Investment management is a dynamic endeavour. The global economy and capital markets are fluid and change is both a certainty and a constant. It is, therefore, crucial to subject one’s approach to investment management to continuous critical examination to ensure relevance and global best practice. We use thematic investments as one of the refinements we have made to our investment process relates to the identification and investment into long-term trends or themes. Thematic investing, as opposed to geographic or sector-based investing, involves creating a portfolio (or section of a portfolio) that combines a collection of companies involved in certain areas which are predicted to generate above-average market returns over the long term. Major themes could include, inter alia, globalisation, population ageing, environmental change, water security, e-commerce, the rise of inflation, robotics and AI (artificial intelligence) etc. From an implementation point of view, we access themes by investing in Exchange Traded Funds.

The advantage of this approach is that we do not have to attempt to pick the individual company or investment that will reap the largest benefit from a specific theme, but rather diversify broadly within a theme. We, therefore, participate in the general rise and associated investment returns generated by a theme but mitigate the risk of investing in shares of one or two individual companies (in other words, we eliminate company specific risk). We believe that introducing thematic investment to our pragmatic approach to investing in leading, global multinational companies, will improve our portfolio’s risk and return characteristics. Going forward, we will be discussing a different theme every month and continue to monitor and report on the performance regularly.

Battery technology and energy storage

The “discovery” of electricity is widely accredited to Benjamin Franklin, who in 1752 conducted his famous experiment with a kite and a key in a thunderstorm. However, much earlier in around 600BC, the Ancient Greeks discovered that rubbing fur on amber created an attraction between the two materials – static electricity. In the 1930’s, archaeologists discovered pots with sheets of copper inside, believed to have been batteries that produced light at ancient Roman sites. In 1800, the Italian physicist Alessandro Volta discovered that particular chemical reactions could produce electricity. He constructed the voltaic pile (an early electric battery) that produced a steady electric current, and so he was the first person to create a steady flow of electrical charge. Since then, many great minds did enormous amounts of research about electricity including Michael Faraday, Thomas Edison, Nikola Tesla, James Watt and Andre Ampere, to name but a few.

It is evident that the concept of electricity has been around for thousands of years and that since the earliest of days, man has attempted to harness its power and store energy for use on demand.

Today, there is a wide array of energy storage systems based on different technological approaches to manage power supply:

1. Battery chemistry – A range of electrochemical storage solutions, including advanced chemistry batteries, flow batteries, and capacitors

2. Thermal systems – Capturing heat and cold to create energy on demand or offset energy needs

3. Mechanical storage – Innovative technologies to harness kinetic or gravitational energy to store electricity

4. Hydrogen systems – Excess electricity generation can be converted into hydrogen via electrolysis and stored

5. Pumped hydropower storage – creating large-scale reservoirs of energy with water

A number of developing trends over the last decade are expected to support the demand for more efficient, reliable and cost-effective energy storage solutions:

1. Internet of Things – Portability of devices and continuous connectivity to the Internet. Think of mobile phones and tablets, cameras, laptops, “wearables” like watches, medical devices, vending machines, power tools and many more.

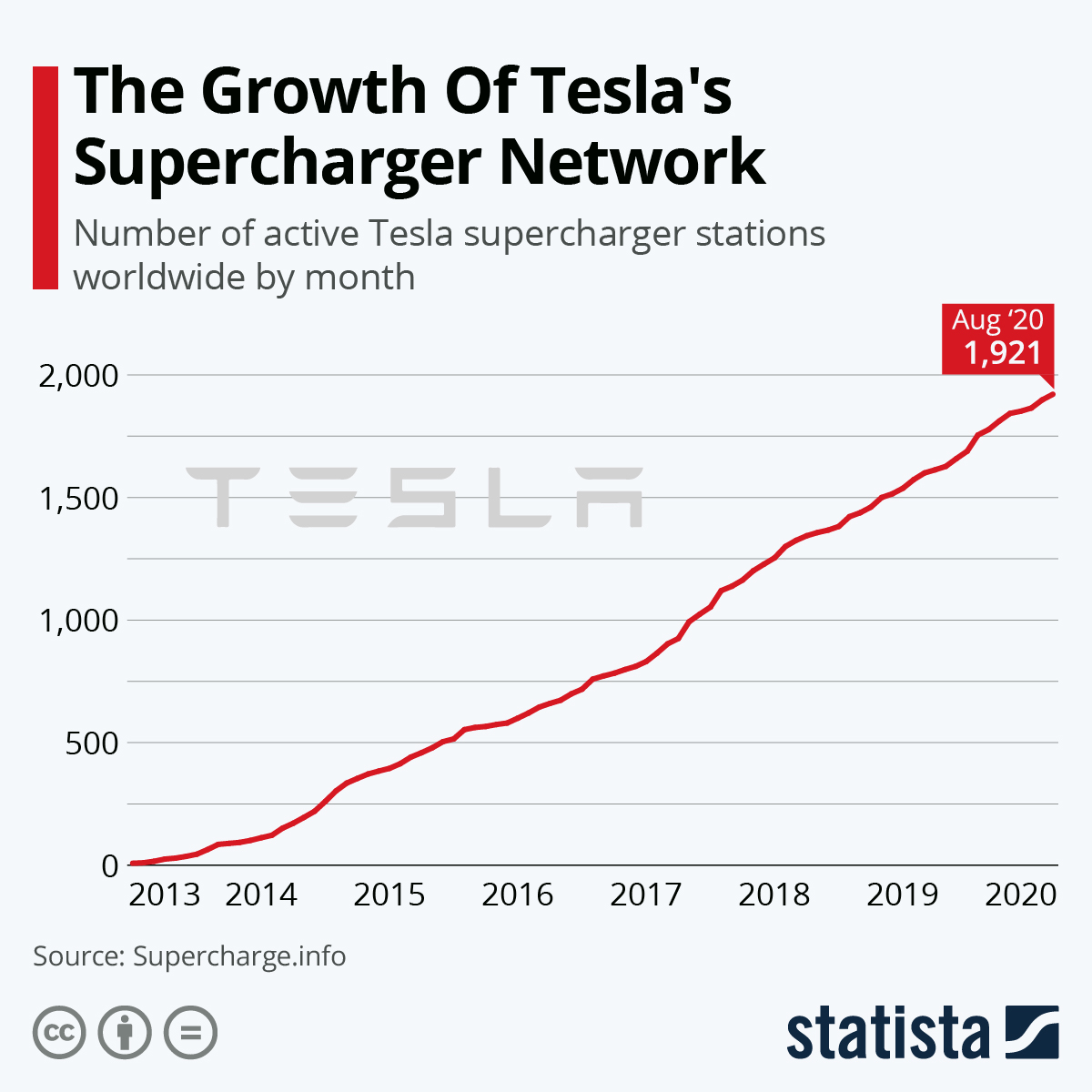

2. The rise of Electric Vehicles (EV’s) – In recent years several EV producers, most notably Tesla, have entered the vehicle manufacturing industry. Although global manufacturing of EV’s is still tiny in comparison to traditional Internal Combustion Vehicles (ICV’s), growth in the EV market is expected to be very strong indeed.

3. The quest to reduce the planets carbon footprint and adoption of green or clean energy. There are many alternatives to fossil-based energy, but no reliable and cost-efficient way of storing massive amounts of energy for utilisation in the grid when it is needed.

Investment Opportunities

“White Petroleum”

Lithium (Li) is also known as “white petroleum” due to its colour and common usage in state-of-the-art batteries that power a wide range of energy storage systems, both portable (like mobile phones) and fixed (energy grids and storage industries), as well as vehicles (electric and hybrid vehicles and scooters). Li is lighter, more efficient and more durable than other types of battery chemistries and is, therefore, a superior choice for energy storage where weight and heavy usage are important factors.

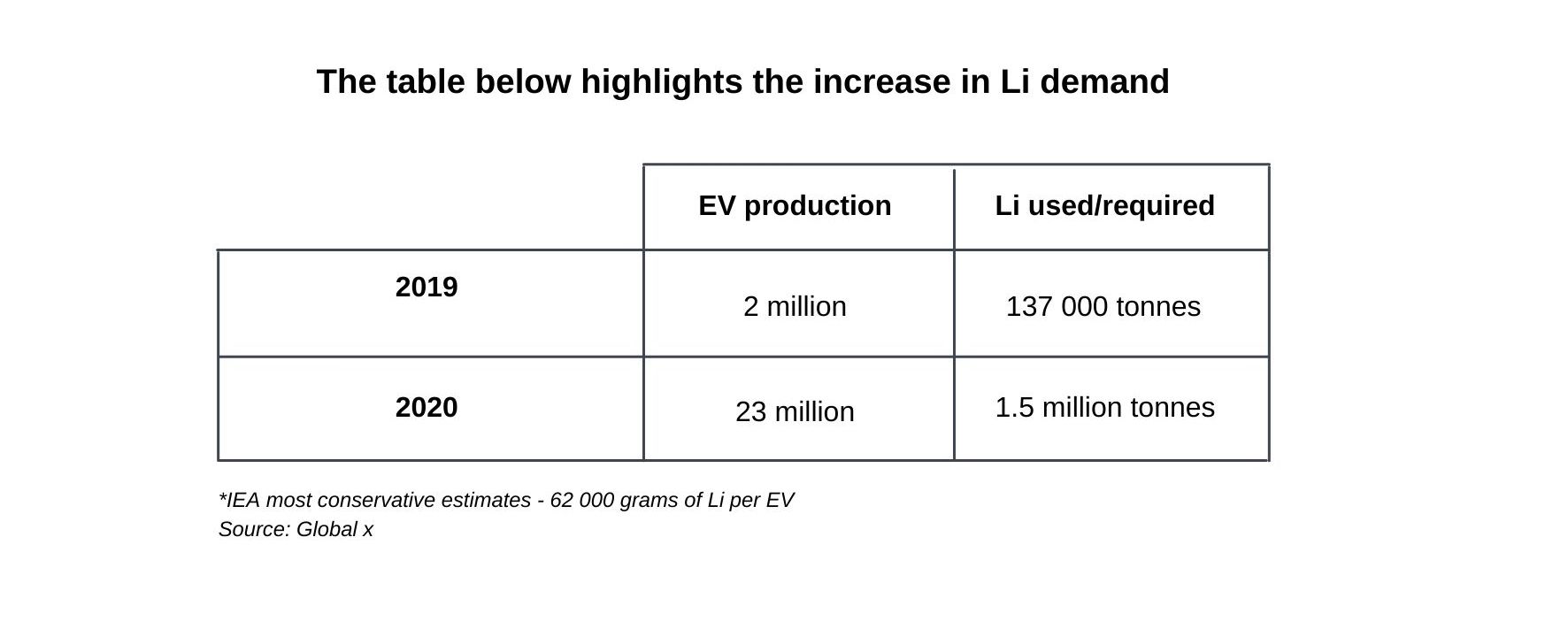

Although approximately half of the demand for Li comes from industrial applications like glass, ceramics, lubricants and casting powders, future demand growth is expected to come from the battery industry. It is expected that by 2030, about 90% of Li demand will come from the battery segment. The majority of this growth in demand will be driven by EV’s. An EV uses about 5 000 times more Li than a smartphone while long range EV’s like the Tesla Model S can use as much as 10 000 times more Li.

The three main sources of demand for Li are expected to come from the following areas:

1. Continued growth in EV adoption and production scaling; by 2040, EV’s are expected to equal 50% of new vehicle sales. China in particular has big ambitions when it comes to EV adoption. By 2040, the Chinese want EV’S to make up 60% of its passenger vehicle fleet. Currently the Chinese manufacture more than 20 million vehicles per year, a market that is expected to grow to approximately 80 million vehicles by 2040.

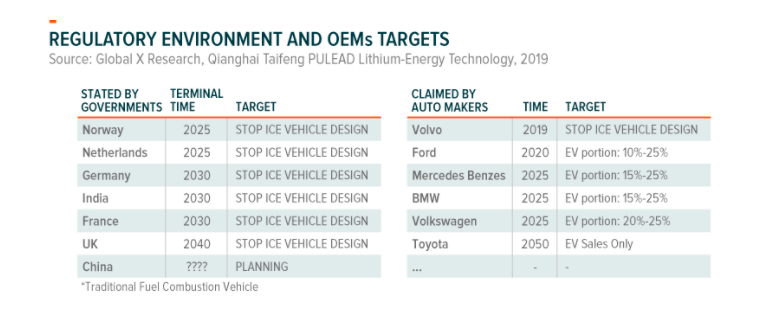

2. Continued support from governments in terms of regulation to phase out ICV’s:

3. The electric grid and energy storage industries (solar and wind) are expected to increase their reliance on batteries to store energy.

The emergence of the “mega factory” is also expected to support the demand for Li. A mega factory is a Li battery plant that produces an annual output of approximately 1 GWh or the battery capacity to power 20 000 Tesla vehicles. Globally there are approximately 115 mega factories (of which only four are Tesla owned). By 2028, these factories are expected to produce 2 000 GWh capacity annually, enough to power 40 million EV’s. At this capacity level, the annual demand for Li will be at 1.6 million tons per annum.

It is worth noting, as far as demand for Li goes, that there is no substitute for Li and that it should remain the basic building block for battery technology.

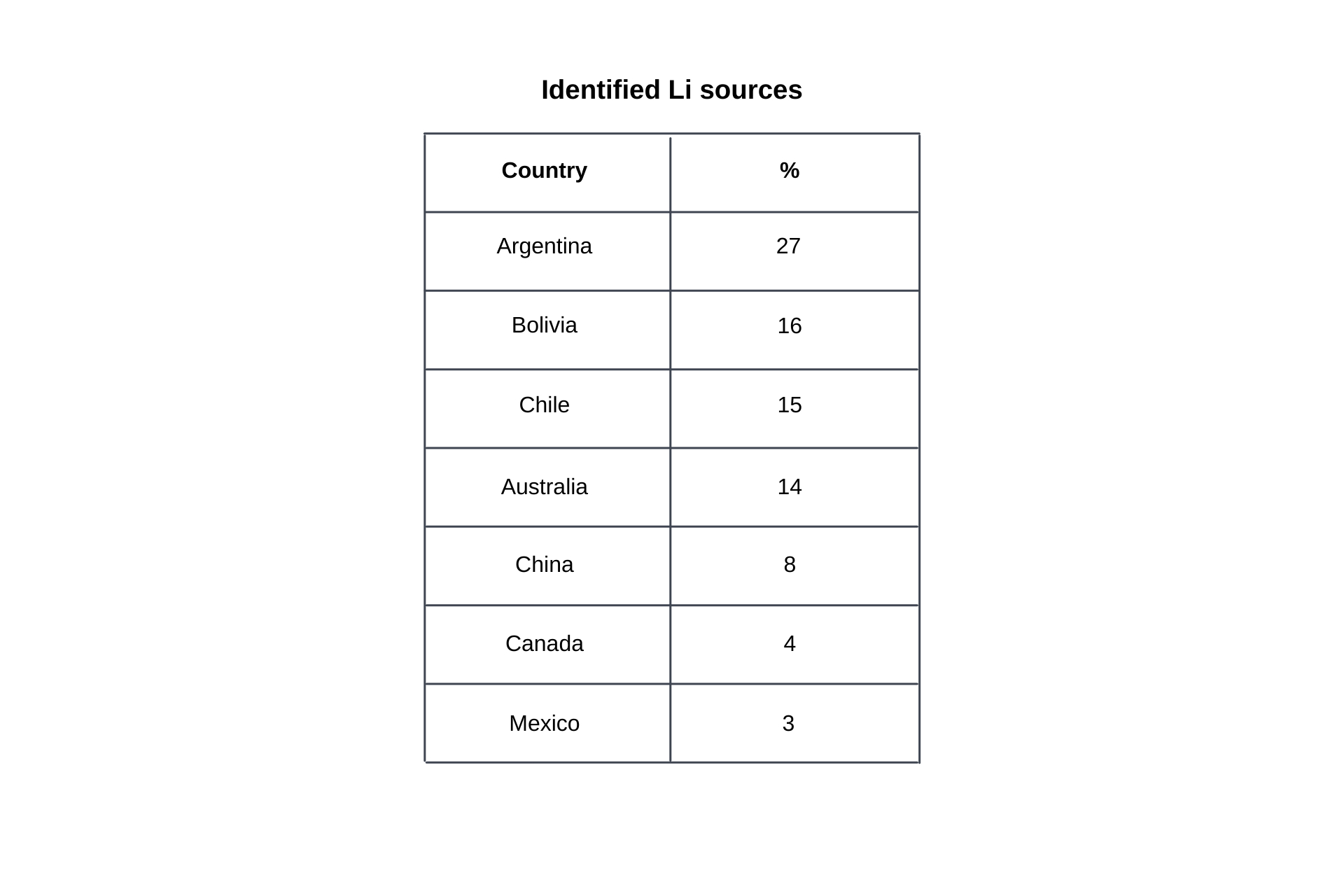

From a supply perspective, the world’s Li resources are estimated at 55 million tons (identified).

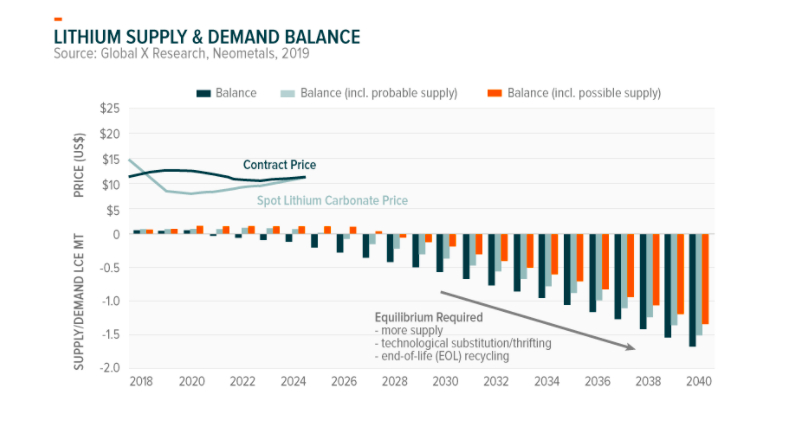

Li is sourced via two sources: brine deposits, which generally yield low grades but are easy to mine, and hard rock resources which yield high grades but are difficult to mine. The pre-production capital expenditure cycles range between 3 and 5 years. At present, production estimates by existing producers point to a shortfall in Li by the mid 2020’s. It is worth noting, as far as demand for Li goes, that there is no substitute for Li and that it should remain the basic building block for battery technology. From a supply perspective, the world’s Li resources are estimated at 55 million tons (identified).

Other Metals

The growth in the battery technology and storage industry is also expected to have a positive impact on the demand for other metals that are used in the manufacturing of batteries. Nickel and Cobalt are two other critical elements in battery manufacturing. Copper may also benefit as the amount of copper used in an EV is three times that of an ICV. Furthermore, the charging networks for EV’s will also require an increased demand for copper.

Perception, EV adoption and R&D

One of the problems with EV’s relates to “range anxiety” and the perception that EV’s are unreliable, lack range and are expensive. Significant research and development are being undertaken in the battery storage industry to improve battery performance in terms of energy density (range), charge time, cost, safety, discharge rate and degradation. For instance, SK Group, Korea’s oldest oil refiner, is investing USD 10 billion in battery research and manufacturing. Big Auto and Oil companies, who once dismissed affordable energy storage as a pipe dream now see it as an existential threat and invest billions in research and development. For instance, Volta Energy Technologies is a venture capital fund that invests in battery and energy storage startups on behalf of nervous energy and auto companies.

New technologies that improve battery performance and cost may change the perception about the reliability of EV’s and making EV’s less “exotic”. A “million-mile” battery could help shake the fear of short range and battery replacement costs. As an example, Hyundai’s US sales doubled in 2005 compared to 2002 and they doubled their market share by 2011 when they offered 100 000-mile warranties that allayed customers fears about vehicle reliability.

On the technological advancement front, a lot of progress has been achieved in the quest for a million-mile battery that is also affordable. Li-ion battery technology uses different chemistries, either an NCA chemistry (nickel-cobalt-aluminum) or an NMC chemistry (nickel-manganese-cobalt). New chemistries like Li-iron, Li-iron phosphate, Li-silicon and Li-sulfur batteries, do not require cobalt or nickel, both very expensive metals.

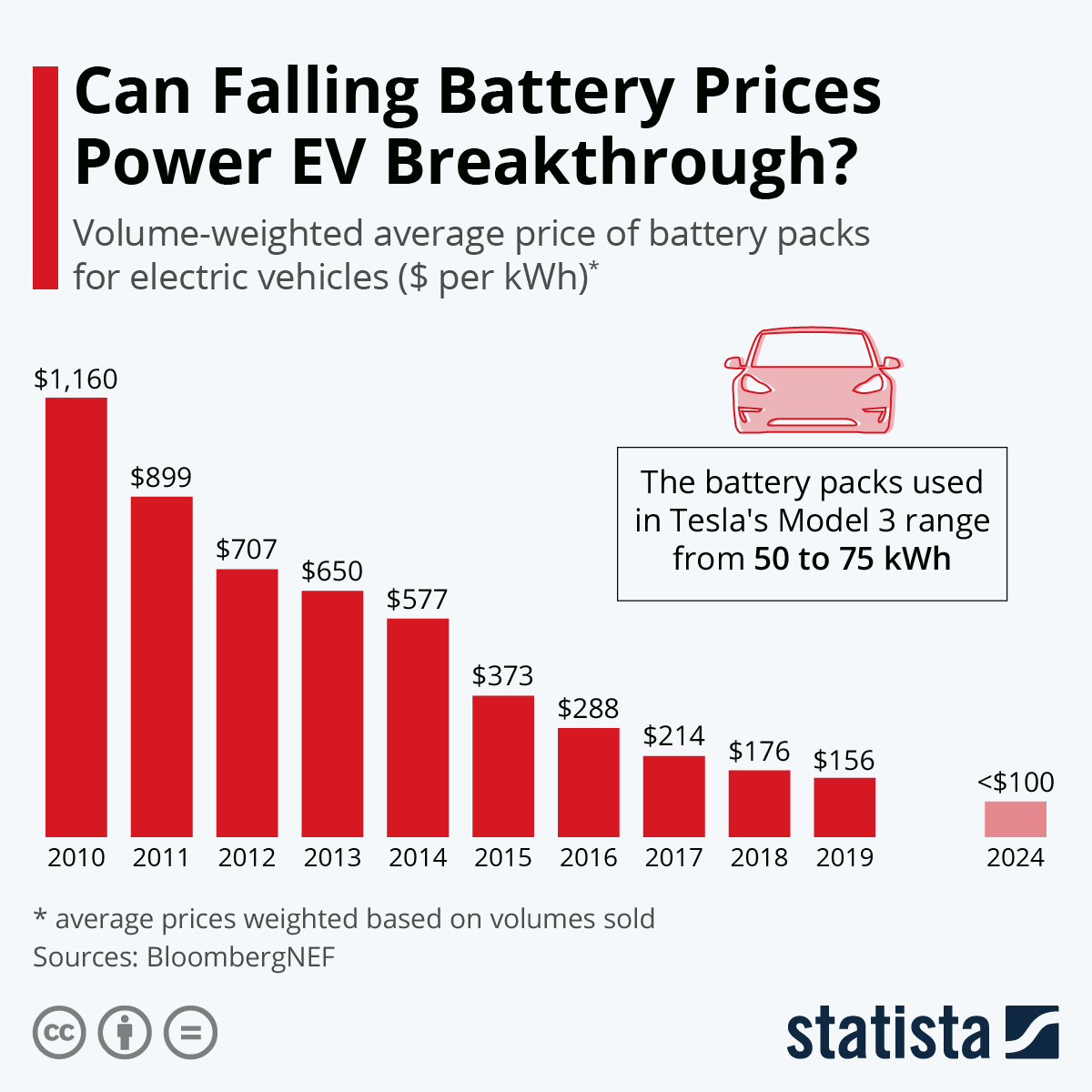

The research and development are paying off: in 2010, the cost of a Li-ion battery was USD 1 000/kWh. In 2015, the cost was USD 381/kWh. The cost of a Li-ion battery is approximately USD 147 at present, getting ever closer to the magical USD 100/kWh level that is estimated to be the breakeven cost where EV’s will be cost neutral relative to ICV’s.

It is possible that with more breakthroughs in research and development, the perception about EV’s and battery technology may improve – as costs reduce and reliability, range and safety continue to increase. This in itself, will support demand for EV’s, batteries and the metals that are used in the manufacturing of batteries.

In addition to battery technology relating to EV’s, many other applications are being researched:

- Energy from Wi-Fi

- Gold nanowire technology

- Solid-state Li-ion batteries

- Graphene batteries

- Foldable batteries

- Over air charging technology

- Quick charge batteries

- Transparent solar chargers

- Aluminium air batteries

In summary, battery technology and storage solutions offer many opportunities across the value chain, including: mining, production, manufacturing, research and development and many more. Our approach is to invest and deploy investment strategies in a broadly diversified Exchange Traded Fund, that will provide exposure to all the role players involved in this industry. We cannot forecast with any degree of certainty which companies will be the winners or losers in each of the segments of this industry, but believe it is imperative to be a part of this transition.

ABOUT THE AUTHOR:

Benjamin van Wyk, CFA® – Chief Investment Officer

Benjamin van Wyk, CFA, has been active in the financial services sector, specifically asset management, since 1997. He has worked for several JSE Top 40 listed financial services companies. In his capacity as a research analyst and portfolio manager, he has over 20 years of experience in managing domestic and international investments on behalf of retail and institutional investors.