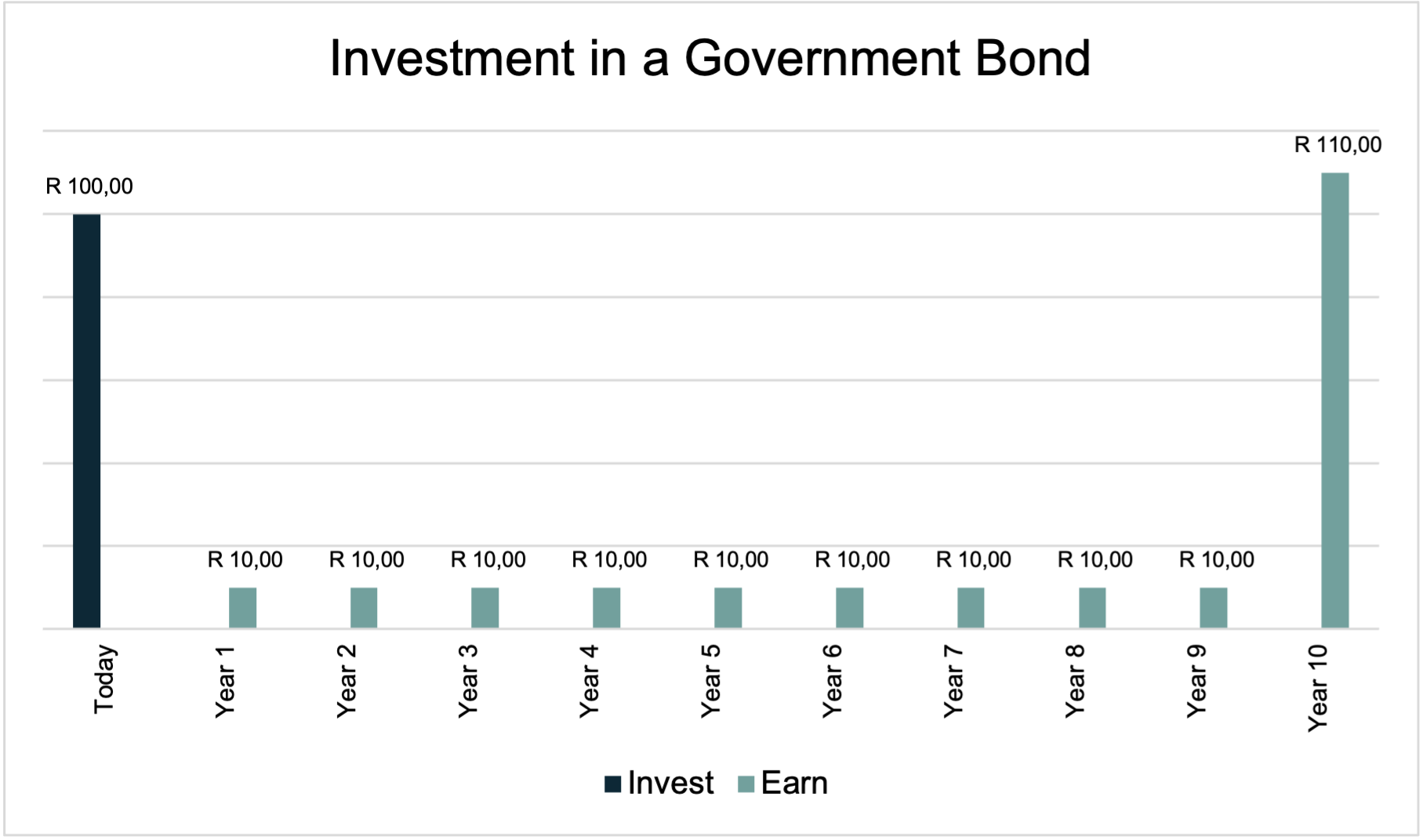

As a general rule, over an economic cycle (peaks through troughs), fixed interest instruments like cash or government bonds are generally not effective hedges against inflation. For instance, the fixed interest yield of 10% on a government bond with a ten-year maturity is not adjusted higher to account for higher inflation (the 10% interest rate is fixed). Thus, R 100 invested in a ten-year bond yielding 10% interest, will deliver interest of R 10 per annum for ten years plus the original capital returned at maturity. If inflation runs at an annualized rate of 5%, the purchasing power of interest received in the latter years as well as the capital returned at maturity will have been eroded. See the problem?

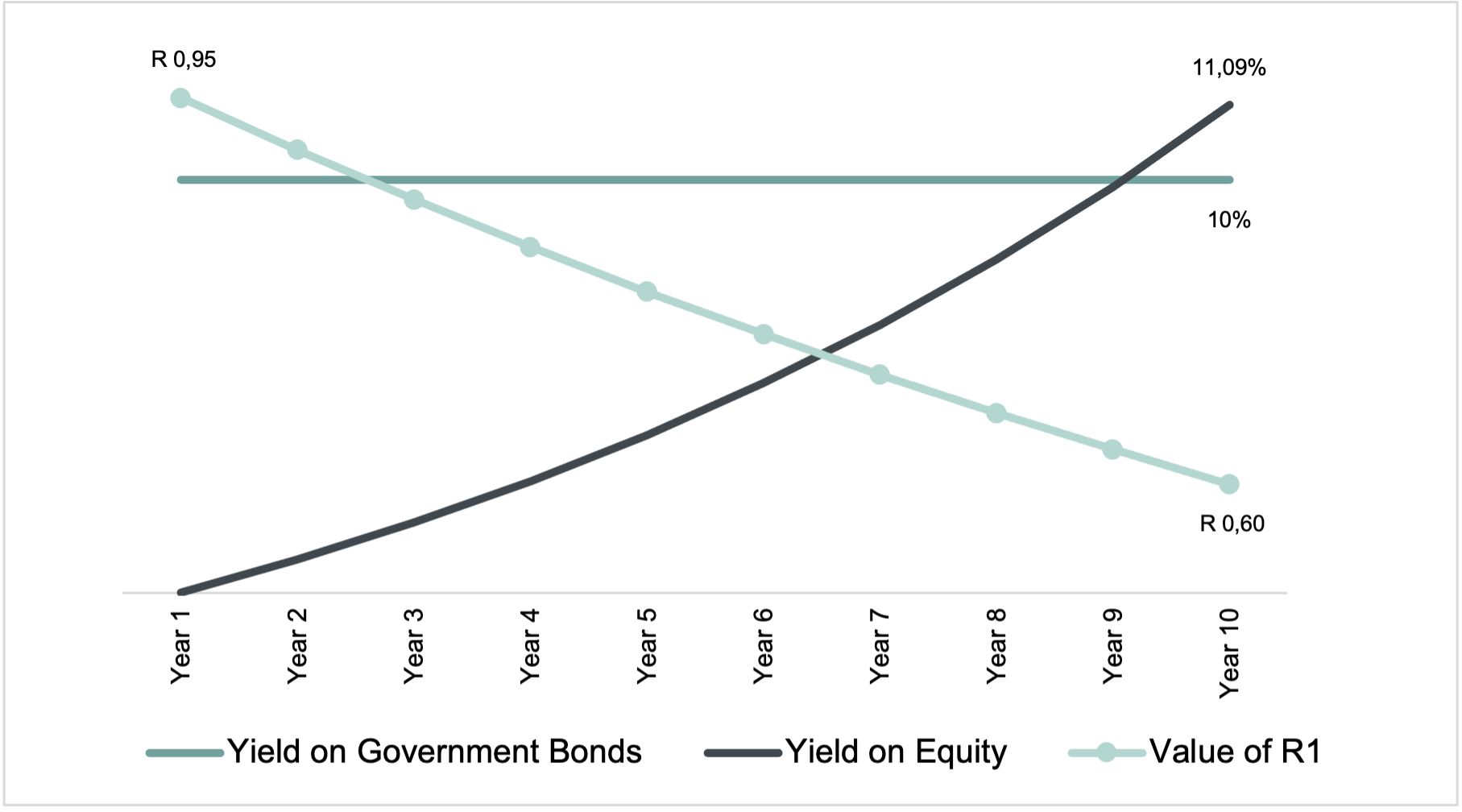

A more effective way of addressing the impact of inflation is to invest a reasonable portion of one’s funds in “productive” assets which generate a return (dividends and capital appreciation) that keeps pace with or outperforms inflation.

A business is operated with a profit objective and shareholders expect a company’s management team to grow profits and dividends. On R 100 invested in the shares of a well-run business, one may earn a dividend of say 4% which may grow by (on average) 12% per annum. Over ten years the 4% yield would have grown to approximately 11,09%.

The value of the shares will likely have grown as well because profit and dividend growth determine the rate of capital appreciation of a business and its shares over time. Granted, company profits and dividends are not guaranteed but we do not invest for the short term and always diversify.

We won’t go into it here, but the tax treatment of interest, dividends and (realised) capital appreciation is quite different (favourable to dividends and capital gains in shares).

I want to emphasise that this explanation of inflation is very simplistic and there are many complexities not elaborated on.

Two points I want to highlight briefly:

1. Inflation has a negative impact on the future purchasing power of money, it’s just a question of how big that impact will be (i.e. high vs low inflation).

2. Different types of investments (like shares in listed companies or fixed interest securities like bonds) are believed to perform differently under different inflationary environments. Which is not entirely correct. It is the perception about future inflation or the anticipated change in the inflationary environment that drives the relative performance of asset classes. There is a lot of psychology involved with inflation and its trajectory. Sometimes inflation goes up because people believe it’s going to go up and act pre-emptively.

How have we hedged against the rise of inflation?

Initially highlighted on 1 November 2020, when we first introduced inflation as a theme, below is the list of investment strategies we employed as response. The investment strategies below were identified in an attempt to protect one’s investments against rising inflation.

We believe that we may be entering a multi-year period of increasing inflation. The investment strategies which we have identified in an attempt to protect one’s investments against inflation are listed below.

As usual, we believe in a healthy dose of risk management and position sizing coupled with a measured pace of implementation.

1. Precious metals

Gold and silver act as inflation hedges and are an efficient store of value during periods of high inflation.

2. Other real assets

Commodities or markets linked to their production. Emerging markets for example are usually very dependent on commodity prices as they are major producers.

3. US alternatives

As the US dollar is exhibiting weakness, overweighting the rest of the world can protect one from currency risk.

4. Mistrust of the financial system and the US dollar

In addition to precious metals, new age “currencies”, like Bitcoin, may benefit.

5. Value shares

6. Inflation linked bonds

7. Volatility instruments like IVOL (an ETF that captures the impact of higher inflation via increased volatility)

One of the effects of low and stable inflation has been that volatility of capital markets has reduced. Higher inflation and more uncertainty may cause volatility to increase.

8. Equities

Equities act as inflation pass through securities as management teams will adjust the prices of their products and services to higher inflationary environments, translating into higher profits.

So why all this talk about the rise of inflation? As described above, inflation has a meaningful impact on the value of your money. Importantly, a change in expectations about the future inflation trajectory may have a significant impact on the relative performance of investments. This is especially true if there are major policy shifts or regime changes with regards to monetary and fiscal policy. Read our continued discussion on the rise of inflation here.

ABOUT THE AUTHOR:

Benjamin van Wyk, CFA® – Chief Investment Officer

Benjamin van Wyk, CFA, has been active in the financial services sector, specifically asset management, since 1997. He has worked for several JSE Top 40 listed financial services companies. In his capacity as a research analyst and portfolio manager, he has over 20 years of experience in managing domestic and international investments on behalf of retail and institutional investors.

1 Comment

Comments are closed.